Key Events

- Middle East: ceasefire deal or further retaliations?

- US Advance GDP (Wednesday)

- Chinese Manufacturing and Non-Manufacturing PMIs (Thursday)

- US Non-Farm Payrolls (Friday)

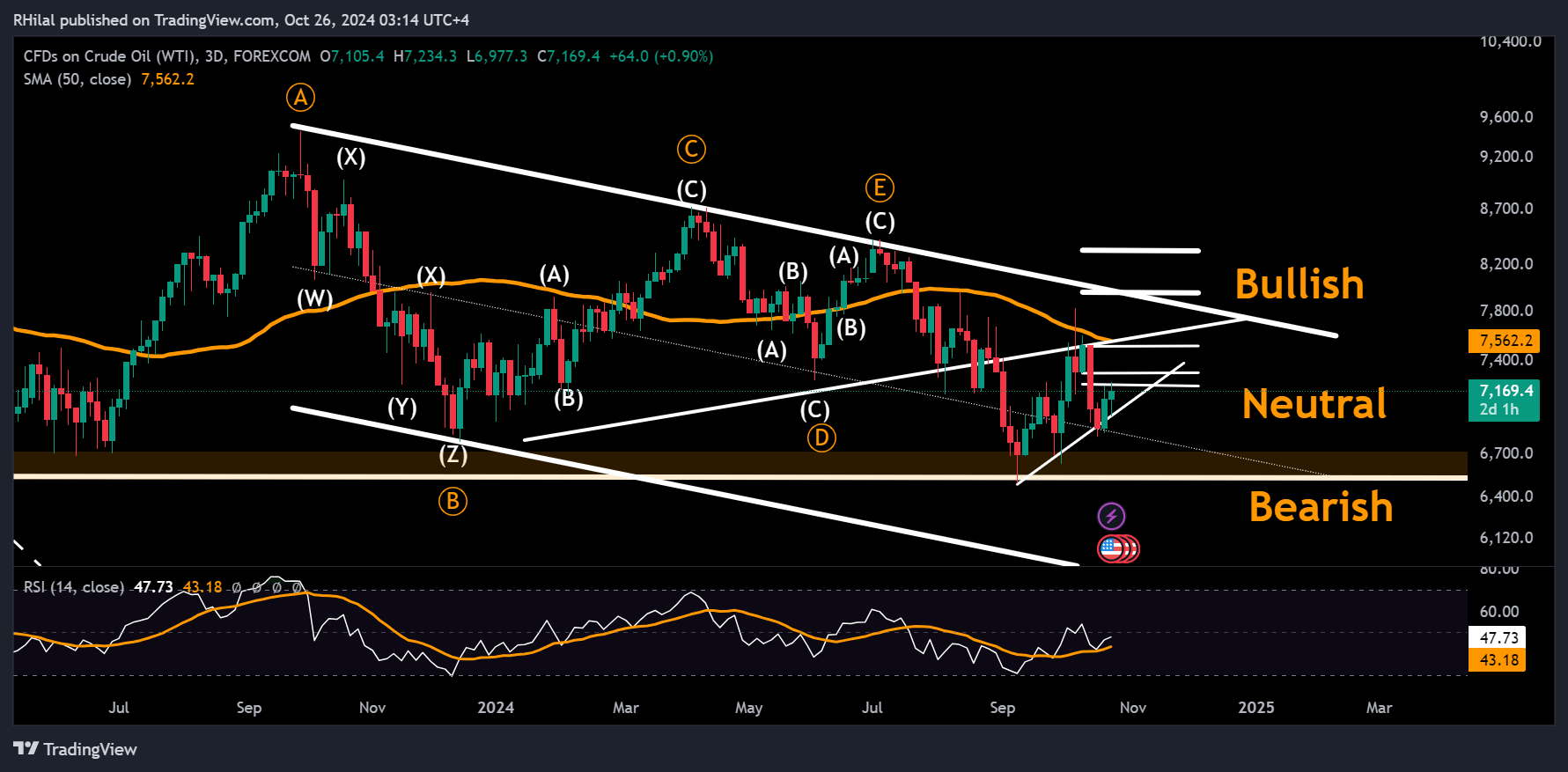

- Technical Analysis: USOIL

Middle East: Ceasefire Deal or Further Retaliations?

With US elections just two weeks away, hopes for a ceasefire in the Middle East remain uncertain, challenging the ongoing downtrend in oil prices. Investors are hedging against the potential for further market volatility, with haven assets and crude oil in focus.

While gold ended the week near record highs and oil held steady above the $70 mark, the ongoing conflict between Israel and Iran—despite no direct attacks on oil supplies—keeps the risk of further retaliations on the horizon, threatening to disrupt oil markets further.

Chinese PMIs, US GDP, US NFP

Beyond geopolitical risks, this week’s Chinese PMIs, US GDP, and Non-Farm Payrolls (NFP) reports are closely watched for their potential impact on the oil demand outlook and prices. With the Fed rate decision and US elections approaching, US economic data will be key.

China's PMI data will be analyzed for signs of recovery, while any slowdown in US GDP and NFP figures could point toward easier monetary policy, shaping expectations on whether the Fed will cut rates or hold steady.

Technically Speaking

Crude Oil Week Ahead: 3 Day Time Frame - Log Scale

Source: Tradingview

Although the latest supply concerns supported oil’s positive rebound from the mid channel and trendline connecting September’s consecutive lows, Oil is still trading below its year-long consolidation and 50-period SMA.

The upside potential for oil remains between 73 – 75 before confirming a bullish scenario From the downside, a break below the 68 and 65 support levels is needed to confirm the extension of the primary downtrend.

--- Written by Razan Hilal, CMT – on X: @Rh_waves