- Major Events Impacting Oil Prices

- Trump vs Harris: Policy Impacts on Oil

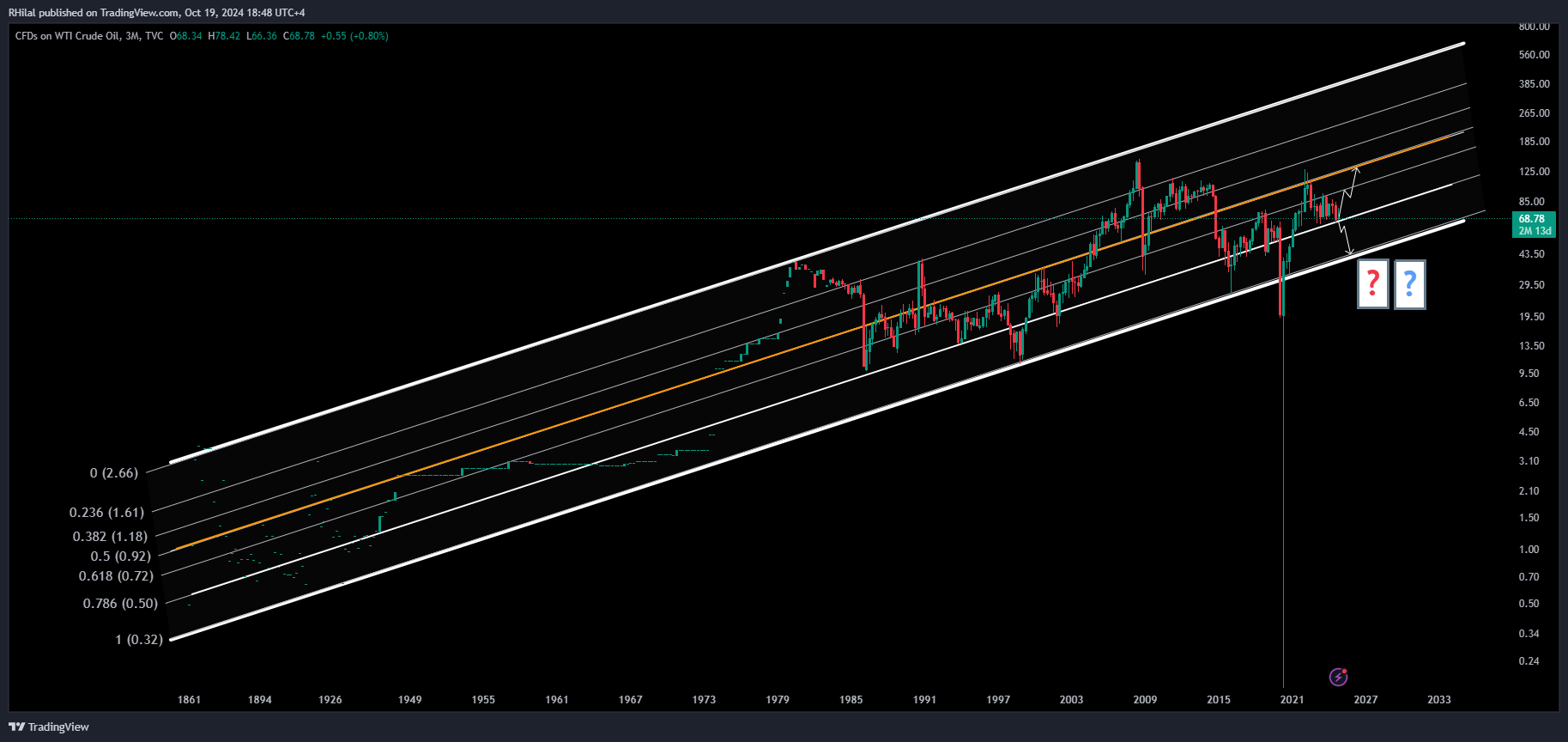

- Crude Oil Technical Analysis

Crude Oil US Election Outlook: Monthly Time Frame

Source: Trading view

Major Events Impacting Oil Prices

Over the past 44 years, oil price movements have rarely been driven by specific White House policies. Instead, major global events have played the key role:

- 1980 – 1992 (Republicans: Reagan and Bush): OPEC Supply Hike & Gulf War

- 1992 – 2000 (Democrat: Clinton): Asian Financial Crises & Recovery

- 2000 – 2008 (Republican: Bush): Iraq War and 2008 Financial Crisis

- 2008 – 2016 (Democrat: Obama): Economic recovery and Shale Oil Production

- 2016 – 2020 (Republican: Trump): COVID – 19

- 2020 – 2024 (Democrat: Biden): Geopolitical conflicts including Russia, Ukraine, and the Middle East

