Market Overview and Key Updates

1. Political Uncertainty in South Korea

- KOSPI Index: The KOSPI dropped 2.3% intraday, closing with a 1.4% decline, following significant political developments:

- President Yoon Suk-yeol reversed martial law under parliamentary pressure and assured market stabilization measures if needed.

- Speculation of impeachment is growing, with potential new elections taking up to six months, prolonging uncertainty.

- Investor Sentiment: Despite political instability, recent rate cuts by the central bank and a buyback program from South Korea’s largest tech company had bolstered the market. The KOSPI remains 2% above its yearly low, hinting at possible bottoming.

- Outlook: The low P/E ratio of 8.7 for South Korean tech-heavy equities could make Seoul’s market attractive for mid- to long-term investors, despite near-term volatility.

2. Robust US Economic Data

- JOLTS Report (October):

- Job openings rose by 372,000 to 7.74 million, exceeding market expectations of 7.48 million.

- Voluntary resignations hit a five-month high at 3.33 million, signaling confidence in the labor market.

- Retail Sales Growth:

- The Johnson Redbook Index climbed 7.4% YoY for the week ending November 30, indicating robust consumer spending.

- Market Impact:

- U.S. Treasury yields ticked higher across maturities.

- The USD strengthened, with EUR/USD dipping below 1.05, reflecting positive sentiment toward the U.S. economy.

3. Corporate Highlights

- Salesforce:

- Reported Q3 revenue of $9.44 billion, beating estimates of $9.35 billion, and posted an adjusted operating margin of 33.1%.

- Optimism around Salesforce’s AI-driven strategy pushed shares toward record highs.

- Volkswagen Strikes: Nearly 100,000 workers participated in a one-day strike, underscoring labor unrest across major industries.

- Bitcoin Breaks $100,000:

- Surpassed this key psychological milestone, fueled by post-election optimism for crypto.

- President-elect Donald Trump nominated Paul Atikins, a pro-crypto figure, to lead the SEC, signaling a major shift in U.S. crypto policy.

DAX Overview

- Leaders:

- Commerzbank: +2.31%

- Zalando SE: +1.72%

- MTU Aero Engines: +1.43%

- Deutsche Post: +1.18%

- Laggards:

- BASF: -0.87%

- Airbus Group: -0.44%

- SAP: -0.39%

- Henkel AG: -0.42%

Upcoming Earnings

- Premarket:

- Kroger (KR)

- Dollar General (DG)

- Aftermarket:

- Lululemon Athletica (LULU)

- Hewlett Packard (HPE)

Agenda Today (GMT)

- 13:30: USD Initial Jobless Claims – Key labor market data to assess employment trends in the U.S.

