About DAX

As the Crop Science Unit struggles due to pricing pressures, Bayer shares plummeted -14.5% on Tuesday and continued its slide with an additional loss of -3.5% yesterday.

Porsche and Infineon dropped -6.17% and -4.70% respectively.

Top gainers yesterday were Siemens Energy AG which closed an impressive 18.95% higher my market close and Deutsche Telekom with a humbler gain of +2.21%.

To Watch today

13:30 CET – ECB Publishes Account of Monetary Policy Meeting

18:30 CET – Bundesbank-Mitglied Mauderer spricht

19:30 CET – EZB-Mitglied Schnabel spricht

20:00 CET – EZB-Präsidentin Lagarde spricht

DAX Technical Analysis

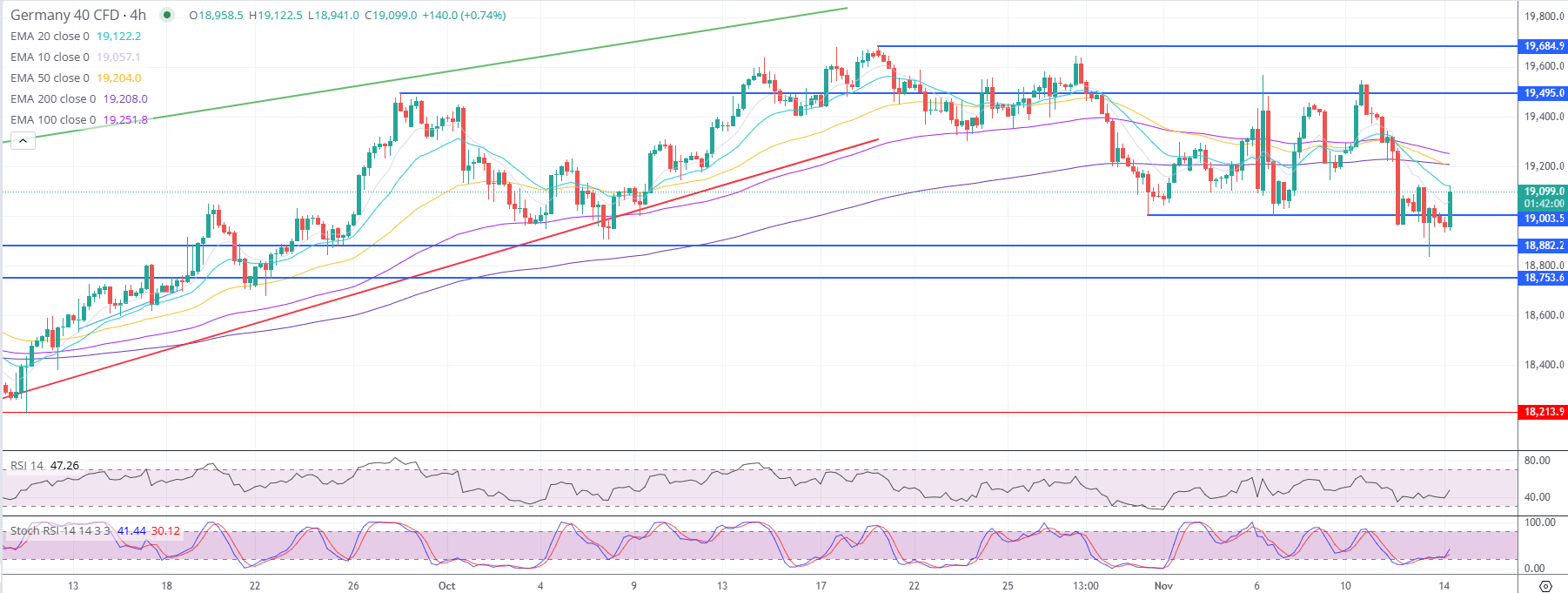

The DAX is currently trading at 19,100, showing a slight recovery after testing the support levels near 18,882.2. The recent price action indicates a bounce from support, but the index is still trading below key resistance levels, suggesting that traders are cautious.

Resistance:

The immediate resistance level is 19,308. A break above this would be needed for a potential bullish continuation. Above this, the next resistance is at 19,495, which could serve as a target if bullish momentum builds.

Support:

The immediate support is at 19,003.5. Holding above this level would be essential for the bulls to maintain control. Below that, 18,882.2 and 18,753.6 provide additional support levels, which could act as stabilizing zones if the price moves lower.

Moving Averages

The DAX is trading below all but the EMA 10:

The EMA 20 is slightly above the current price, acting as immediate resistance levels.

The EMA 50 and EMA 100 are at the same price around the 19,205 level which adds a strong resistance at this level.

The EMA 200 at 19,208.0 continues to act as the stronger of the bearish trends.

RSI and Stochastic RSI:

The RSI is at 47.26, reflecting a neutral to slightly bearish outlook, as it is just below the 50 level but not yet oversold.

The Stochastic RSI is at 41.44, with the fast line at 30.12, indicating that the index is approaching oversold territory. This could suggest a possible short-term bounce if support holds.

If the DAX can maintain support above 19,003.5 and break above 19,308, it could signal a continuation of the range, with a target of 19,495.

If the DAX fails to hold above 19,003.5 and breaks below 18,882.2, it could confirm a bearish breakdown with a potential move toward 18,753.6 and possibly lower.

A sustained move above or below these support levels would confirm further upside or downside risk where the secondary resistance/support levels would come into play.

Stay knowledgeable,

--Written by Philip Papageorgiou – Market Analyst

-Follow me on X ex Twitter: PhilipForexCom