Trump vs. Harris: Policy Differences

Trump: promotes a fossil fuel-driven energy strategy with deregulations and increased oil supply

Harris: promotes renewable energy transitions while maintaining regulated increases in oil supply

While both Donald Trump and Kamala Harris have outlined their approaches to lowering energy prices, the real influence on oil often comes from OPEC policies, geopolitical conflicts, supply and demand, financial crises, and natural disasters.

In other words, key factors to consider for the oil market during the elections include war support/funding, economic policies, foreign relations, global renewable energy transitions, and the interaction between OPEC and non-OPEC policies. These elements will likely shape oil price volatility and market dynamics in the lead-up to and aftermath of the US elections.

Key Factors Influencing Oil During US Elections

- US-China Relations & Oil Demand

- Geopolitical Conflicts & Supply Risks

- OPEC and Non-OPEC Policies

- Renewable Energy Transitions

- Technical Analysis

US-China Relations & Oil Demand

China's slowing economic growth, along with the global shift towards renewable energy transitions, has led the IEA and OPEC to revise oil demand downward for 2024 and 2025. While the latest Chinese stimulus has yet to take full effect, a Trump victory could bring higher volatility to oil markets due to his history of aggressive trade policies and tariffs with China, affecting both Chinese demand and US inflation / geopolitical risk. In contrast, Harris's support for renewable energy could further contribute to lower oil demand, resulting in a more moderate and stable market impact.

- Trump: Higher volatility and oil risk

- Harris: Moderate, lower demand and risk

Stands on Geo-Political Conflicts

Escalating conflicts in the Middle East and between Russia and Ukraine, with growing risks to oil facilities, have raised concerns over supply disruptions, fueling speculation on upside risks for oil prices. With a close interference with the ongoing wars between sanctions and funding, the stand between Harris and Trump might differ with respect to the ceasefire intensity/cost. Trump is expected to take a more aggressive stance, potentially increasing volatility, while Harris favors diplomatic efforts.

- Trump: Upside risk for supply disruption, higher volatility

- Harris: Less volatility, possible diplomatic solutions

OPEC and Non-OPEC Policies

OPEC production quotas remain a key driver of oil prices. Trump’s push for deregulation and increased US production could lead OPEC to adjust quotas, while Harris would likely encourage a more balanced approach.

- Trump: Potential OPEC supply adjustments, bearish pressure

- Harris: Stable, regulated supply outlook

Renewable Energy Transitions

A recent IEA report marked 2024 as a record year for renewable energy, projecting a 60% increase in consumption by 2030. Harris supports this transition under the Inflation Reduction Act (IRA), which could support the decline in global oil demand. Trump, meanwhile, would likely slow the renewable energy shift, supporting fossil fuels.

Technical Analysis

Given the numerous factors that influence crude oil prices, technical analysis—essentially a mathematical summary of historical market behavior—suggests the following key scenarios for potential price movements.

Crude Oil – 3 Month Time Frame – Log Scale

Source: Tradingview

Between the lows of the 1800s and the highs of the 2000s, crude oil has followed a primary up trending channel, with deviations mainly occurring during major global events, such as the COVID-19 pandemic, which temporarily pushed prices out of this trend. Oil regained its momentum within the uptrend channel, with the 2022 high of $128 aligning with mid-channel resistance, and the 2024 low of $65 coinciding with the 0.786 Fibonacci Channel support.

Bullish Scenario

A rebound from the $64-65 support zone could push prices higher, targeting resistance levels at $80, $90, $100, and the 2022 high of $128.

Bearish Scenario

A close below $64 could extend the downward trend towards 58 – 49 – 41 (bottom border of primary channel) and potentially as low as $28.

From both a technical and fundamental perspective, the oil market is currently in a sideways consolidation phase, leaning towards a neutral to bearish outlook. Key upcoming events, such as the US elections, the impact of Chinese monetary policy stimulus, the OPEC meeting in December, green energy transitions, and geopolitical developments are also at an indecisive stage. A definitive breakout from the mentioned key technical levels, alongside major fundamental clarity, is needed to confirm and establish a clear trajectory for crude oil prices.

--- Written by Razan Hilal, CMT – on X: @Rh_waves