Key Events:

- OPEC Monthly Report

- EIA Short-Term Energy Outlook

- US CPI (m/m, y/y, Core CPI)

- Crude Oil Inventories

OPEC and EIA Reports

OPEC Monthly Report: OPEC delivered its second consecutive downward revision for oil demand in 2024-2025, citing economic challenges in China and the global shift toward cleaner energy. This adjustment has led to the reversal of the previously planned October production hike, adding to the bearish sentiment in the oil market.

EIA Short-term Energy Outlook: Despite the bearish demand outlook, the EIA expects oil prices to rebound in the remaining part of 2024, driven by OPEC’s production cuts and potential inventory drops. Global consumption of liquid fuels has been adjusted lower for both 2024 and 2025, but the supply-demand balance is expected to support higher prices in the medium term.

US CPI and Rate Cut Expectations

With the Fed rate cut size under debate, the latest expectations by the CME Fed Watch tool for the upcoming rate cut magnitude is 65% for a 25bp cut and 35% for a 50bp cut, yet to be altered with the upcoming CPI data today.

Crude Oil Perspective: if a significant drop in US CPI was able to revise the 50bp rate cut magnitude expectation upwards, positive volatility can be seen on oil charts given stronger easing policies on the horizon for the economy.

USDJPY Perspective: With a 25bp cut largely priced into the dollar, a shift to a 50bp cut could see USDJPY break below the key 140 level. The upcoming BOJ policy for a rate hike or rate hold is set to lead the trend on the USDJPY pair following the effect of the Fed rate cut magnitude.

Technical Outlook

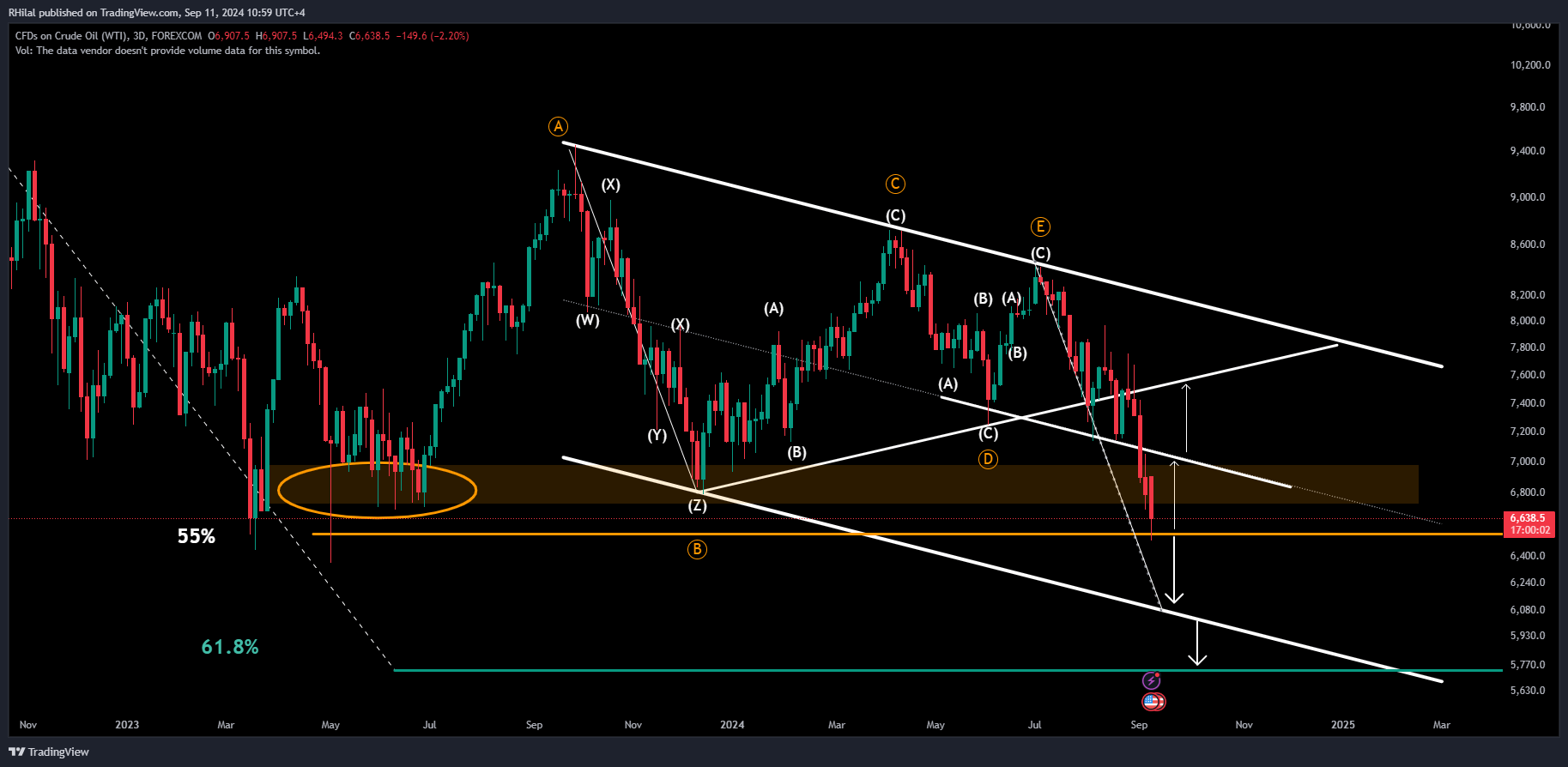

Crude Oil, USDJPY Analysis: USOIL – 3D Time Frame – Log Scale

Source: Tradingview

Following the bearish impact from the global oil demand outlook revisions, oil retested a strong support barrier at the 65 price-zone and is one more drop away towards the lower end of the channel and the 60 price-zone.

