With France's budget crisis and German inflation figures taking centre stage, Europe's political and economic stability is under threat. With bond rates rising to levels last seen during the 2012 euro zone debt crisis, the political uncertainty in France has also caused the French CAC40 stock index to drop to its lowest point since August. In short, A no-confidence vote against Prime Minister Michel Barnier's contentious budget, which seeks to increase taxes and reduce expenditure, is being threatened by far-right leader Marine Le Pen. This comes not 1 month after the dissolution of the German Government and weighs down the optimism in the EURO region.

In Germany, the economic uncertainty continues, as consumer mood continues to decline due to worries about job cuts, and the November inflation figures predicted to stay high at 2.6%. For 2024, the government predicts an economic shrinking of 0.2%, which would be the second year this would happen.

Isabel Schnabel, the director of the European Central Bank (EZB), yesterday gave a brief interview which caused noticeable market movements as she tried to throw water in the fire by mentioning that that the current 3.25 percent deposit facility rate was already close to a neutral level. As a consequence the financial markets now price in less rate cuts for 2025.

European equities are the focus of attention while US markets are closed for Thanksgiving.

Crypto news

Bitcoin approached the $100K mark once more after relaxing in the last 5 days, however, strength was not there to go past $97.2K.

Other cryptocurrencies like Solana and Ripple were pulled up with the first attempt, however, have relaxed slightly.

Corporate news:

CrowdStrike Beats Q3 Forecasts Despite Worldwide Outage Issues. With adjusted earnings of $0.93 per share on $1.01 billion in revenue, CrowdStrike Holdings exceeded analysts' projections of $0.81 per share and $983 million in revenue, delivering better-than-expected Q3 results.

Dell Technologies dropped 12.25% after weak forward guidance.

Hewlett Packard Enterprises dropped 6.25% after decreases in the Personal computing space and Printing were announced.

On the agenda today GMT

13:00 EUR German CPI (MoM) (Nov)

13:00 EUR ECB's Elderson Speaks

17:00 EUR ECB's Lane Speaks

23:50 JPY Industrial Production (MoM) (Oct)

DAX leaders

Airbus Group +2.84%

Daimper Truck Holding +2.77%

Deutsche Bank +1.33%

Commerzbank +1.19%

DAX laggards

Fresenius SE -0.48%

Qiagen N.V. -0.35%

Symrise AG -0.33%

Vonovia -0.13%

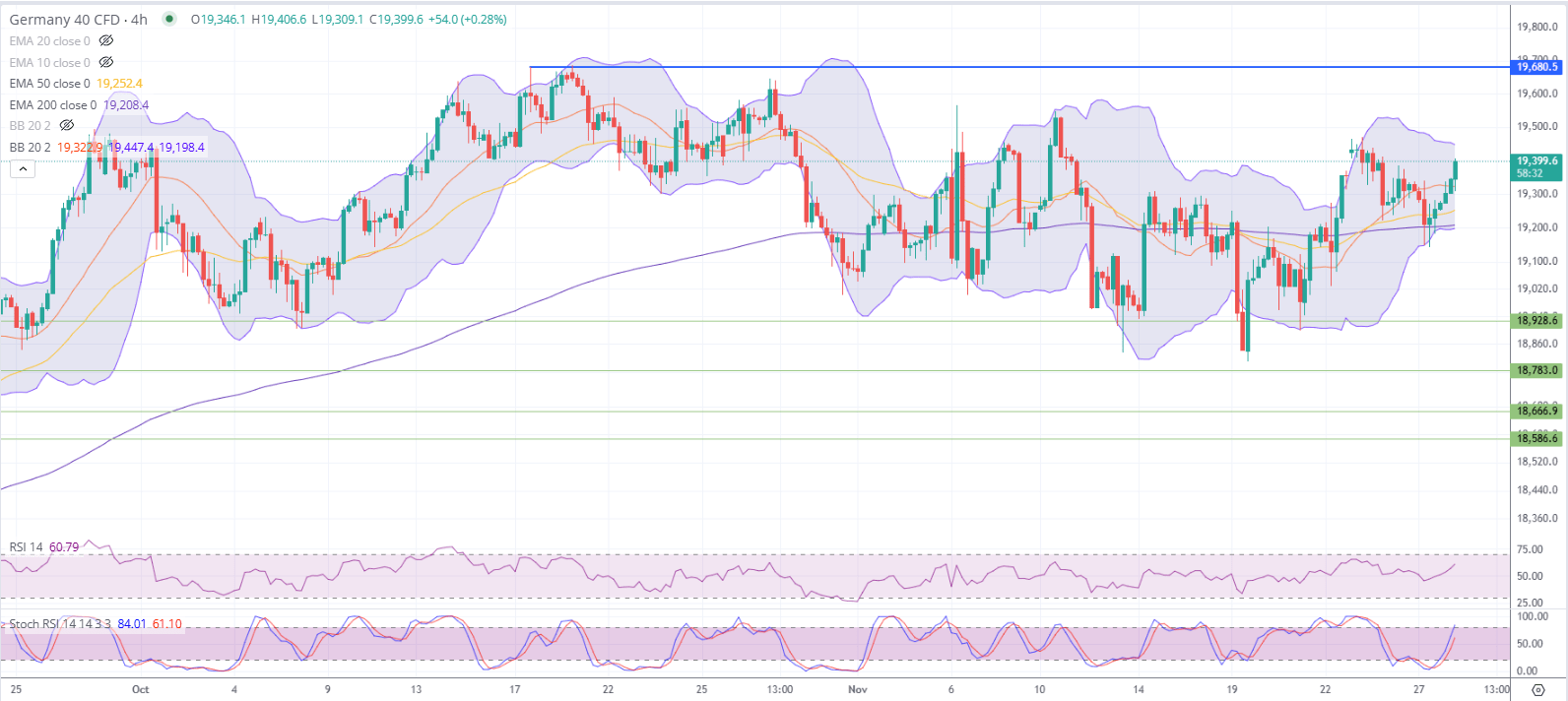

Germany 40 CFD (DAX) 4-hour Technical Analysis:

1. Current Price Action and Trend:

- The DAX is currently trading at 19,399.6, showing bullish momentum as it approaches resistance levels.

- The price is trading near the upper Bollinger Band, indicating strong upward pressure but also suggesting potential overextension in the short term.

2. Support and Resistance Levels:

- Resistance:

- Immediate resistance lies at 19,430, aligning with the upper Bollinger Band and recent highs.

- The next significant resistance is at 19,530.5, with a key psychological resistance at 19,680.5, marking a crucial test for bullish continuation.

- Support:

- Immediate support is at 19,252.4, near the middle Bollinger Band and EMA 50.

- Further support lies at 19,120.5, with a stronger base at 18,984.7, which has held as a key pivot in previous price action.

- Lower support levels include 18,783.0 and 18,666.9, which provide additional downside targets in case of bearish pressure.

3. Bollinger Bands:

- The DAX is nearing the upper Bollinger Band, suggesting potential short-term resistance.

- The middle Bollinger Band at 19,252.4 acts as dynamic support, and a break below this level could signal a reversion toward lower bands near 19,120.5.

4. RSI and Stochastic RSI:

- The RSI is at 60.79, reflecting bullish momentum but not yet overbought, leaving room for further upside.

- The Stochastic RSI is at 84.01, indicating overbought conditions, which could lead to a short-term pullback or consolidation.

5. Moving Averages:

- The DAX is trading above all key moving averages:

- The EMA 50 at 19,252.4 reinforces the importance of this zone as a critical level for maintaining bullish momentum.

- The rising moving averages indicate a healthy short-term uptrend.

Observations:

The DAX is demonstrating strong bullish momentum but is approaching overbought territory near 19,430. A breakout above this level could lead to a continuation toward 19,530.5 and 19,680.5, while a failure to break higher might result in a pullback to support levels at 19,252.4 or 19,120.5.