Weekly Market Analysis: Impact of Extraordinary Political and Economic Events

This has been an extraordinary week in global politics and economics, and it is safe to say that we will not see a week like the one that was any time soon, at least not planned. We all know by now; Trump won the US presidential elections. The market reacted positively, propelling the S&P500, Dow Jones and Bitcoin to all-time highs. Then we had the dissolution of the German Coalition government followed by interest rate cuts both in the UK and the USA. I have outlined the changes and the market impacts below.

Major Events of the Week

- US Presidential Election

- Donald Trump’s return to the presidency sparked a strong market rally that extended into Thursday, with investors optimistic about pro-business, and more lenient policies regarding the green energy transition and positive policies for the domestic market under his administration.

- German Government Crisis

- Chancellor Olaf Scholz’s dismissal of Finance Minister Christian Lindner led to the dissolution of the coalition government. Despite the political uncertainty, the German market reacted positively:

- The DAX surged by 300 points, and defense and industrial stocks saw significant gains:

- Rheinmetall rose 7%

- Heidelberg Cement increased 5%

- ThyssenKrupp climbed 6%

- Bank of England (BoE) Interest Rate Decision

- The BoE cut rates to 4.75%, with the GBP/USD pair gaining 200 points. However, inflationary concerns linger as markets weigh the impact of a more accommodative policy.

- Federal Reserve Interest Rate Cut

- The Fed reduced rates by 0.25% to 4.75%, marking a shift towards easier monetary policy in response to economic signals and recent political changes.

Market Implications

German Market Reaction

- The positive market response to the German government crisis suggests that investors are optimistic about potential political changes that could lead to:

- Business-friendly policies or increased government spending, which might stimulate the economy.

- Future changes to the coalition with might be more accepting of business as a reform is anticipated.

- Increased defense sector investments, with defense stocks rallying on expectations of higher military spending due to rising geopolitical tensions. Trump also mentioned that the war in Ukraine will be stopped soon, which would leave Germany and the EU to ramp up defence spending, as Olaf Scholz already mentioned.

- Trump presidency also affected the German market indirectly, due to the anticipation of his policies limiting and reducing trade between the US and the EU. EU policy makers have had meetings between them already encouraging EU partners to strengthen ties between them in anticipation of more restrictive policies.

Currency Movements

- The GBP’s strength against the USD, despite rate cuts from both the BoE and Fed, indicates:

- Market approval of the BoE’s proactive decision.

- Concerns about the US economic outlook under the new Trump administration, which could influence currency trends.

Global Interest Rate Trend

- With both the BoE and Fed moving towards lower interest rates, there’s a clear trend of more accommodative monetary policy globally, which could:

- Stimulate economic growth and potentially fuel inflation in the medium term. Especially with Trumps presidency and policies regarding Tariffs,

- Benefit stock markets as cheaper borrowing supports corporate growth and investment.

Looking Ahead

While next week may be quieter, the past events will continue to affect the market sentiment and economic policies going forward.

- US Policy Direction: Any new policy announcements or cabinet appointments from Trump’s administration. Examples are Elon Musk being appointed into the DOGE. Military spending and mainly climate change topics. These will come out, the more time we are given.

- Interest Rate Cut Reactions: The market response to recent rate cuts, especially with regard to inflation expectations and currency trends.

Though next week may see less volatility, the ripple effects from these events are likely to continue influencing markets and guiding investor sentiment for months to come.

- German Politics:

The German political system will now need to continue working with various potential scenarios:

- Formation of a New Coalition:

- Scholz could attempt to form a new coalition, potentially reaching out to other parties like the CDU/CSU.

- This would require intense negotiations and possible policy compromises.

- Minority Government:

- The SPD and Greens might opt to continue as a minority government.

- This would necessitate issue-by-issue support from other parties, making governance challenging.

- Snap Elections:

- If no viable coalition can be formed, Germany might head to early elections.

- This could reshape the political landscape but also prolong uncertainty.

- Caretaker Government:

- In the interim, a caretaker government led by Scholz might manage day-to-day affairs.

- Major policy decisions would likely be put on hold during this period.

