Daily Market Overview and Strategy - January 2025

Global Market Update

- US Treasury Yields Surge:

- 10-year Treasury yields hit 4.805%, a 14-month high, sparking investor concerns over inflation and the future of Fed rate policies.

- Strong US payroll data reduced expectations of near-term rate cuts, fueling market uncertainty.

- Tech Sell-off Spreads to Asia:

- US technology stock weakness extended to Asian markets.

- Japan’s Nikkei dropped 1.5% amid global investor anxiety.

- Dollar Strength:

- The dollar index reached a two-year high before easing slightly.

- Strong economic data supported its rise, though investors remain cautious ahead of US inflation data.

- Oil Prices Surge:

- Brent and WTI crude prices are up over 8% YTD, hitting a 5-month high.

- Supply concerns were driven by:

- Declining stockpiles in the US (Cushing, Oklahoma, at their lowest since 2014).

- Harsh winter forecasts in the US.

- Tightened sanctions on Russian energy exports and insurance companies.

- Political Developments in Europe:

- France’s 2025 budget debate, with focus on pension reforms, raised political uncertainty and drove French debt risk premiums to 12-year highs.

Corporate News

- US Tech and AI Restrictions:

- Further export restrictions on AI chips and technology targeting China.

- TikTok Ban Progress:

- US Supreme Court appears likely to uphold a potential TikTok ban, citing national security concerns.

- Apple Market Share Decline:

- Falling iPhone shipments in China led to a 2.4% drop in Apple stock.

- M&A Activity:

- Johnson & Johnson plans to acquire Intra-Cellular Therapies for $14.6 billion.

- Amazon Service Closure:

- “Try Before You Buy” for Prime members to end by January 31, 2025.

- Crypto Market:

- Bitcoin fell below $91,000, raising concerns at the $3.2 trillion market support level.

- BlackRock launched a Bitcoin ETF in Canada.

Economic Calendar:

- USA:

- PPI Data: Key indicator of inflation.

- EIA Short-Term Energy Outlook: Focus on oil price drivers.

- Federal Budget Balance for December.

- FOMC Member Williams Speaks: Possible monetary policy insights.

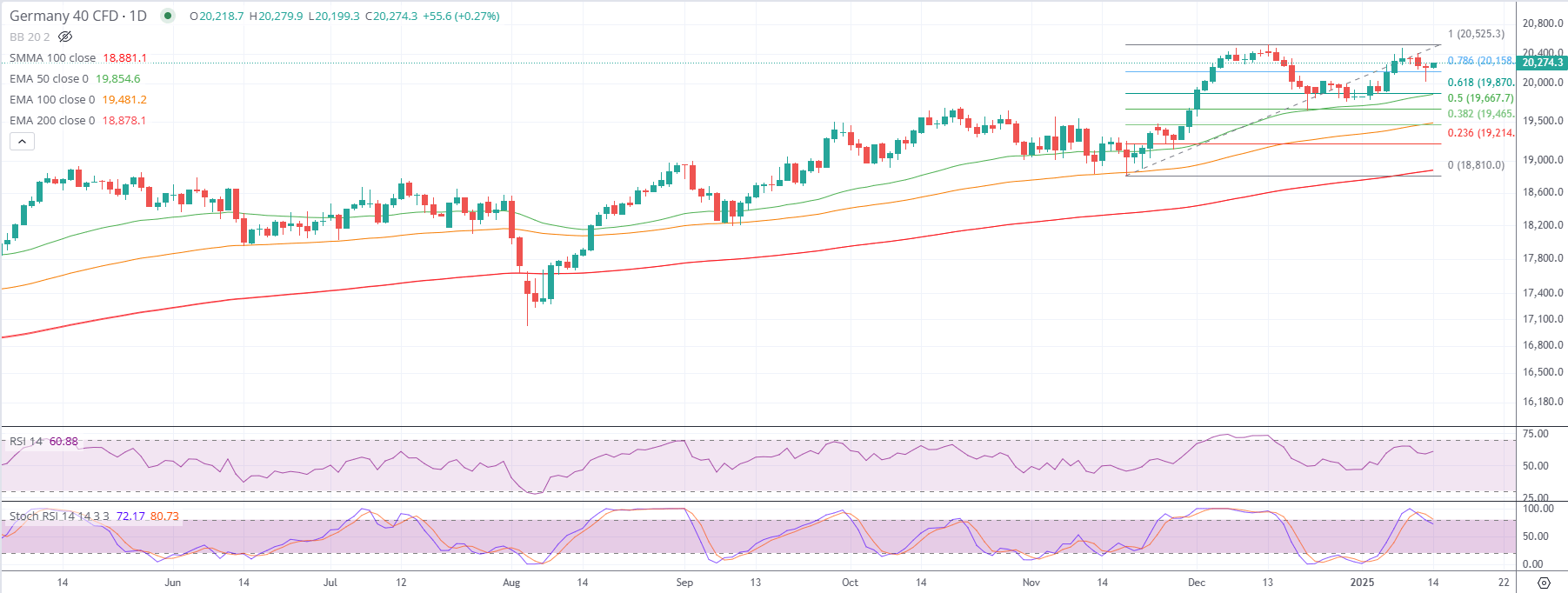

DAX Technical Analysis

- Trend Overview:

- The DAX remains in an uptrend with bullish momentum.

- Trading above key moving averages (50, 100, 200 EMA) supports long-term sentiment.

- Key Levels to Watch:

- Resistance: 20,525.3 (previous swing high).

- Support: 20,158 (Fibonacci 0.786 level); 19,870 (Fibonacci 0.618 level).

- A break above 20,525.3 could signal a continuation of the uptrend.

- Indicators:

- RSI: Mildly bullish at ~60.88; caution above 70.

- Stochastic RSI: Overbought (~80.73); signals potential consolidation or pullback.

- Outlook:

- Bullish Case: Breakout above 20,525.3 targets new highs.

- Bearish Case: Drop below 19,870 may signal a pullback to 19,667 or 19,465.

Actionable Strategy

- For Equity Traders:

- Watch US tech sector for signs of stabilization post-selloff.

- Traders might currently be watching the DAX levels of 20,525.3 where strong resistance lies historically according to the chart. If this resistance is breached a possible continuation might be in order..

- For Oil Traders:

- Monitor Brent and WTI price action amid tight supply dynamics and geopolitical risks.

- Short-term bullish bias, particularly if forecasts of colder US weather materialize.

- For FX Traders:

- Focus on USD strength; evaluate the dollar's performance post-PPI data.

- Watch for volatility in EUR/USD due to European political concerns.

- For Crypto Investors:

- Cautiously assess Bitcoin's ability to hold above critical support levels.

- Monitor the impact of BlackRock’s ETF on market liquidity and sentiment.

- Prepare for High Volatility Events:

- If you are exposed to excessive risk and wish to hedge a portion of your account, it may be prudent to adjust stop-loss levels and position sizes ahead of US inflation data and Fed commentary.

Latest market news

Yesterday 10:50 PM

Yesterday 09:45 PM

Yesterday 08:02 PM

Yesterday 07:00 PM

Yesterday 06:25 PM

Yesterday 05:30 PM