Key Points:

- US Job Sector Revision Matches 2009 Statistics

- Crude Oil Inventories Drop Below Expectations

- Flash Manufacturing and Services PMIs in Focus Today

- Technical Analysis

Recent data from the Chinese economy has hit lows not seen since 2009, and the latest revision of US job market growth aligns with those 2009 figures as well, pushing oil prices back to their 2024 starting point. Despite a significant drop in crude oil inventories—falling to 4.6M barrels, well below the expected 2M barrels—the oil market's trend remains more influenced by the broader global economic outlook.

Today's Flash Manufacturing PMI reports from France and Germany fell below expectations, indicating contraction in their industrial sectors. Meanwhile, France’s Flash Services PMI stood out by retesting April 2023 highs, highlighting the ongoing challenges in the services sector amid disinflationary efforts. Attention now turns to upcoming PMI results from the UK and US, which will provide further insight into industrial activity ahead of Powell’s address at the Jackson Hole Symposium tomorrow.

Technical Outlook

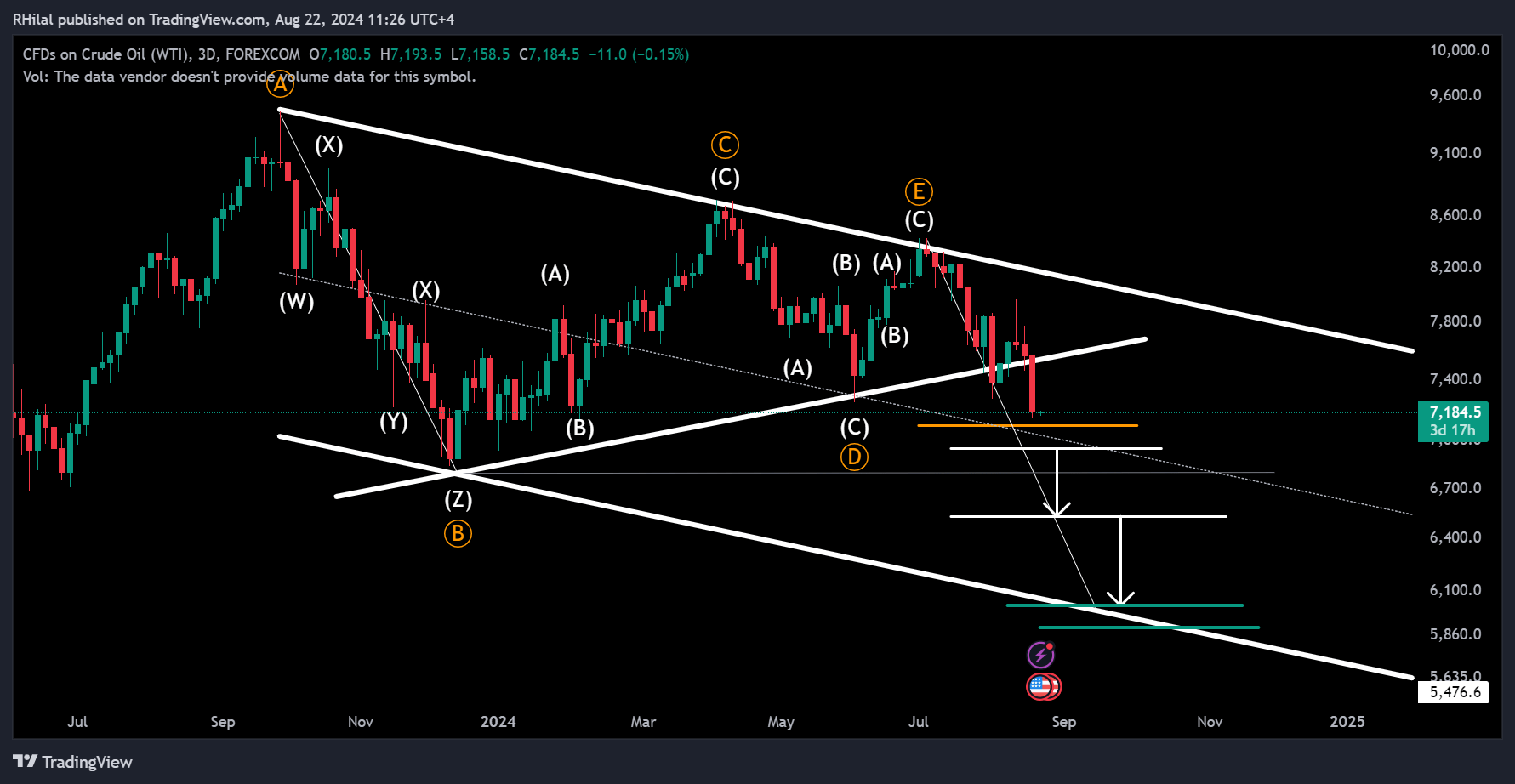

Crude Oil Update: USOIL – 3 Day Time Frame - Log Scale

Source: Tradingview

As oil prices return to yearly lows and the mid-channel zone, the trend faces a critical juncture: either continuing its decline towards the $60 price range or stabilizing above the $70 mark until a bullish catalyst emerges.

