Wall Street record highs and strong Chinese manufacturing data helped Asian equities rise on Monday. The Caixin PMI reached a six-month high, supporting government forecasts of modest expansion. While the Topix index and the Hang Seng rose, Japan's Nikkei lost 0.3%.

Strong Chinese manufacturing statistics and lingering Middle East tensions helped oil prices rise slightly, but pressure from a stronger dollar and an Israeli truce caused gold to drop 0.7%.

President Donald Trump threatened to impose a 100% tax on any BRICS countries who challenged the US dollar's hegemony, warning them against doing so. With the Fed's impending announcement, markets were also paying more attention to US monetary policy. As a result, the dollar appreciated, although it was also supported by strong US statistics and growing chances of a rate cut by the Fed.

With Germany already functioning with a restricted coalition and the now added pressure from a possible fall of the French government, European currencies declined.

Hunter Biden, Joe Biden's son, who was awaiting trial for offences related to guns and taxes, was pardoned. notwithstanding prior promises to refuse clemency.

Carlos Tavares, the CEO of Stellantis, quit unexpectedly on Sunday, two months after the company issued a profit warning. Stellantis is a manufacturer of Jeep, Fiat, and Peugeot vehicles that has seen a 40% decline in value this year. The numbers have been poor, and he has recently been the target of a lot of criticism.

While smaller Cryptocurrency projects witnessed growth over the weekend, Bitcoin stayed mostly steady in the $96,000 to $98,000 area. Nonetheless, there has been a notable surge in cryptocurrency initiatives pertaining to payments. With Ripple (XRP) up around 370% since the US elections and up nearly 50% since Friday.

On the agenda today (GMT)

The calendar for today does have some events, mainly regarding the US markets. Especially the Manufacturing PMI will be watched closely by traders.

10:00 EUR ECB President Lagarde Speaks

10:00 EUR Unemployment Rate (Oct)

14:45 USD S&P Global US Manufacturing PMI (Nov)

15:00 USD ISM Manufacturing Employment (Nov)

15:00 USD ISM Manufacturing PMI (Nov)

15:00 USD ISM Manufacturing Prices (Nov)

20:15 USD Fed Waller Speaks

21:30 USD FOMC Member Williams Speaks

DAX Check

Dax closed bullish on Fridays, due to an increase in afternoon trading and due to rising in the US markets, which made the DAX close in a plus of 1%. The distance from all time high at 19,678 is now only 0.2% away. From the data the consolidation that remained for the past few weeks is now almost over.

