Despite Donald Trump's threat of fresh tariffs, Asian equities were divided overnight, with the Nikkei 225 declining and China indexes rising. On its way to 45,000, the Dow set a new record high, and US indexes had another solid day. According to Fed minutes, policymakers are still anticipating a gradual relaxation of policy. Markets will start to calm down as trading has already started to thin out ahead of the US Thanksgiving break tomorrow. While gold prices are rebounding after Monday's sharp selloff, oil prices hardly moved yesterday in response to news of the truce between Israel and Lebanon.

Corporate news

Following an internal inquiry that caused the business to postpone its earnings announcement, Macy's (NYSE: M) saw a 2.2% decline in value. Beginning in the fourth quarter of 2021, an accounting mistake reportedly committed by one of the company's workers obscured between $132 and $154 million in sales.

A historic tech merger that might have changed the semiconductor industry has been halted by Qualcomm's waning interest in purchasing Intel. The ruling exacerbated Intel's manufacturing unit's problems, regulatory issues, and $50 billion in debt. The action returns attention to Qualcomm's aspirations to enter new industries including PCs, networking, and automotive processors, as well as Intel's attempts at reinvention.

On the calendar today (GMT)

In terms of calendar announcements, yesterday was very unremarkable, but today is jam-packed with information that has the potential to influence the market. Please take note that the US stock markets will be closed on November 28 and will shut early on November 29 at 7 p.m. CET. Additionally, various commodities and metals, as well as indexes like the S&P 500 and Wall Street, will have shortened trading hours on both days.

13:30 USD Continuing Jobless Claims

13:30 USD Core Durable Goods Orders (MoM) (Oct) P

13:30 USD Core PCE Price Index (MoM) (Oct)

13:30 USD Core PCE Price Index (YoY) (Oct)

13:30 USD Core PCE Prices (Q3) P

13:30 USD Durable Goods Orders (MoM) (Oct) P

13:30 USD GDP (QoQ) (Q3) P

13:30 USD GDP Price Index (QoQ) (Q3) P

13:30 USD Initial Jobless Claims

13:30 USD PCE price index (MoM) (Oct)

13:30 USD Personal Spending (MoM) (Oct)

14:45 USD Chicago PMI

15:30 USD Crude Oil Inventories

18:00 EUR ECB's Lane Speaks

DAX Analysis

DAX leaders

Henkel AG +2.81%

Beiersdorf AG +1.38%

Vonovia +1.09%

Brenntag AG +0.72%

DAX laggards

Commerzbank -1.98%

Deutsche Bank -1.30%

Bayer -1.01%

MTU Aero Engines -1.01%

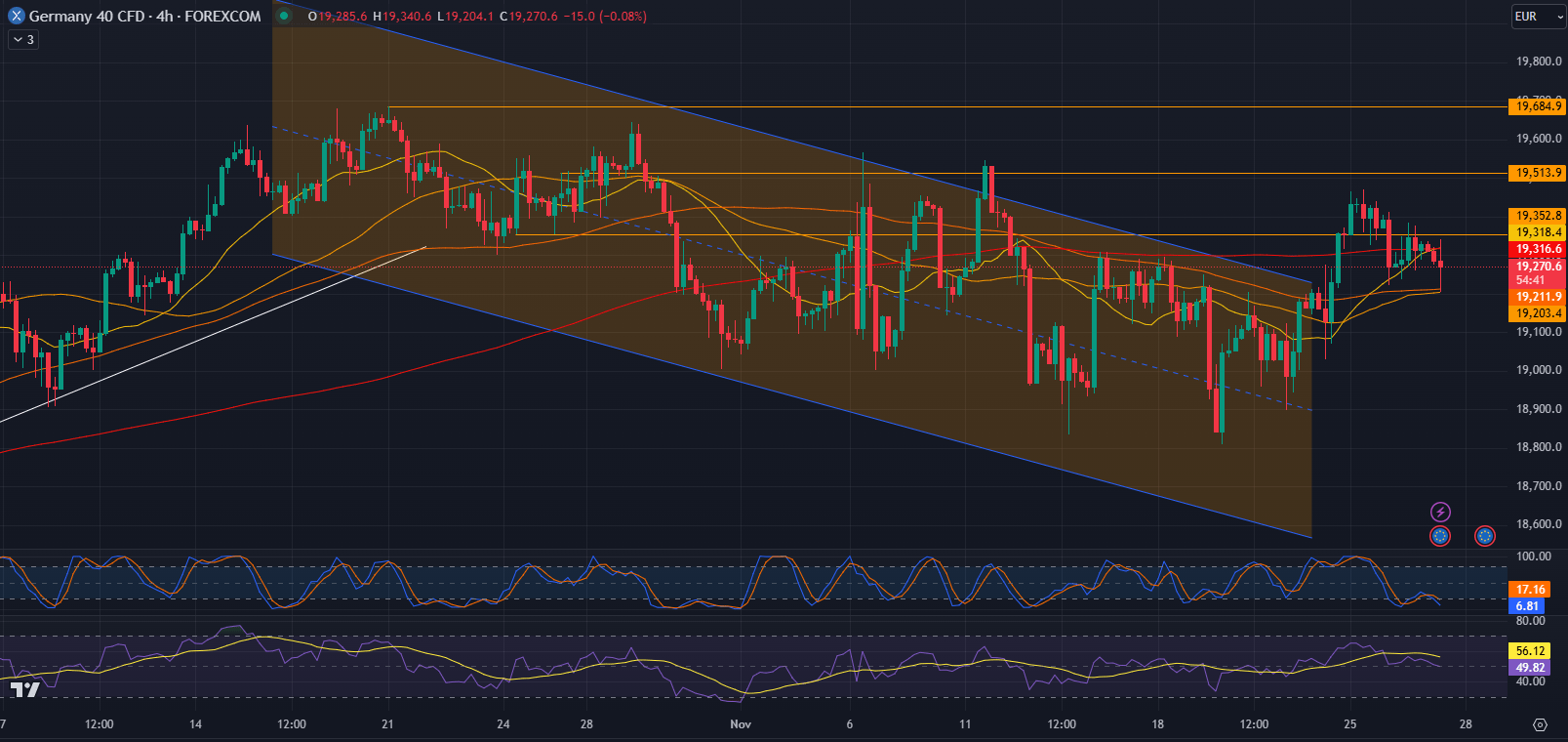

Germany 40 CFD (DAX) 4-hour chart

1. Current Price Action and Trend:

- The DAX is trading at 19,270.6, showing hesitation near the top-level of a descending channel (highlighted in orange).

- The recent recovery tested 19,318.4 (a key resistance level) but faced rejection, indicating possible weakness.

2. Support and Resistance Levels:

- Resistance:

- Immediate resistance lies at 19,318.4. A breakout above this level could lead to a test of the upper channel boundary near 19,513.9.

- Further resistance is at 19,684.9, representing a critical level for any broader bullish continuation.

- Support:

- The nearest support is at 19,211.9, aligned with the lower range of the recent consolidation zone.

- Further support lies at 19,203.4. A breakdown below this level would likely retest 19,100 or lower, targeting the lower boundary of the descending channel near 18,950.

3. Moving Averages:

- The price is trading below the EMA 10 at 19,316.6, which acts as immediate resistance.

- The EMA 20 at 19,318.4 further reinforces the importance of the current resistance zone.

- The EMA 50 at 19,159.4 and the EMA 200 at 19,203.4 act as dynamic support levels, with the price currently hovering between these key averages.

4. RSI and Stochastic RSI:

- The RSI is at 49.82, indicating a neutral outlook but leaning slightly bearish as it approaches the lower half of the range.

- The Stochastic RSI is at 17.16, indicating oversold conditions. This could suggest a potential short-term bounce, provided support levels hold.

5. Key Observations:

- The DAX is consolidating within the descending channel and struggling to break above key resistance levels.

- The combination of oversold Stochastic RSI and proximity to support levels suggests the potential for a bounce, but broader downtrend conditions remain intact unless the price manages to remain above the top level of the channel.

--Written by Philip Papageorgiou – Market Analyst

-Follow me on X ex Twitter: PhilipForexCom