Current pullbacks are confined within the $75 and $80 range, with continued bearish projections below the $70 mark aligning with Dec 2023 lows near the 69 zone, and further aligning with zones 65, 60, and 58.

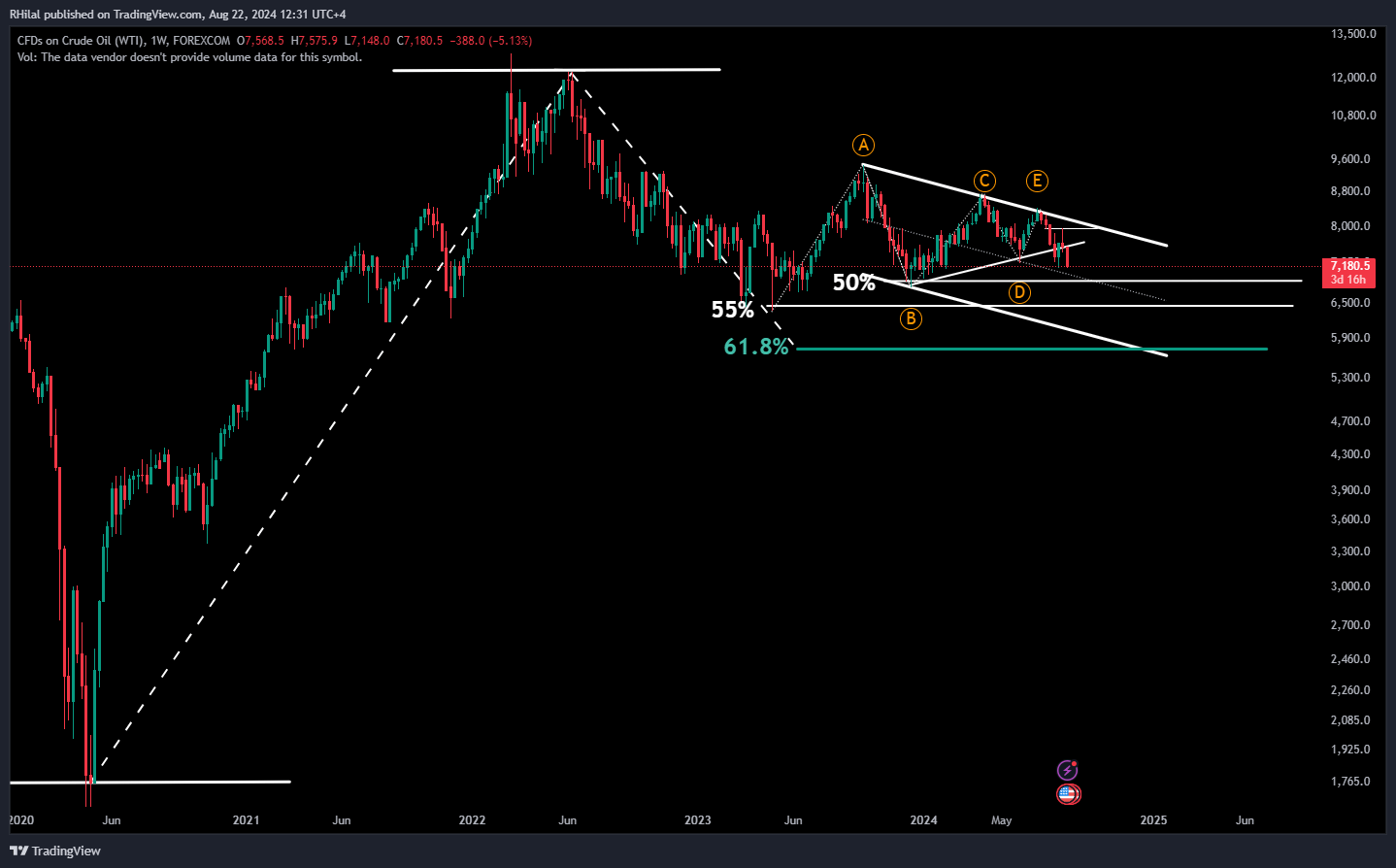

Crude Oil Update: USOIL – Weekly Time Frame - Log Scale

Source: Tradingview

From a weekly time-frame perspective, oil is currently hovering near the 50% Fibonacci retracement level of the uptrend that spanned from the lows of April 2020 to the highs of June 2022. This 50% retracement level, situated around the $70 zone, serves as a crucial support area, indicating potential stability before the trend continues towards the next Fibonacci levels. These levels include the 55% retracement at the $65-$64.80 zone and the golden 61.8% retracement at the $58-$57.70 zone, respectively.

In addition to the bearish projections, close attention is being paid to any potential market interventions or bullish catalysts that could trigger unexpected upturns.

--- Written by Razan Hilal, CMT – on X: @Rh_waves