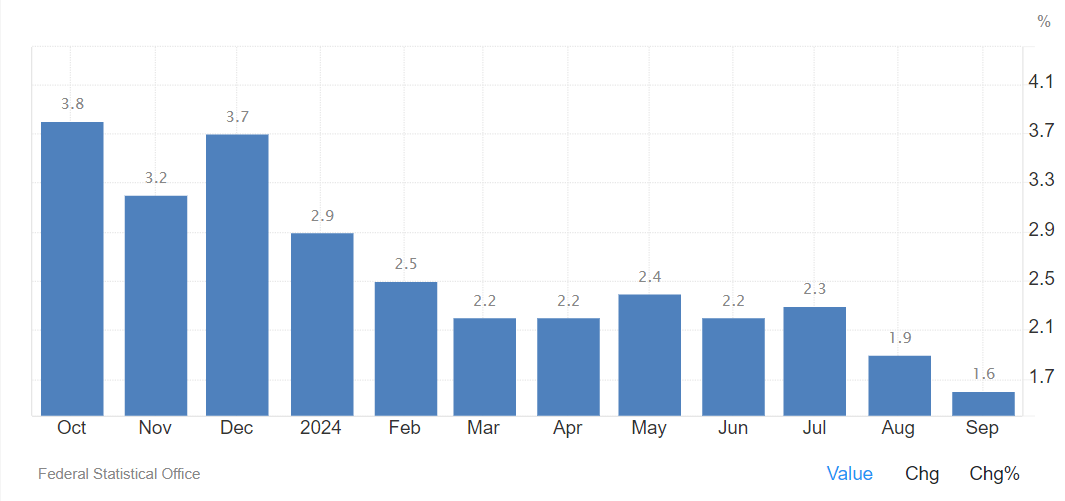

Germany’s Inflation Rate in September 2024: A Detailed Overview

The monthly inflation rate in Germany remained unchanged in September 2024, with consumer prices showing no growth, consistent with preliminary estimates. This follows a 0.1% decline in August, indicating that price pressures continue to ease. This trend is mirrored in the annual inflation rate, which dropped to 1.6% in September from 1.9% in August. This is the lowest level since February 2021, driven largely by falling energy prices and moderate increases in food costs.

Key Factors Contributing to the Slowdown:

- Energy Prices: The largest contributor to the slowdown in inflation is the continued decline in energy costs, which fell sharply by 7.6% in September, compared to a 5.1% decrease in August. Lower energy prices have played a crucial role in offsetting the slight increase in food prices, helping to keep overall inflation in check.

- Food Prices: Food prices increased modestly by 1.6% in September, up from 1.5% in August, showing a moderate but stable rise. This was primarily due to higher costs for certain food categories like edible fats, oils, and processed goods.

- Core Inflation: Excluding volatile items like food and energy, core inflation edged down to 2.7%, the lowest since January 2022, from 2.8% in August. The moderation in core inflation reflects the gradual easing of price pressures in the broader economy.

- Services Inflation: The services sector saw a slight decrease in inflation, falling to 3.8% from 3.9% in August, which also contributed to the overall easing in inflation.

Harmonised Inflation Rate (EU-HICP):

The EU-harmonised consumer price index (HICP), a key metric for comparing inflation across the European Union, also fell to 1.8% year-on-year in September, down from 2% in August. On a monthly basis, the HICP showed a 0.1% decline, consistent with earlier estimates and following a 0.2% drop in August. This marks the lowest harmonised inflation rate since February 2021 and shows a continued downward trend after hitting an all-time high of 11.6% in October 2022.

Historical Context:

- The harmonised inflation rate has averaged 1.9% in Germany since 1996. It reached a historic low of -0.7% in July 2009 during the financial crisis and peaked at 11.6% in October 2022, driven by the global energy crisis and supply chain disruptions.

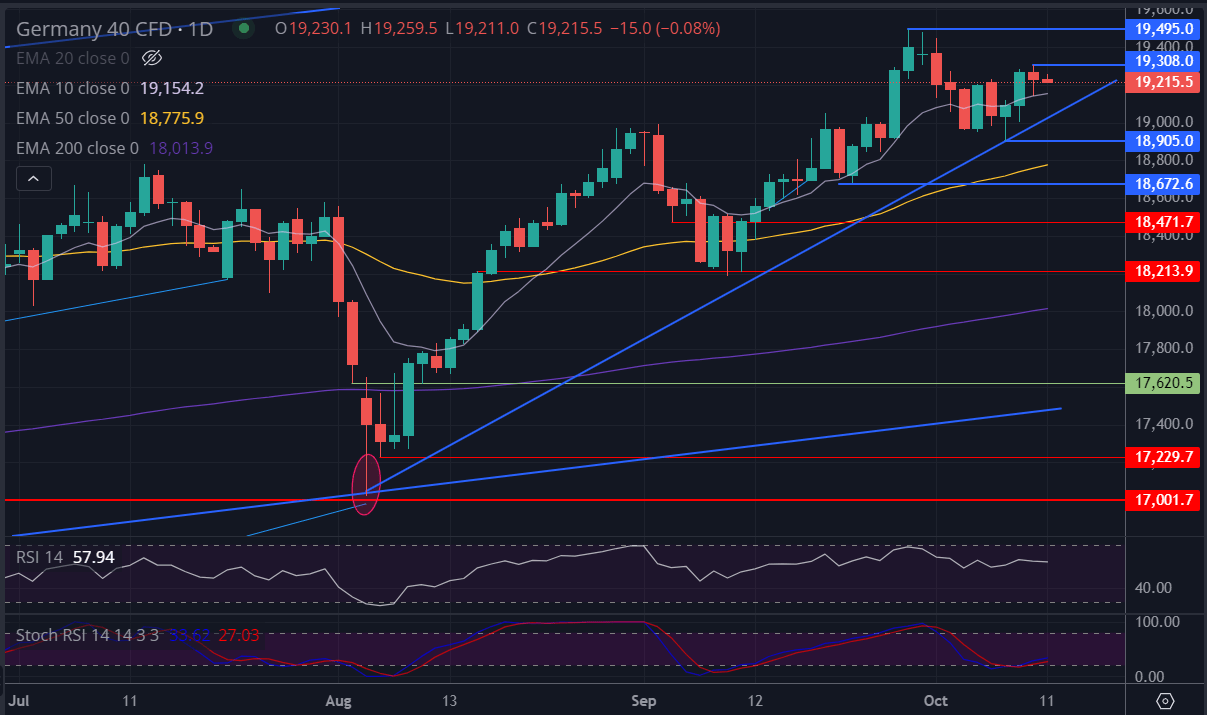

DAX Technical Analysis:

- Following the inflation data, the DAX (German stock index) experienced a muted reaction as traders assessed the impact of lower inflation on future European Central Bank (ECB) policy moves. The lower inflation rate could ease concerns about maintaining rates higher for longer, which might provide relief for equities.

- On the technical side, the DAX has been showing signs of consolidation after recent gains. Support levels are seen around 19,500, while resistance levels are close to 19,000. A clearer outlook on ECB monetary policy next week could provide direction for the index

In summary, the cooling inflation figures in Germany for September 2024 are a welcome sign for policymakers, consumers, and businesses alike, as lower energy prices provide relief. However, with core inflation still above pre-pandemic levels, the European Central Bank may remain torn about further policy easing in the near term.

Sources:

- Federal Statistical Office (Germany)