Key Events This Week

- Chinese New Loans (Monday)

- OPEC Monthly Report (Tuesday)

- Chinese FDI (Wednesday)

- US CPI (Wednesday)

- IEA Monthly Report (Thursday)

- Chinese Retail Sales and Industrial Production (Friday)

OPEC and IEA Reports

The October reports from OPEC and the IEA showed downward revisions in both price and demand for crude oil through 2025, reflecting concerns about geopolitical risks and supply disruptions in 2024. With a potential Trump presidency in 2025, focused on cutting energy prices by 50%, these projections could face new adjustments. OPEC has already hinted at postponing any production increases at its December meeting, adding significance to Tuesday’s report for a revised outlook.

Chinese Data

China will release data on new loans, FDI, retail sales, and industrial production this week, which will provide analysts with a closer look at China’s economic activity and investor sentiment. After a 15-year low in new loans and FDI levels this past July, recent manufacturing PMIs moved back above the expansionary 50 mark for the first time in seven months, potentially raising hopes of an economic improvement following recent fiscal stimulus measures.

FOMC and Upcoming CPI Data

The FOMC is balancing its dual mandate—reaching the inflation target while maximizing employment—against an uncertain economic outlook, especially with Trump’s 2025 agenda on the horizon. For the rest of 2024, the Fed is expected to take a data-driven approach alongside its easing cycle.

Recent CPI data showed monthly and core CPI holding steady at 0.2% and 0.3%, with year-over-year CPI cooling slightly from 2.5% to 2.4%. Further easing may be anticipated if inflation rates proceed downwards as the Fed continues rate cuts to stimulate necessary economic activity.

Technical Analysis: Quantifying Uncertainties

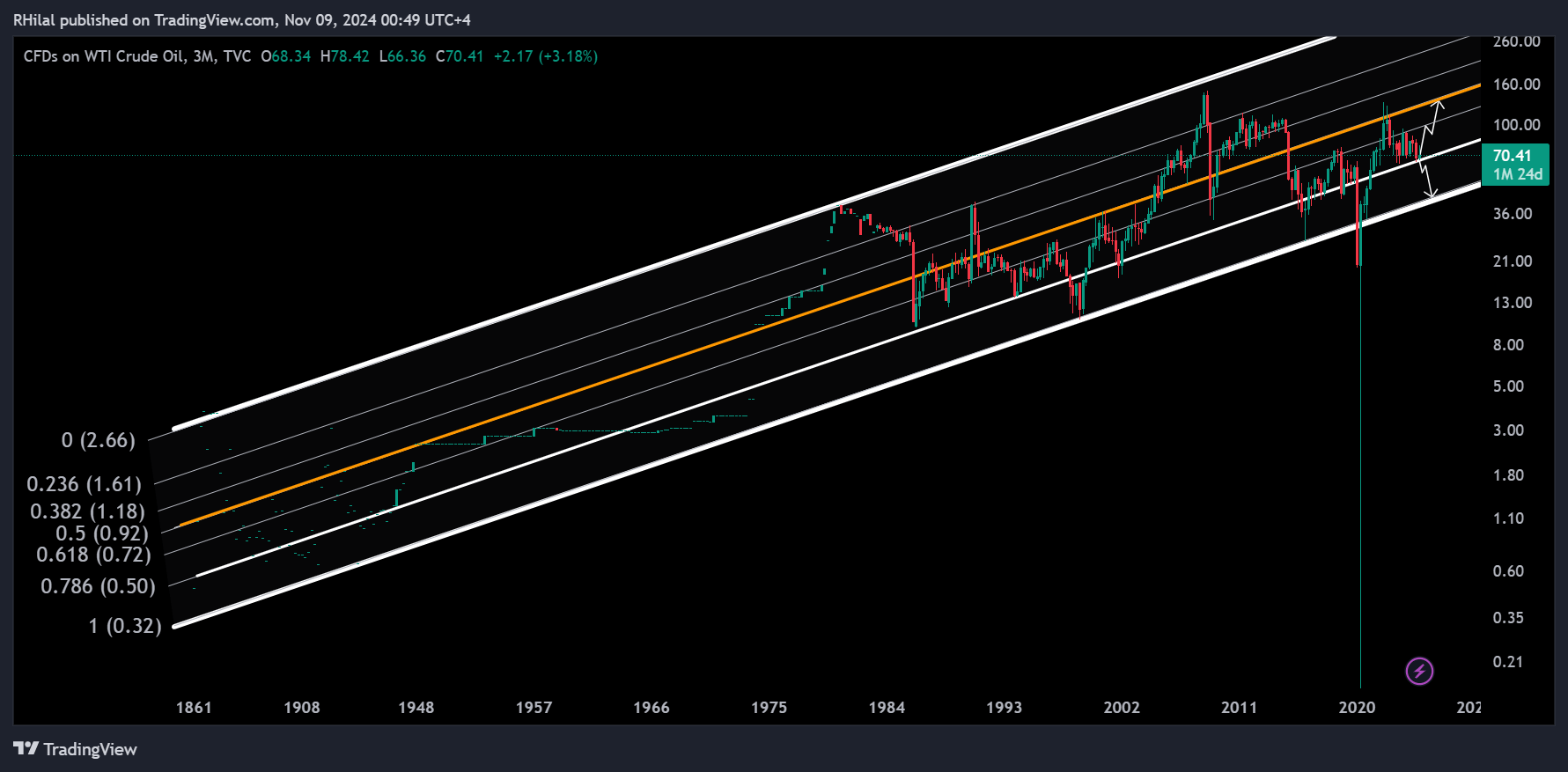

Crude Oil Week Ahead: 3-Month Time Frame

Source: Trading view

Oil prices remain constrained between the $65 support and the $72 resistance. This prolonged consolidation reflects the dual influences of anticipated demand declines and geopolitical risk factors. The longer this tight range persists, the sharper a potential breakout may be.

The 3-month chart reveals the primary up-trending parallel channel, which has contained crude oil prices since the lows recorded in the 1800s, with the exception of the unusual breakout during the pandemic. Currently, prices hover around the crucial $64-$65 support zone, aligning with the 0.786 Fibonacci level of the channel.

Bullish Scenario: A decisive close above $72.30 may drive prices toward resistance levels at $76, $80, and $84, potentially paving the way for a long-term rally to 2022 highs near $128.

Bearish Scenario: A decisive close below the $64-$65 range could push prices down to the $60-$58 zone and potentially further to the lower boundary of the primary uptrend near the $40 price zone.

--- Written by Razan Hilal, CMT – on X: @Rh_waves