European markets started the week positively as investors scaled back some Trump trades. This was also evidenced in other markets such as the EUR/USD gapping higher. But with the US election now just one day away, things can turn rapidly across financial markets, particularly because this is turning out to be such a close election and the polls cannot and should not be trusted. Given the fact that the DAX has weakened in the last couple of weeks, this also argues against a sustainable recovery as the prior bullish momentum has been lost. The DAX outlook will become a lot clearer once the US election is out of the way.

US Presidential election: Polls show Harris take surprise lead

The big news today has been from the US presidential race, where the latest polls show Kamala Harris had received a boost in the polls. ABC News and Ipsos poll has given her a 49%-46% edge nationally against Trump, while other surveys pointed to a coin flip between the two candidates, with voters narrowly split across the all-important swing states.

This comes after recent polls had pointed to a Trump victory, casting a shadow over market sentiment. Given the high risk that this could still be the case, investors are considering how such an outcome might impact fiscal policy, with some expecting increased spending and tax cuts that could exacerbate inflation pressures. Additionally, the prospect of higher tariffs could impact European and Chinese assets, adding complexity to the global trading environment. These factors have contributed to one of the roughest months for Treasuries this year. Rising yields will not go unnoticed and may increase market pressure amid the potential for a fiscally expansive government post-election, at a time when deficit spending is already at an alarming rate.

For European exporters, the prospects of Trump coming to power again means more tariffs which is never a good thing for company profits. Against this backdrop, you would think the DAX forecast will get a downgrade if Trump ends up winning, and a relief rally should Harris ends up at the White House as President.

The impact of a Trump win should be negative for European market, but that may depend more on the Congress composition. A clean sweep for his Republican party would be the most bearish scenario, while if Trump wins but the Dems secure the house then in that case, we might see a more muted response in European markets.

What does a win for Trump or Harris means for US markets?

I think if Trump wins there definitely the longer-term impact of tariff and trade war concerns, which could ultimately weigh on a number of sectors. This would be less of a concern should Kamala Harris wins due to the continuation of existing economic policies. In addition, stock markets in Europe and China could stage a relief rally as Trump tariffs are avoided.

On a sector level, a Trump victory would likely mean the elimination of incentives for green energy, and this could lead to slower electric-vehicle sales growth. But for fuel-powered vehicle companies such as those made by GM and Ford, this could be good news.

Then there is the energy sector. Trump wants to unleash more oil drilling in the US, which means oil stocks could rise in immediate response. In contrast, a win for Harris would likely give a lift to solar, wind, and other renewable energy producing companies.

DAX outlook: technical analysis

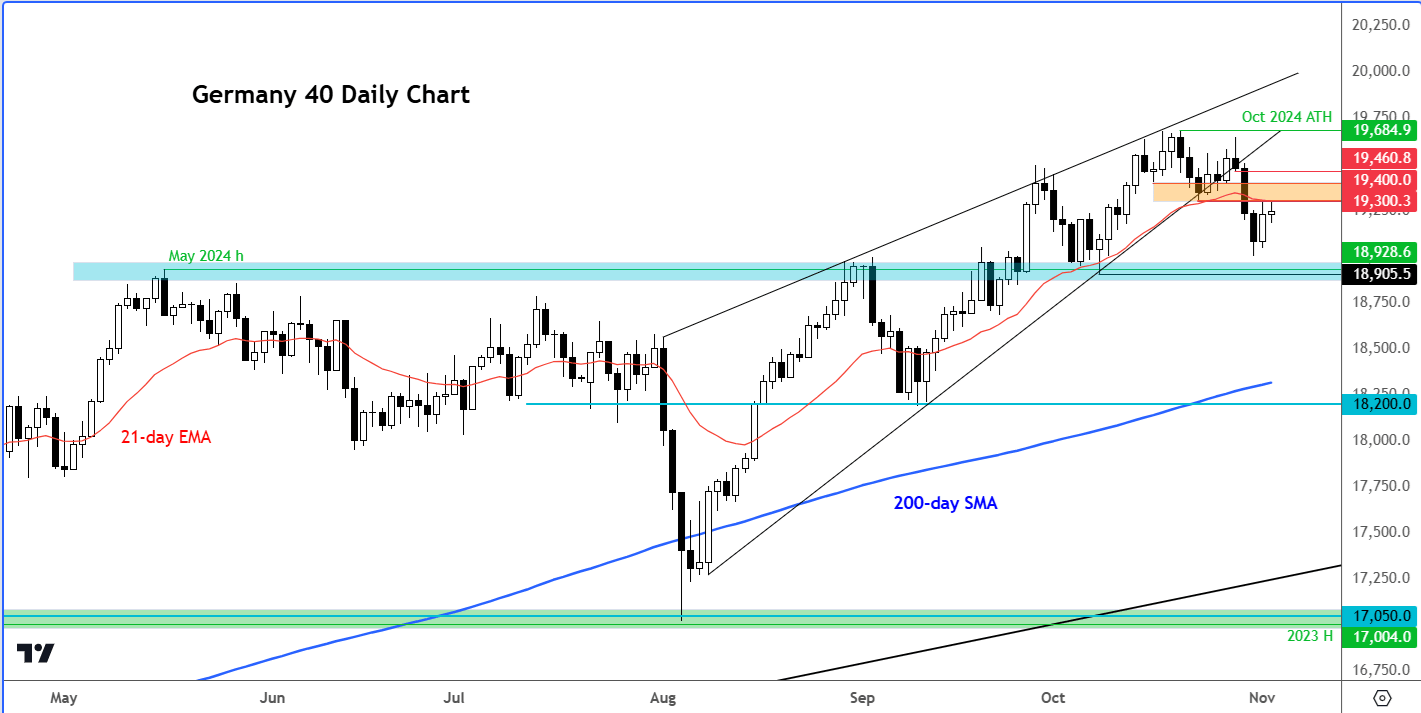

Source: TradingView.com

From a purely technical point of view, the short-term DAX outlook has turned bearish. This is because the German index has broken below some key support areas, including the 19,300 to 19,400 zone. As you can see from the chart, this area was previously support until it gave way last week, and now it is turning into a bit of resistance. The index sold off when it broke below a bullish trend line that was in place since early August. It has subsequently broken and held below the 21-day exponential moving average, objectively pointing to a shift in the short-term trend.

Despite the breakdown, the long-term technical DAX outlook remains bullish for as long as the index holds above the 200-day moving average, which happens to converge within the next big area of support around 18,350 to 18,500 area. It remains to be seen whether the index will dip to the 200-day average this week, because standing on the way of it lies a key support area around 18,930 which was previously a major resistance on a couple of occasions before turning into support in early October. This area is therefore pivotal insofar as the short-term technical outlook on the DAX is concerned.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R