Market Overview: Key Developments and Outlook

Asian Session Highlights

- USD vs. Yen: The U.S. dollar remained near a six-week low against the yen.

- Euro Weakness: The euro declined, partly due to political instability in France, where Prime Minister Michel Barnier faces a potential vote of no confidence, which could introduce volatility in the euro and European equities.

- Chinese Yuan: The yuan hit a 13-month low, driven by concerns about potential U.S. tariffs.

- Commodities:

- Gold fell 1.1% to $2,625.69/oz, influenced by a stronger USD and profit-taking.

- Oil prices remained steady.

U.S. Political Developments

- US Steel Protectionism: President-elect Trump opposed the acquisition of US Steel (X) by Japan’s Nippon Steel, pledging tax incentives and tariffs to bolster U.S. steel companies.

- Warren Stephens Nomination: Trump nominated Warren Stephens as the U.S. envoy to Britain, signaling continued focus on strengthening U.S.-UK relations.

Swiss Inflation

- Headline Inflation: November figures came in as expected at 0.7% YoY (headline) and 0.9% YoY (core). The Swiss National Bank (SNB) is expected to cut rates by 25 bps at its next meeting on 12 December.

Key Agenda Items (GMT)

- 15:00: USD JOLTS Job Openings (October) – A key indicator of U.S. labor market health.

- 21:30: USD API Weekly Crude Oil Stock – Insight into U.S. oil inventory levels.

- Earnings Releases:

- Salesforce (Aftermarket)

- Okta (Aftermarket)

Outlook for Europe

- ECB Insights: Five ECB officials, including President Lagarde, will speak on 5 December ahead of next week’s ECB meeting. A 25 bps rate cut is fully expected on 12 December, with further cuts totaling 164 bps by the end of 2025 anticipated.

- Policy Rationale: The ECB’s rate cuts aim to support European growth in response to potential U.S. tariffs and reduced U.S. involvement in Ukraine.

DAX Overview

DAX leaders:

- Deutsche Bank: +1.92%

- Heidelberg Materials: +1.61%

- BMW AG: +1.44%

- BASF: +1.33%

DAX Laggards:

