An Action-Packed Day: EU CPI & Core CPI and the Fed Interest Rate Decision – What Traders Need to Know

September 18th, 2024 could be one of the most crucial days of the year for global financial markets. Traders will be faced with a storm of economic events with the release of the European Union Consumer Price Index (CPI) and Core CPI, followed by the much-anticipated Federal Reserve interest rate decision later in the day. The backdrop to these events is even more intriguing now, as the European Central Bank (ECB) is already on the second interest rate cut that occurred last week.

The stakes are therefore high for the FED to initiate their first interest rate cut since 2020. And if indeed it happens, bringing the rate down to levels not seen since June 2023.

The EU CPI & Core CPI: Gauging the ECB's Decision

The release of Wednesdays EU CPI and Core CPI data will be interesting information, to see if the ECB made the right call, in cutting rates last week. The ECB's decision to lower the rates was a move made by the ECB to try bolster the Eurozone economy back up, after seeing slowing growth and weaker demand in the domestic market. However, the question remains whether the ECB should have cut rates even further, or perhaps if the move was premature given the current inflationary environment of potentially sticky inflation.

The Importance of the first EU CPI and Core CPI data after a rate cut

As the CPI measures the overall change in consumer prices, this number reflects pressures and mitigation successes across the Eurozone. The last YoY CPI report came in at 2.2%, being the lowest level since August 2021 and making this the lowest level in the last 3 years. Core CPI which excludes volatile items like food and energy, provides a different picture of inflation trends but is often overlooked. The latest Core CPI reports also show a potential stabilisation around these levels of 2.8%. The last 10 readings of the Core CPI were reported as either higher or lower by 0.1% and thus having potentially stabilised.

The eurozone’s final Consumer Price Index (CPI) for August is a key focus for the region. According to the flash estimate, inflation cooled to 2.2% year on year, marking the slowest increase since July 2021.

However, the core inflation remains stubborn at 2.8%. The target the ECB has is 2.0%.

Also noteworthy is the German ZEW Economic Sentiment Index for September, released on the 17th of September reached a 11 month low at 3.6 opposed to 19.2 previously and implies a weakening in outlook for the next 6 months and in turn for the economic health of the country and overlapping into Europe.

You can read more on what the ZEW means here: https://www.forex.com/ie/news-and-analysis/zew-current-conditions-and-economic-sentiment-what-does-it-mean/

In August, the index also fell sharply to a 6-month low of 19.2, highlighting the continued deterioration of Europe’s largest economy.

Recent political uncertainty is also contributing to the gloomy outlook.

Scenarios for the EU CPI print

-

Scenarios of A Higher-than-Expected CPI:

If the CPI numbers on Wednesday come in higher by a long margin than the expected 2.2% currently, and Core CPI come in surprisingly higher than the expected 2.8%, it may suggest that inflation is still not under control. This could indicate that the rate cut was introduced prematurely and might spark renewed fears of recession if the rates will need to remain at these levels for longer. For the EUR a strong inflation print could also push the euro lower, as it might signal that the ECB’s cut wasn’t sufficient to stabilize the economy. -

A Lower-than-Expected CPI:

On the other hand, if the inflation data shows that price pressures are easing, it could lend credibility to the ECB’s decision, and market participants could interpret this as a success. Lower CPI and Core CPI figures could indicate that inflation is on the right track to cooling further and would validate the ECBs decision to cut at last week’s announcement. This could buoy the market sentiment as it would appear that an avoidance of more severe measures was achieved.

European equities should be closely watched, particularly those sensitive to interest rates, such as financials and real estate could react negatively to a hotter than expected CPI report, as this could reignite fears of a more hawkish tone at the next meetings.

Conversely, a surprise of a lower CPI could offer some relief to the euro and provide a tailwind for European stocks, as it would suggest that the ECB’s rate cut has been sufficient to keep inflation at check at this point.

The UK is scheduled to disclose its August CPI on Wednesday. Preliminary estimates indicate that inflation will stay stable at 2.2%. In spite of this, the economy has grown at a flat rate for the last two months, which could lead the Bank to consider another decrease in November.

The Fed Interest Rate Decision: All Eyes on Powell

In the afternoon, the spotlight will shift across the Atlantic to the Federal Reserve’s interest rate decision where markets are fluctuating between a 25 bps rate cut and a 50 bps rate cut. Last week’s U.S CPI report fell mostly in line with estimations, however the Core CPI comparing to last month came in just slightly hotter than expected at 0.3% as opposed to the 0.2% expected, however this was not interpreted as a risk of continuing inflation.

