Key Events:

- IEA Short-Term Energy Outlook (Tuesday)

- FOMC Meeting Minutes (Wednesday)

- Crude Oil Inventories (Wednesday)

- US CPI core, y/y, m/m (Thursday)

US Economic Indicators

Friday’s labor market data reinforced a strong economic outlook:

- Pushing the US Dollar Index above 102 and boosting stock market indices towards their record highs

- Reducing expectations of a large rate cut to 25 bps

- Enhancing expected oil demand alongside improving labor market conditions

This week, FOMC meeting minutes and US CPI data are likely to add volatility to the market, especially with their influence on rate cut expectations. As labor market concerns ease, these events will play a key role in determining oil price trends from a monetary policy perspective.

Middle East Tensions

On the supply side, escalating tensions in the Middle East have shifted away from ceasefire hopes, adding upward pressure on oil prices due to potential supply disruptions. As threats of strikes on oil facilities increase, oil retested the $75/barrel zone last Friday.

Technical Outlook

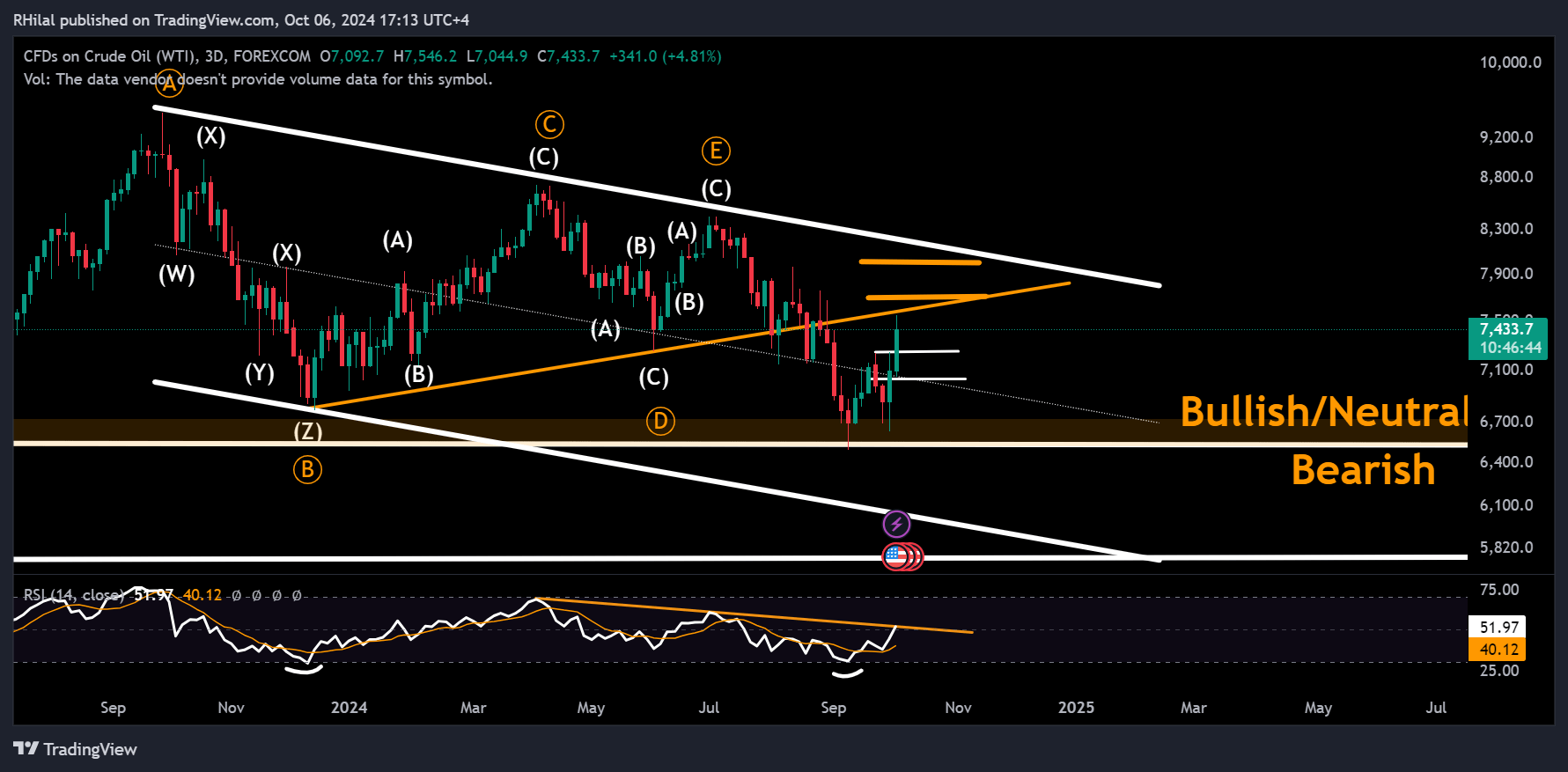

Crude Oil Week Ahead: 3Day Time Frame – Log Scale

Source: Tradingview

As concerns over the US labor market eased and worries about Eastern oil supply disruptions grew, USOIL saw a positive rebound from the $65 support level, retesting the lower boundary of the year-long consolidation at $75.40. With $76 acting as a significant resistance level, a close above this point could shift overall sentiment towards a more optimistic outlook, targeting potential levels at $77 and $80.

The Relative Strength Index (RSI) is aligned with a resistance level that connects the lower highs from April and July 2024, indicating a potential reversal back to the $70 and $65 levels.

The $65 support remains crucial in defining a neutral or downward scenario for oil. On the upside, a break above $77 would push oil prices toward the $80 mark, potentially leading to further gains towards the highs of 2024.

--- Written by Razan Hilal, CMT – on X: @Rh_waves