- Sartorius AG VZO: -2.42%

- Symrise AG: -1.55%

- Siemens Energy AG: -1.28%

- Mercedes Benz Group: -1.27%

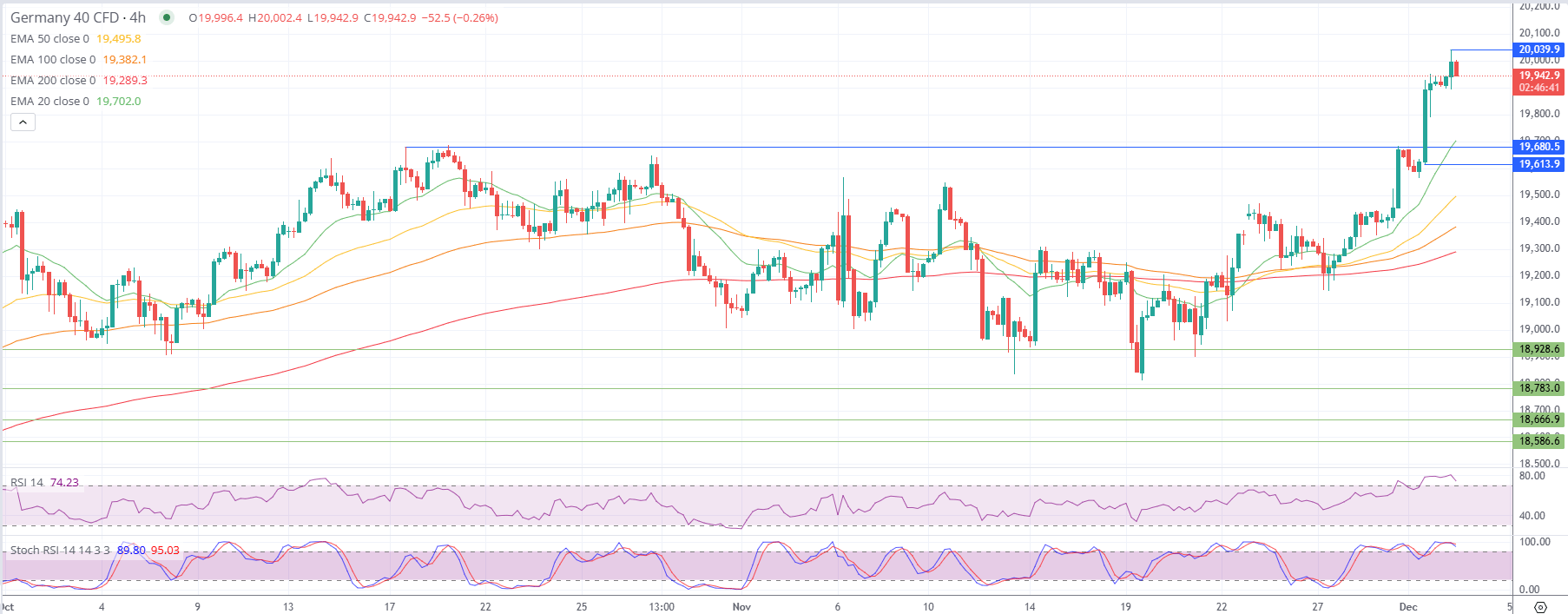

Germany 40 (DAX) Technical Analysis 4-hour chart:

The DAX has shown strength, led by industrial and financial sectors, reflecting optimism ahead of ECB rate cuts. However, political instability in France and potential U.S. tariffs could introduce near-term volatility. Investors should monitor Eurozone inflation updates and ECB speeches for further direction.

1. Current Price Action and Trend:

- The DAX is trading at 19,942.9, showing a slight pullback after testing the psychological resistance at 20,000.

- The recent breakout above 19,680.5 indicates strong bullish momentum, but overbought conditions suggest a potential short-term pause or retracement.

2. Support and Resistance Levels:

- Resistance:

- Immediate resistance is at 20,039, which aligns with the psychological 20,000 level.

- A breakout above 20,039 would signal further upside, potentially targeting 20,200.

- Support:

- The first support lies at 19,680.5, the previous breakout level. This will act as a critical pivot for bullish continuation.

- Further support levels are at 19,613.9 (aligned with recent consolidation) and 19,495.8 (near the EMA 50).

- Lower support is at 19,382.1 (EMA 100) and 19,289.3 (EMA 200).

3. Moving Averages:

- The DAX is trading above all key moving averages, confirming the bullish trend:

- EMA 20 at 19,702.0 provides immediate dynamic support.

- The EMA 50 at 19,495.8, EMA 100 at 19,382.1, and EMA 200 at 19,289.3 reinforce medium- to long-term bullish sentiment.

4. RSI and Stochastic RSI:

- The RSI is at 74.23, indicating overbought conditions. This suggests the possibility of a pullback or consolidation in the near term.

- The Stochastic RSI is at 95.03, confirming extreme overbought conditions, which may lead to short-term profit-taking.

5. Key Observations:

- The DAX has extended its bullish run with a breakout above 20,000, but momentum indicators are signaling caution.

Thesis:

Scenario 1: Bullish Continuation:

- If the DAX breaks above 20,039, it could target 20,200 and potentially higher levels in a sustained bullish scenario.

- A strong push above 20,039 would confirm the continuation of the uptrend, supported by rising moving averages.

Scenario 2: Short-term Pullback:

- Overbought conditions suggest a potential pullback toward 19,680.5 or 19,613.9.

- A breakdown below 19,680.5 could lead to a deeper correction, targeting 19,495.8 and 19,382.1.

Latest market news

Today 04:10 PM

Today 12:30 PM

Today 09:44 AM

Today 09:34 AM