The 25 bps Cut – Likely, but Not Without Risks

The expectation of a 25-bps hike is widely priced into markets, however is fluctuating between 25 bps and 50 bps almost daily. As Fed Chair Jerome Powell highlighted at the Jackson Hole symposium, they are ready to cut at the next FED meeting. But we have no information yet as to the extent of the cuts.

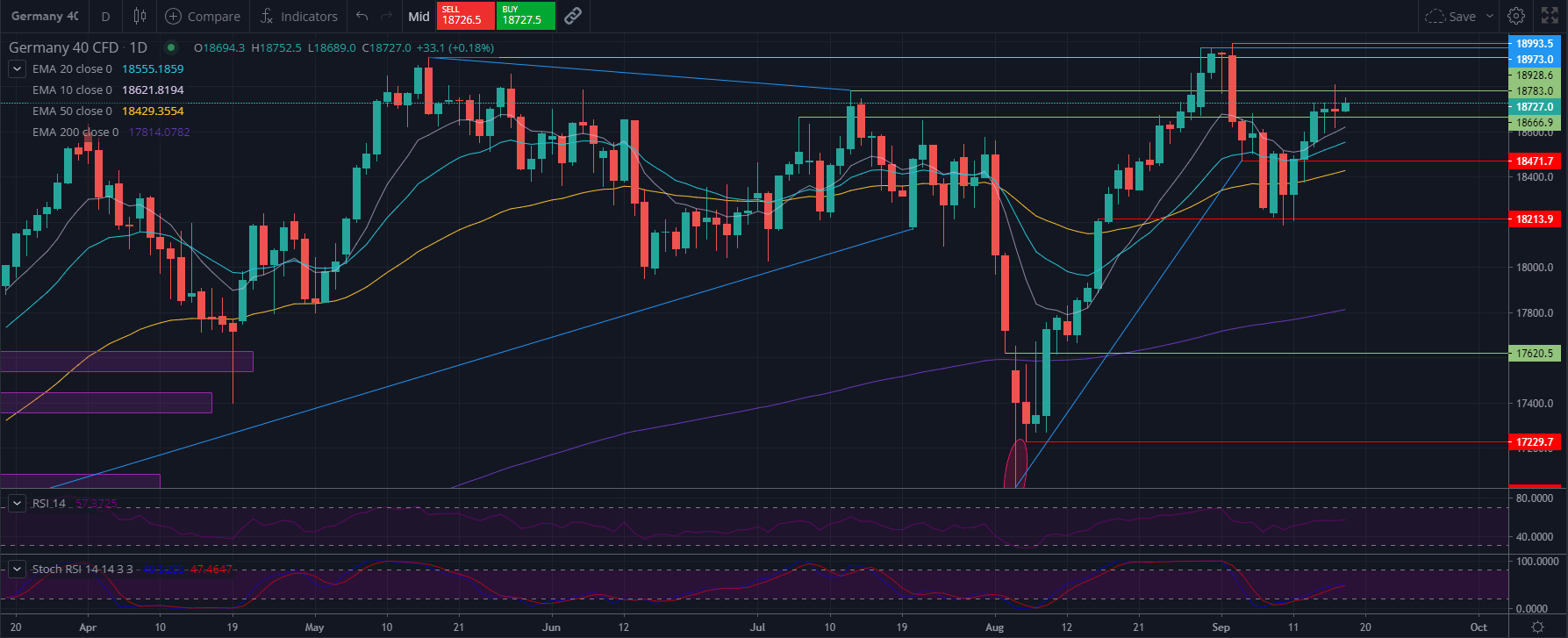

DAX technical analysis

The DAX posted a light loss of -0.13% yesterday creating a large shooting star candle. As mentioned, several times before, the 18,210 mark served as support on several occasions last week, from which the price bounced several times.

In the last trading week, we saw the price break through the 18471-resistance level and subsequently reach the 18666 resistance level. We are currently above the 10, 20, 50 and 200 EMAs between the 18.783 and 18666 resistance and support lines.

Today we opened slightly lower than yesterdays close, ahead of this action-packed day. We now have the 18666 and 18471 level as support should we continue to lose bullish momentum. If the price turns around, the 18783 level will have to be attacked again on the upside. Currently, the RSI is slightly bullish with a 55 reading, and the Stochastic RSI is also at the center line and trending upward. This could be a sign that the bulls are gaining ground. With several high volatility sessions coming up today, we are expected to have volatility which could go both ways. Traders could stay cautious.

All eyes open,