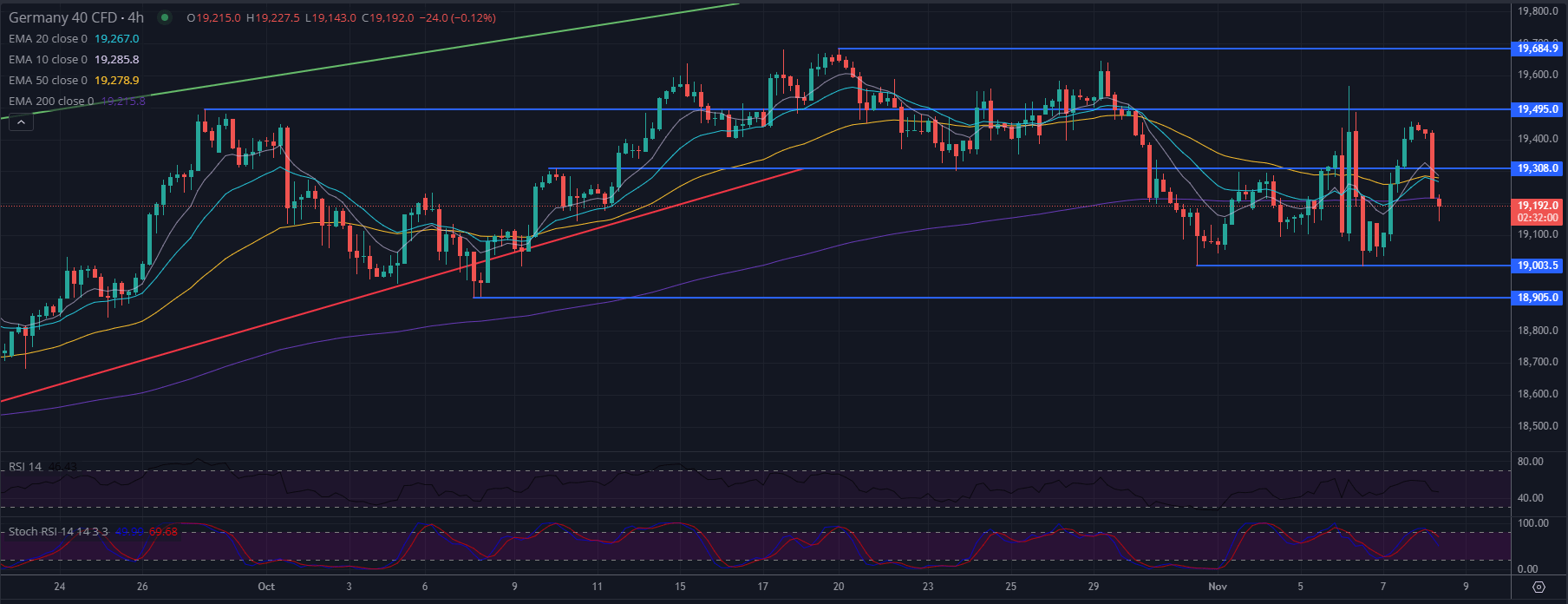

Germany 40 CFD (DAX) 4-hour Technical Analysis

1. Current Price Action and Trend:

- The DAX is currently trading around 19,192, showing some bearish momentum after a recent pullback from the 19,308 resistance level.

- The price has breached below the short-term ascending trendline (in red), suggesting a potential shift in momentum and signaling a bearish outlook if the price continues to decline.

2. Support and Resistance Levels:

- Immediate Resistance:

- The nearest resistance is at 19,308. If the DAX manages to reclaim this level, it could target the next resistance at 19,495.

- Above that, a significant resistance is at 19,684.9, which could act as a barrier for any bullish attempt.

- Support:

- The immediate support level to watch is 19,003.5. A break below this level could lead to a further decline toward 18,905.

- The area around 18,905 is crucial, as it represents the lower boundary of a recent consolidation range, offering strong support in the event of increased selling pressure.

3. Moving Averages (EMA 10, 20, 50, and 200):

- The DAX is trading below the EMA 10 and EMA 20, positioned around 19,285.8 and 19,267.0 respectively, which indicates short-term bearish pressure.

- The EMA 50 at 19,278.9 is slightly above the current price, acting as additional resistance.

- The EMA 200 at 19,215.8 is also just above the current level. A decisive close below this average could confirm further downside pressure.

4. RSI and Stochastic RSI:

- The RSI is at 46.43, indicating a neutral to slightly bearish outlook, as it is below the 50 level but not yet oversold.

- The Stochastic RSI shows a value of 49.98 on the fast line, suggesting that there’s room for further downward movement before hitting oversold levels.

5. Potential Consolidation Range:

- The chart shows a recent consolidation range between 19,495 and 18,905. If the price fails to reclaim 19,308, the DAX could continue to trade within this range, oscillating between the upper and lower bounds until a clear breakout or breakdown occurs.

Scenario 1: Bearish Continuation:

- If the DAX fails to reclaim the 19,308 level and continues to trade below the EMAs, it could signal further downside movement. In this scenario, a breakdown below 19,003.5 would confirm a bearish outlook, with the potential to test the 18,905 support level.

Scenario 2: Recovery and Range Continuation:

- If the DAX finds support near 19,003.5 and can reclaim 19,308, it could resume a consolidation pattern within the 19,308 to 19,495 range. This would indicate a neutral outlook, where price oscillates within this zone without a clear directional trend.