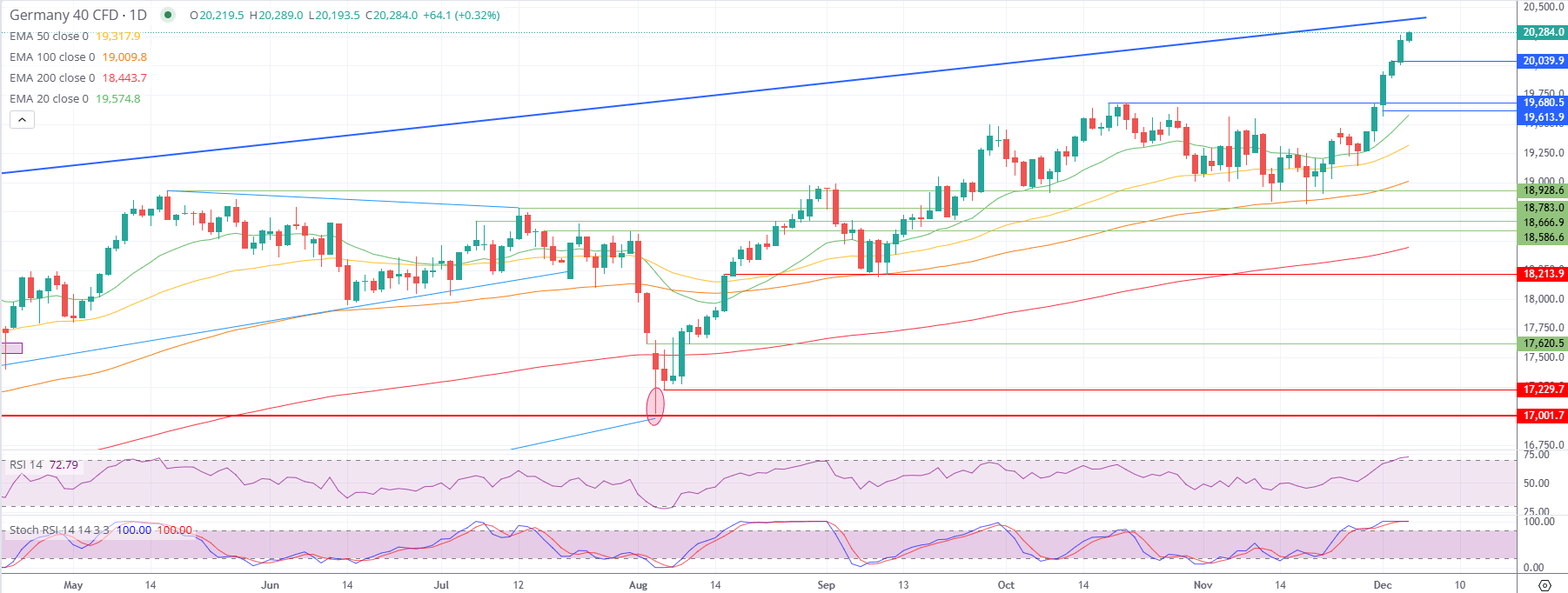

DAX Technical Analysis - 1 Day chart

- Following Wednesday’s record high of 20,261, the DAX remains in a strong bullish trend, trading well above the 50-day and 200-day EMAs, confirming upward momentum.

- The 14-day RSI at 72.82 indicates the index is in overbought territory, suggesting the possibility of increased selling pressure near the recent high.

Key Levels to Watch

Upside Resistance:

- 20,350: A break above this resistance level could enable bulls to target 20,500 in the short term.

- 21,350: A breakout above the all-time high of 20,261 could set the stage for a longer-term rally to this target.

Downside Risks:

- 20,000: A move below this psychological support level could signal a retracement toward 19,750.

- 19,750: Breaking below this level would increase bearish momentum, potentially bringing 19,500 into focus.

Factors Influencing DAX Trends

- Economic Data:

- German Factory Orders: Strong data could support continued gains, while weaker numbers might trigger selling pressure.

- US Labor Market Data:

- Positive job data could boost global equity sentiment, supporting the DAX, while weak data might weigh on the index.

- Central Bank Commentary:

- Any hints of further rate cuts from the ECB or Fed could provide additional support to equities.

- US Tariff News:

- Updates on tariffs could directly impact Germany’s export-heavy economy, influencing DAX performance.

Outlook

- Bullish Scenario: If the DAX holds above 20,000 and breaks through 20,261, it may continue its rally, with 20,500 and 21,350 as key upside targets.

- Bearish Scenario: A sustained drop below 20,000 could signal a deeper correction, with 19,750 and 19,500 acting as key support levels.

Conclusion

- South Korea’s KOSPI faces short-term challenges due to political turmoil but holds mid-term opportunities in its tech-driven market.

- US Economic Strength: Positive labor and retail data reinforce the robust outlook, supporting the USD and equity markets.

- Crypto Milestone: Bitcoin's surge reflects optimism over policy changes and potential regulatory clarity in the U.S.

- DAX Focus: European equities remain mixed, with strong gains in financials and tech offset by declines in industrials like BASF and Airbus.

- --Written by Philip Papageorgiou – Market Analyst

-Follow me on X ex Twitter: PhilipForexCom

Latest market news

Today 09:44 AM

Today 09:34 AM

Yesterday 07:55 PM

Yesterday 05:50 PM