A potential support can be found at the 60 level from a psychological and round number point of view, yet my sharper projection is towards the 58 level as it aligns with the weekly 0.618 Fibonacci retracement between the lows of 2020 and highs of 2022.

From the upside, a positive impact from inventories, supply disruptions, or rate cut magnitudes can trace bullish corrections back towards the 71 and 76 levels respectively, aligning with the forecasts of the EIA.

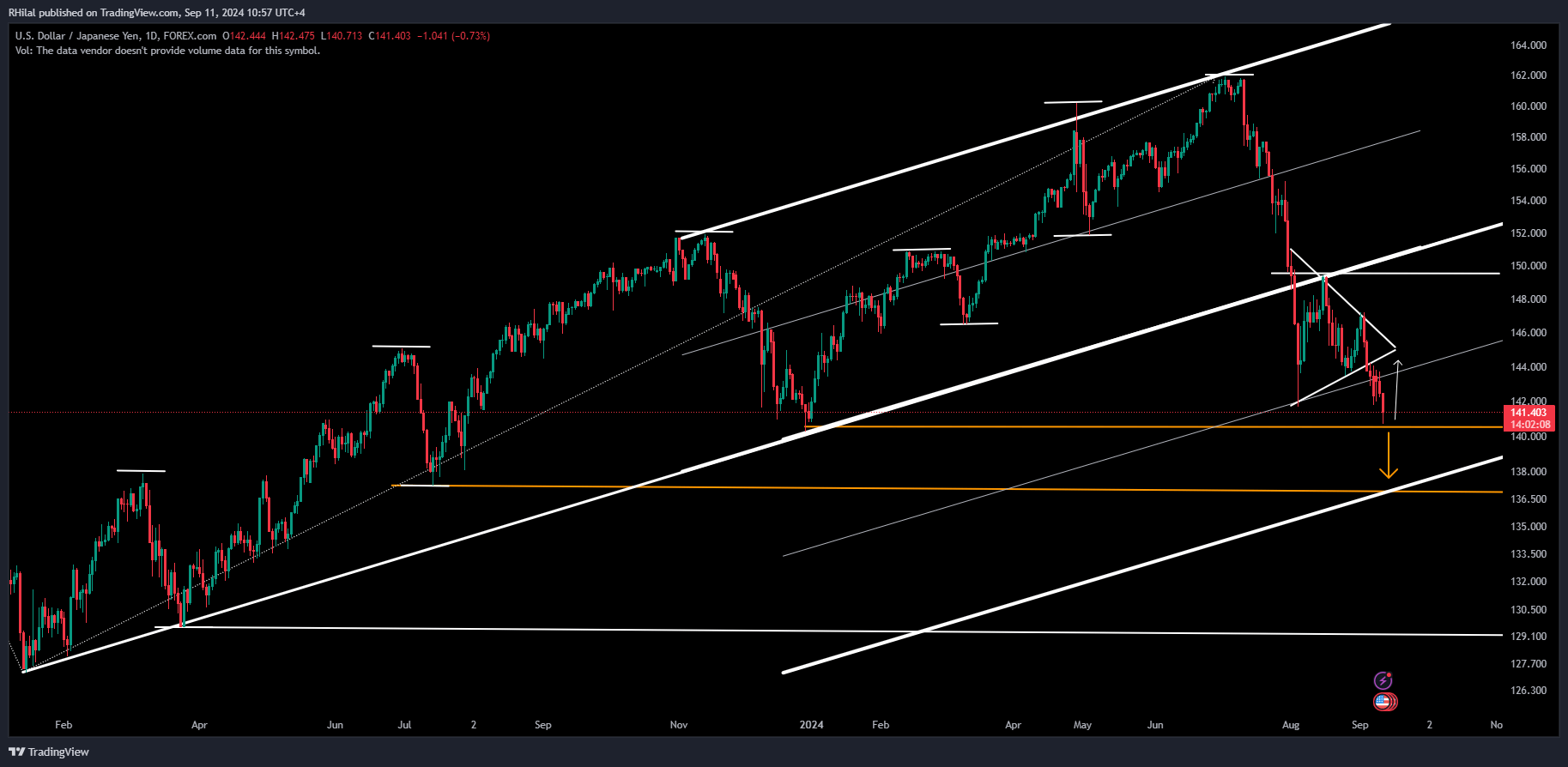

Crude Oil, USDJPY Analysis: USDJPY – Daily Time Frame – Log Scale

Source: Tradingview

The USDJPY pair is currently trading at the lower end of the 140-price range, aligned with a strong support at the lows of December 2023. A break below 140 is expected to drive the pair to retest the July 2023 low at the 137 zone, and a close below that level is expected to drive a sharper drop towards the lower end of the 130-price range.

From the upside, positive dollar volatility can meet potential resistance at the 145 and 150 zones respectively.

--- Written by Razan Hilal, CMT, on X: @Rh_waves