Key Events

- US ISM Manufacturing PMI: Reaches 5-month highs

- US Non-farm Payrolls: Drop to February 2021 lows

- ISM Services PMI (Tuesday)

- US Elections (Tuesday)

- Fed Rate Decision (Thursday)

- FOMC Meeting (Thursday)

US Elections Impact on Crude Oil Prices

Key factors influencing the oil market amid the US elections include policies on military funding, economic strategies, foreign relations, the global shift toward renewable energy, and OPEC/non-OPEC cooperation. These elements are likely to shape oil price volatility in the lead-up to and aftermath of the US elections. Full Article: Crude Oil US Election Outlook

Fed Rate Anticipations

October’s non-farm payrolls plunged to 12k, a significant miss from the expected 106k, and the lowest since February 2021, increasing hopes for a Fed rate cut, according to the CME Fed Watch Tool. While lower payroll numbers may dampen oil demand, they introduce potential policy shifts against a backdrop of geopolitical tensions and election volatility.

US Economic Growth Data

The US Advance GDP estimate declined slightly, from 3% in the previous quarter to 2.8%, reflecting some softening in economic expansion. However, the ISM Manufacturing PMI has shown resilience, rising to 5-month highs, and Tuesday’s ISM Services PMI will provide further insight into economic activity, coinciding with election day.

Geopolitical Tensions

Geopolitical risks continue to influence oil markets, particularly with Middle East tensions straying from ceasefire hopes. These factors add upside risk potential to oil prices, amplifying market sensitivity.

Technical Analysis

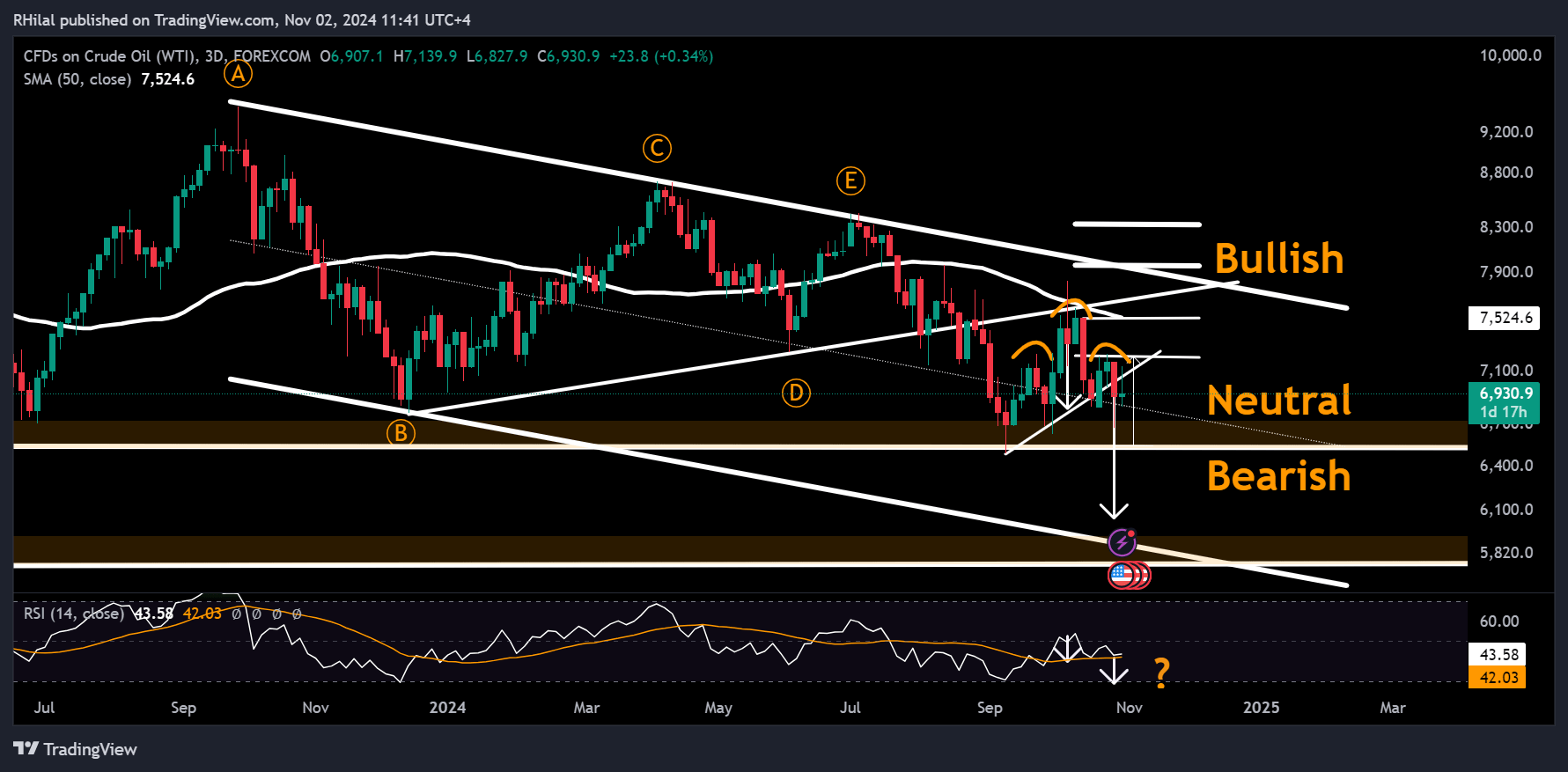

Crude Oil Week Ahead: USOIL – 3Day Time Frame – Log Scale

Source: Tradingview

Crude oil volatility remained constrained below the $72 resistance and above the $65 support level this week, closing below a trendline linking the September and October 2024 lows, with a potential head-and-shoulders pattern forming.

Approaching the key $64-$67 support zone, in place since December 2021, and with geopolitical and election-related uncertainties, irregular volatility is anticipated.

- Short-term resistance zones: 72 - 76

- Long-term resistance zones: 80 - 84

- Short-term support zones: 67 - 64

- Long-term support zones: 60 - 58 - 49

— Written by Razan Hilal, CMT – on X: @Rh_waves