Crude oil prices came off their earlier lows by mid-day in London. But the path of least resistance remains to the downside, and I would be rather surprised if a breakdown does not occur in the coming days, barring a surprise supply-side shock. That’s because sentiment towards crude oil is increasingly turning bearish amid growing signs of excess surplus from non-OPEC producers. And if the OPEC+ decides against extending their production agreement next month – which I am doubtful about – then we could be looking at subdued price levels in the coming months. So, my crude oil forecast remains bearish as per recent updates, even if prices find some short-term support.

Crude oil forecast: Market heading for surplus in 2025 - IEA

Indeed, the oil market looks like it’s in for a surplus next year, with the IEA predicting an excess of over a million barrels a day—thanks largely to China’s cooling demand. Once the star of global oil consumption, China has seen its oil appetite shrink for six months straight, now growing at just a tenth of its 2023 rate. The IEA attributes this slump to a shifting economy, slowdowns in construction, and China’s steady move toward electric vehicles, high-speed rail, and gas-powered trucking.

Traders are also fixated on the supply boom coming from the non-OPEC producers, most notably the US, Brazil and Canada. You can add Guyana in that list too. This surge in non-OPEC output has not only kept prices in check but is also setting the stage for a well-stocked market in 2025. IEA thinks that this year’s oil demand increase will only reach 920,000 barrels a day—less than half of last year’s growth rate—and next year’s rise doesn’t look much better, capped at around 990,000 barrels a day. The story here: lacklustre economic conditions and a growing shift to clean energy are reining in demand.

Meanwhile, the OPEC+ is ready to inch production back up, starting with a modest 180,000-barrel increase planned for January. They’ll review this cautious approach when they meet on December 1, and there is a good chance they could postpone this again, should prices fall further by then. OPEC has had to adjust its forecast downward multiple times, though its outlook still leans more optimistic than the IEA’s. The big picture? Supply is ramping up while demand stagnates, point to a comfortable supply cushion for the foreseeable future.

WTI technical analysis

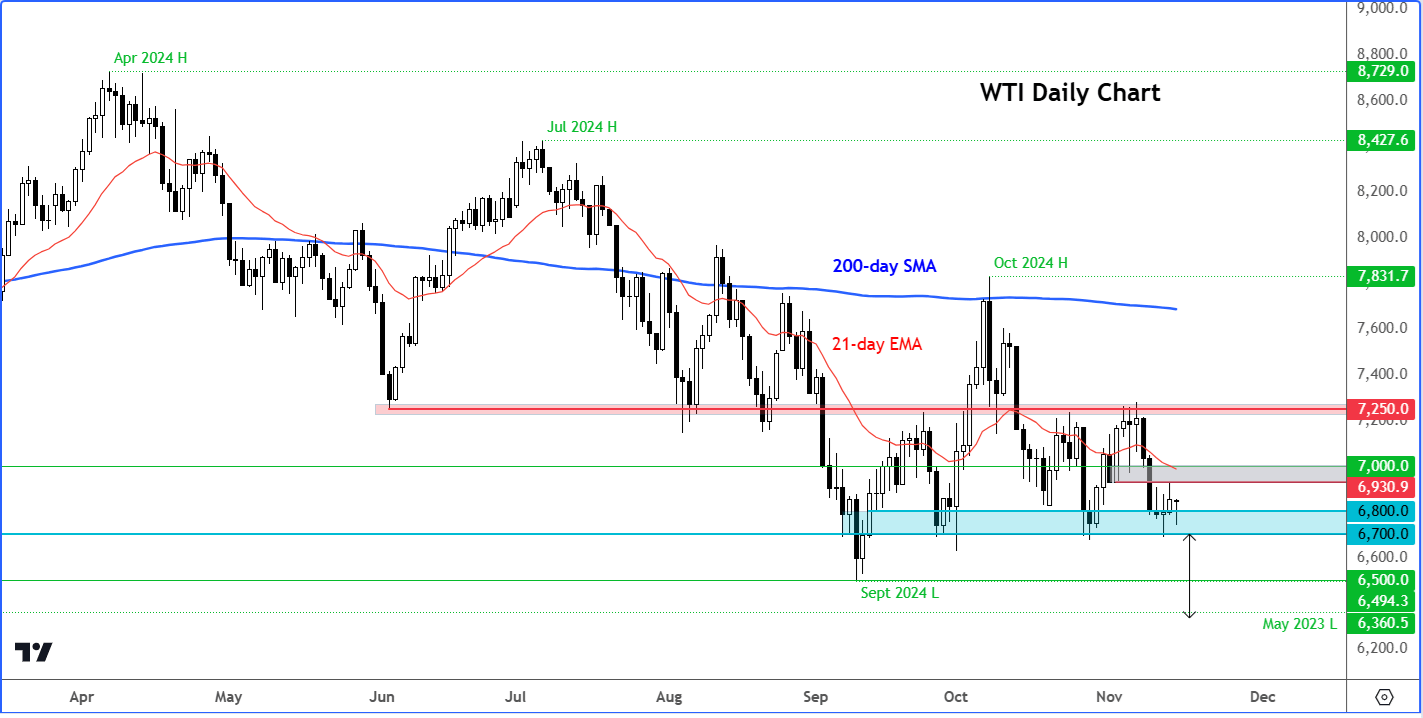

The technical crude oil forecast remains bearish until we see a clear reversal pattern in prices. WTI broke the key $69.30 to $70.00 support range on Monday, which is now holding as resistance. While it has held its own around the December 2023 support area of around $67.00 to $68.00, this could prove to be a temporary floor, before we potentially see a bigger breakdown. A close below this region could see WTI head down to $65.00 and revisit the September low of $64.94, and potentially even the May 2023 low of $63.60.

WTI's price action has been quite heavy as it continues to make lower lows and lower highs. Until we see an end to this series of lower lows and lower highs, the technical crude oil forecast will remain bearish.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R