DAX leaders

Continental AG +1.05%

Münchener Rückversicherung +0.95%

Hannover Rückversicherung +0.90%

Zalando SE +0.78%

DAX laggards

Bayer -2.11%

Porsche -1.43%

Volkswagen VZO -1.20%

Mercedes Benz Group -1.06%

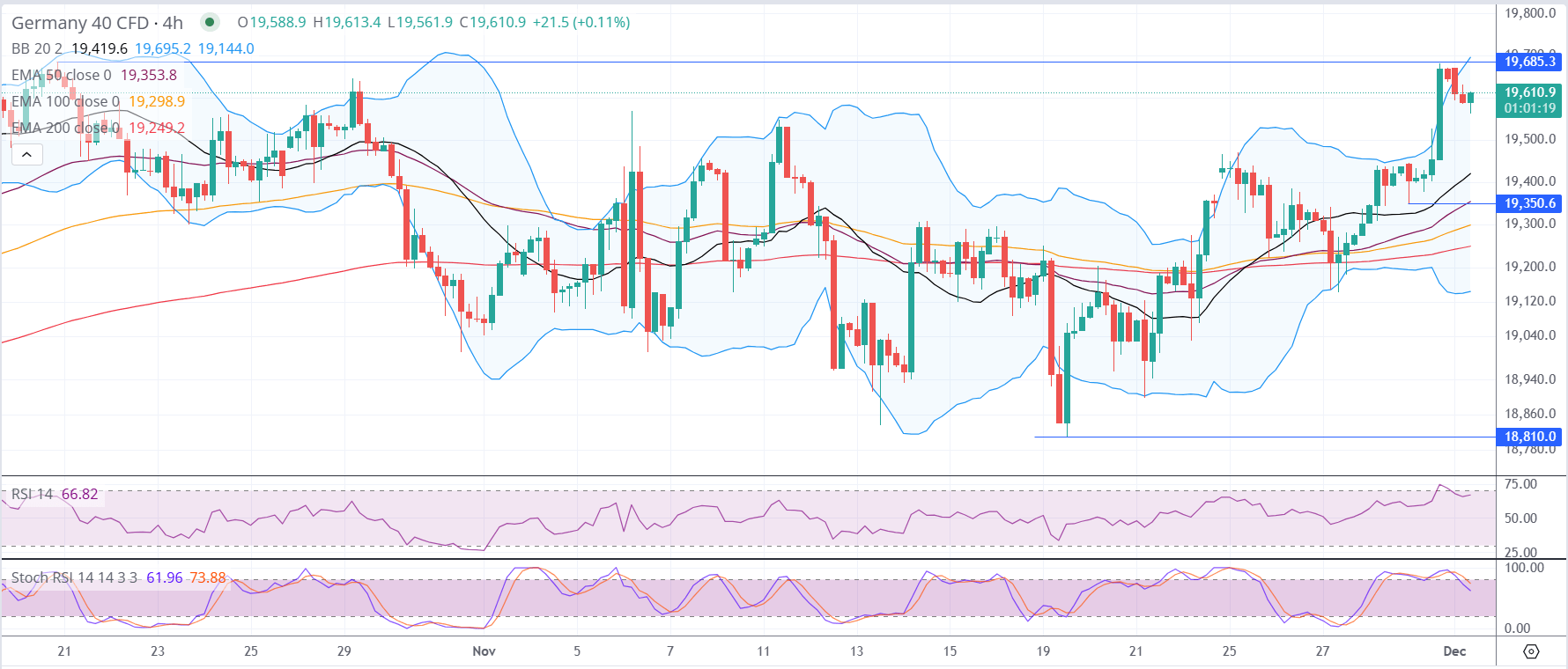

Germany 40 (DAX) 4-hour chart

1. Current Price Action and Trend:

- The DAX is trading at 19,610.9, showing a steady uptrend after a successful breakout above the key level of 19,350.

- The index is nearing the upper Bollinger Band, indicating strong bullish momentum but also potential short-term resistance.

2. Support and Resistance Levels:

- Resistance:

- The immediate resistance is at 19,685.3, the upper boundary of the current range. A breakout above this level would signal further bullish momentum.

- Beyond 19,685.3, the next target is the psychological level of 19,800, which would represent a significant bullish continuation.

- Support:

- Immediate support lies at 19,350, which aligns with the middle Bollinger Band and the EMA 50.

- Further support is at 19,298.9 (EMA 100) and 19,220.8 (EMA 200).

- Key downside support remains at 18,810, marking a critical floor for the current bullish trend.

3. Bollinger Bands:

- The DAX is trading near the upper Bollinger Band, suggesting that the price may encounter resistance or consolidate at this level.

- The middle Bollinger Band near 19,350 serves as a dynamic support zone. A move below this level could signal a reversal or deeper pullback.

4. RSI and Stochastic RSI:

- The RSI is at 66.82, indicating strong bullish momentum but nearing overbought territory.

- The Stochastic RSI is at 73.88, also leaning toward overbought levels. This suggests a potential short-term pullback or consolidation.

5. Moving Averages:

- The DAX is trading above all key moving averages:

- The EMA 50 at 19,353.8, EMA 100 at 19,298.9, and EMA 200 at 19,220.8 all provide strong support and confirm the bullish trend.

- The alignment of these averages reinforces the short-to-medium-term uptrend.

Scenario 1: Bullish Continuation:

- If the DAX breaks above 19,685.3, it could target 19,800 and higher levels.

- Sustained bullish momentum above 19,685.3 would confirm the strength of the current trend.

Scenario 2: Short-term Pullback:

- Overbought conditions on the Stochastic RSI suggest a potential pullback toward 19,350 or 19,298.9.

- A breakdown below 19,350 could lead to a deeper correction, with 19,220.8 as the next support level.

Conclusion:

The DAX is showing strong bullish momentum, with a key resistance at 19,685.3 in sight. A breakout above this level would confirm a bullish continuation toward 19,800, while a pullback to 19,350 or lower support levels is possible if resistance holds. Traders should watch for confirmation of a breakout or signs of consolidation for the next move.