Crude Oil Outlook: WTI

The price of oil has fallen more than 5% in May after registering a fresh yearly high ($87.67) in April, but developments coming out of the Organization of the Petroleum Exporting Countries (OPEC) may curb the recent weakness in crude should the group continue to restrict production.

Crude Oil Price Under Pressure Going into June OPEC+ Meeting

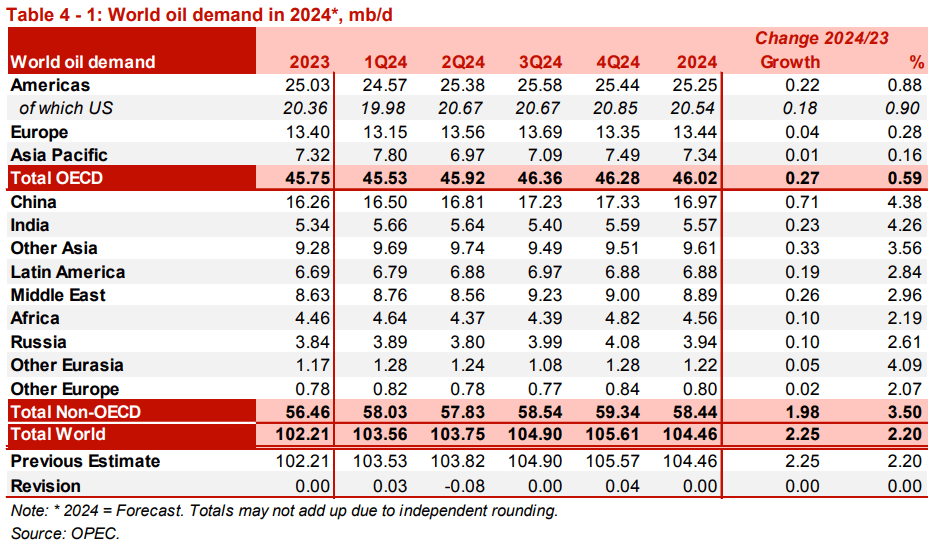

The price of oil appears to be on track to test the May low ($76.15) as it carves a series of lower highs and lows, and OPEC and its allies may stick to the voluntary adjustments from earlier this year as the ‘2024 global oil demand growth forecast remains broadly unchanged from last month’s assessment at 2.2 mb/d.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

OPEC Monthly Oil Market Report (MOMR)

According to OPEC’s Monthly Oil Market Report (MOMR) for May 2024, ‘there were some minor upward adjustments to 1Q24 data, including a slight upward adjustment in OECD Americas and Chinese data due to better-than-expected performance in oil demand in 1Q24,’ and expectations for steady demand paired with the decision by OPEC+ may curb the recent weakness in the price of oil as the group remains ready to ‘take additional measures at any time building on the strong cohesion between OPEC and participating non-OPEC oil-producing countries.’

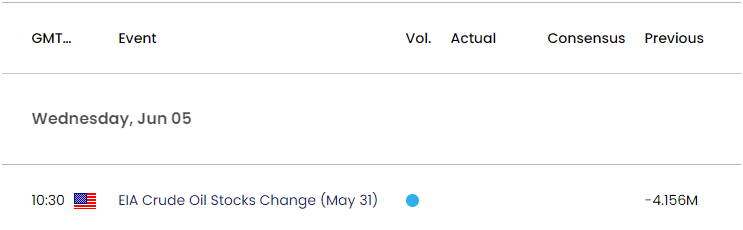

US Economic Calendar

Looking ahead, developments coming out of the US may also sway crude prices as it remains the largest consumer of oil, and another decline in oil inventories may generate a bullish reaction in crude as it instills an improved outlook for energy consumption.

At the same time, a pickup in US inventories may drag on the price of oil as it warns of slowing demand, and OPEC and its allies may continue to regulate energy production in an effort to keep crude price afloat.

With that said, recent price action may lead to a further decline in crude as it carves a series of lower highs and lows, but the price of oil may face range bound conditions should it defend the May low ($76.15).

