- German GDP shrinks by -0.1% in Q2 compared to the previous quarter

- German GFK Consumer Confidence drops to -22, which was -18.6 last month.

Following the recovery in the previous month, consumer sentiment in Germany suffers a severe setback in August. Income and economic expectations recorded noticeable losses and the propensity to buy also fell slightly. As the propensity to save increases this month, the consumer climate falls: in the forecast for September, it drops by 3.4 points compared to the previous month (revised -18.6 points) to -22.0 points.

Private households in Germany are currently less positive about their financial situation over the next 12 months than they were a month ago: the income expectations indicator lost 16.2 points, falling to 3.5 points.

The last time income expectations fell more sharply was in September 2022, when private households suffered considerable losses in purchasing power due to inflation rates of almost 8%.

Many households are currently experiencing an increase in real purchasing power. Nevertheless, uncertainty is on the rise as concerns about job security are increasing again.

The Federal Employment Agency recently reported a slight increase in unemployment figures in Germany. According to the report, the number of people registered as unemployed is currently around 200,000 higher than a year ago.

The deteriorating data in Germany could prompt the ECB to cut interest rates again in September. This market is pricing in a 90% probability of an ECB cut next month, which would support share prices. More details will probably be given after todays Eurogroup meeting.

Eurogroup meeting

Today at 11:00AM GMT+1, the Eurogroup will hold a meeting. Probably not influenced by the GfK meeting, this meeting will still be something to watch as the Eurogroup President, the finance minister of each Member State of the euro area, the Commissioner for economic and monetary affairs, and the President of the European Central Bank will be attending. Focus points will be inflation, policy and implementation.

At the last Eurogroup meeting, the finance ministers assessed budgetary situations and the resilience of the banking sector, emphasizing the need to address innovation gaps to boost productivity across the Eurozone. This was especially applicable to AI.

Given the current situation, the ECB will be inclined to lower interest rates in the September meeting. The implementation of which might be discussed at this meeting and getting all policymakers on board.

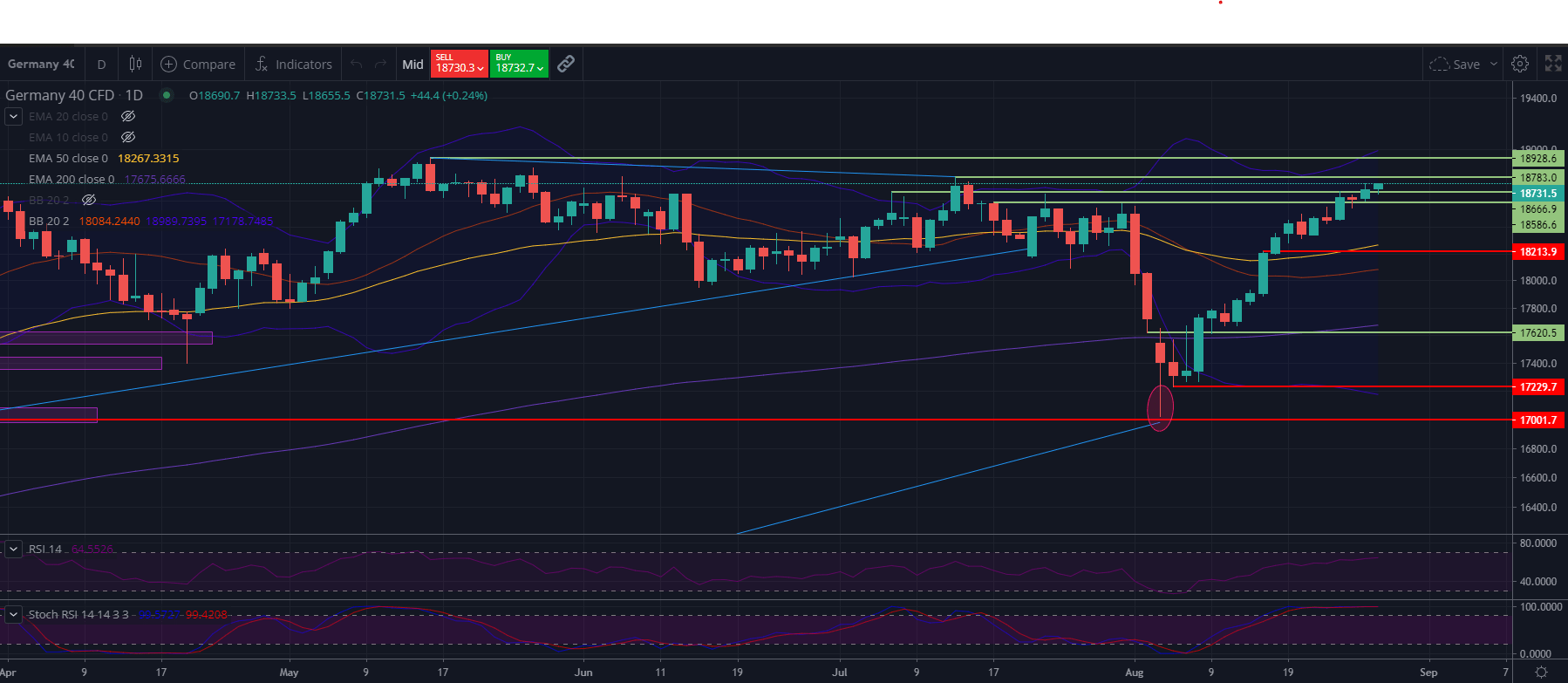

DAX technical analysis

With Germany being one of the largest EU economies, it is paramount to analyse the current situation of the leading german index DAX which actually received a boost due to weak German numbers and in turn an increase in probability to cut rates Soon. This is a situation of “Bad news is good news.”, the index continues its rise from the low of 17,000 at the beginning of August and is only 60 points away from the July high.

With the Eurogroup meeting on the agenda and M3 money supply for the Eurozone being reported today, the DAX will have more information to thrive on today.

(Chart)

Resistance Levels:

18,856.6

18,794.5

18,661.9

Support Levels:

18,213.9

17,620.5

17,229.7

17,001.7

Indicators:

EMA 20: 18,121.8

EMA 50: 18,213.9

EMA 200: 17,645.1

Bollinger Bands: Width--18,045.5 (upper), 17,226.6 (lower)

Relative Strength Index (RSI): 62.40 (Slightly bullish)

Stochastic RSI: 97.98 (Overbought)

The DAX has displayed a bullish trend recently, recovering from previous lows at 17,001.7, crossing multiple resistance levels to its current price at 18,728.3. The RSI is slightly bullish at 62.40, indicating a continued potential for upward movement without overbought signals yet.

However, the Stochastic RSI at 97.98 suggests an overbought situation, indicating the potential for a pullback or consolidations. The EMA values create a bullish scenario as the price stays above the 20 and 50-day EMAs.

We will watch out for further events to come.