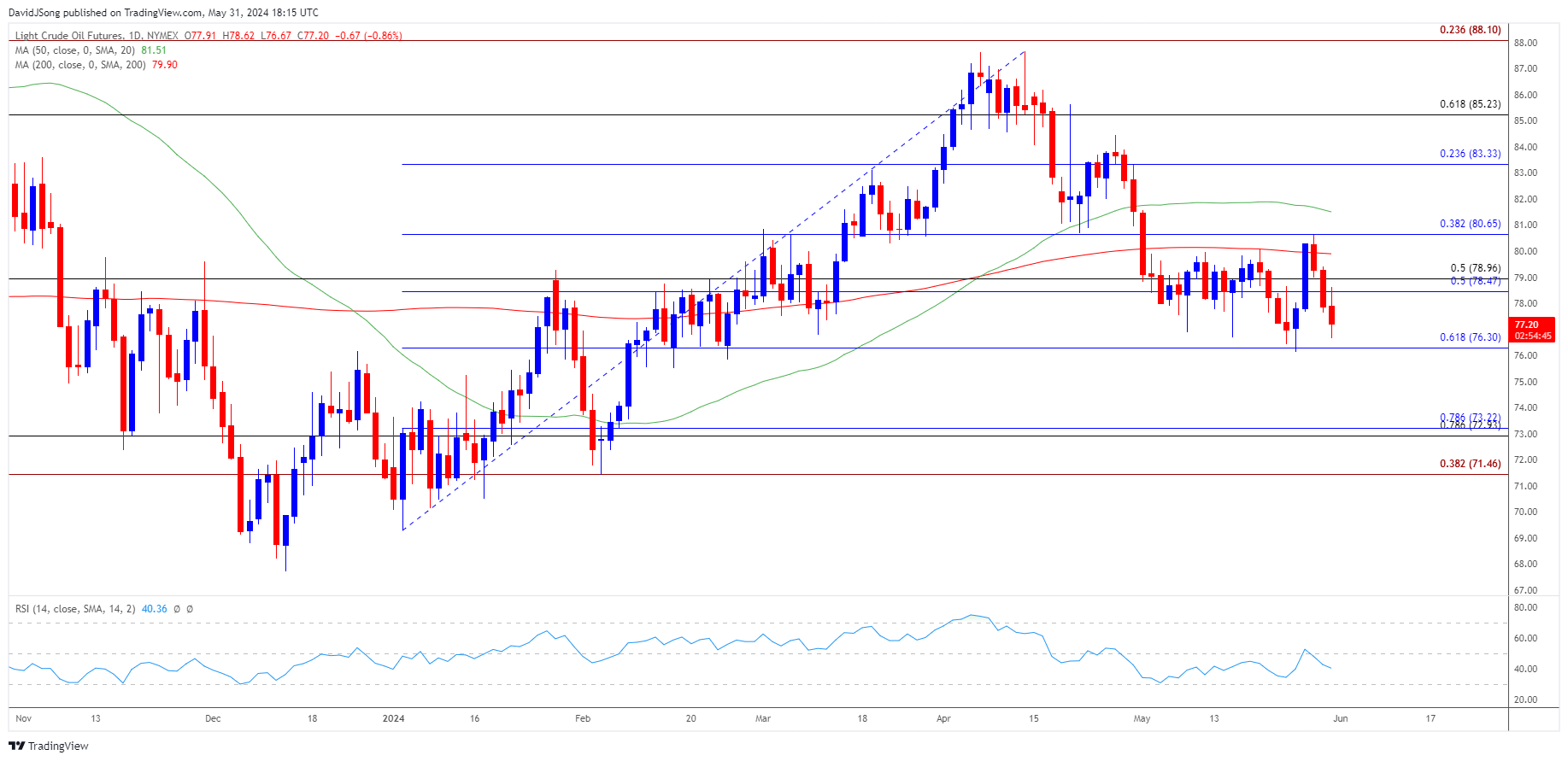

Crude Oil Price Chart –Daily

Chart Prepared by David Song, Strategist; Crude Oil Price on TradingView

- Keep in mind, the price of oil registered a fresh yearly high ($87.67) in April, but crude may struggle to retain the advance from earlier this year as the 50-Day SMA ($81.51) no longer reflecting a positive slope.

- Failure to defend the May low ($76.15) may push the price of oil towards the $72.90 (78.6% Fibonacci retracement) to $73.20 (78.6% Fibonacci retracement) region, with the next area of interest coming in around $71.50 (38.2% Fibonacci extension), which sits just above the February low ($74.41).

- Nevertheless, lack of momentum to close below $76.30 (61.8% Fibonacci retracement) may keep the price of oil within a defined range, with a breach above the $78.50 (50% Fibonacci retracement) to $79.00 (50% Fibonacci retracement) area bringing the May high ($81.57) on the radar.

Additional Market Outlooks

USD/CAD Recovers Ahead of Monthly Low to Preserve Ascending Channel

USD/JPY Eyes Monthly High Ahead of US PCE Report

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong