In today's crude oil forecast, we examine the latest market movements and technical analysis for WTI.

Despite weaker-than-expected industrial data from China overnight, which should have raised concerns about demand, crude oil prices have rallied more than 1.5% today, building on the 3.5% to 4.0% increase from the previous week. Investors have ignored the weaker-than-expected 5.6% y/y rise in Chinese industrial output and news oil refining fell to the lowest rate this year after more plants shut for maintenance. Oil’s resilience suggests investors are expecting the oil market to tighten as we head deeper into the US driving season.

Crude oil drivers and recent trends

Since mid-June, oil prices have experienced a sharp recovery, initially driven by stronger-than-expected US non-farm jobs report and ISM services PMI data. Last week's additional gains were partly due to a delayed reaction to the OPEC+ decision to extend its output cuts, helping to offset ongoing demand concerns. Investors are also expecting the driving season to pick up steam, which should help reduce oil stocks in the coming weeks.

In recent weeks, demand concerns had intensified on the back of softer Chinese data, and rising inventory levels. These concerns were shared by the International Energy Agency (IEA), revising its global oil demand outlook lower. Demand growth in China slowed from 800,000 barrels per day in the first quarter to 95,000 barrels per day in April, according to the IEA. Global oil demand growth will come in at 960,000 barrels per day this year, about 100,000 barrels per day lower than previously forecast as a consequence, according to the agency.

Crude oil forecast: WTI technical analysis

Source: TradingView.com

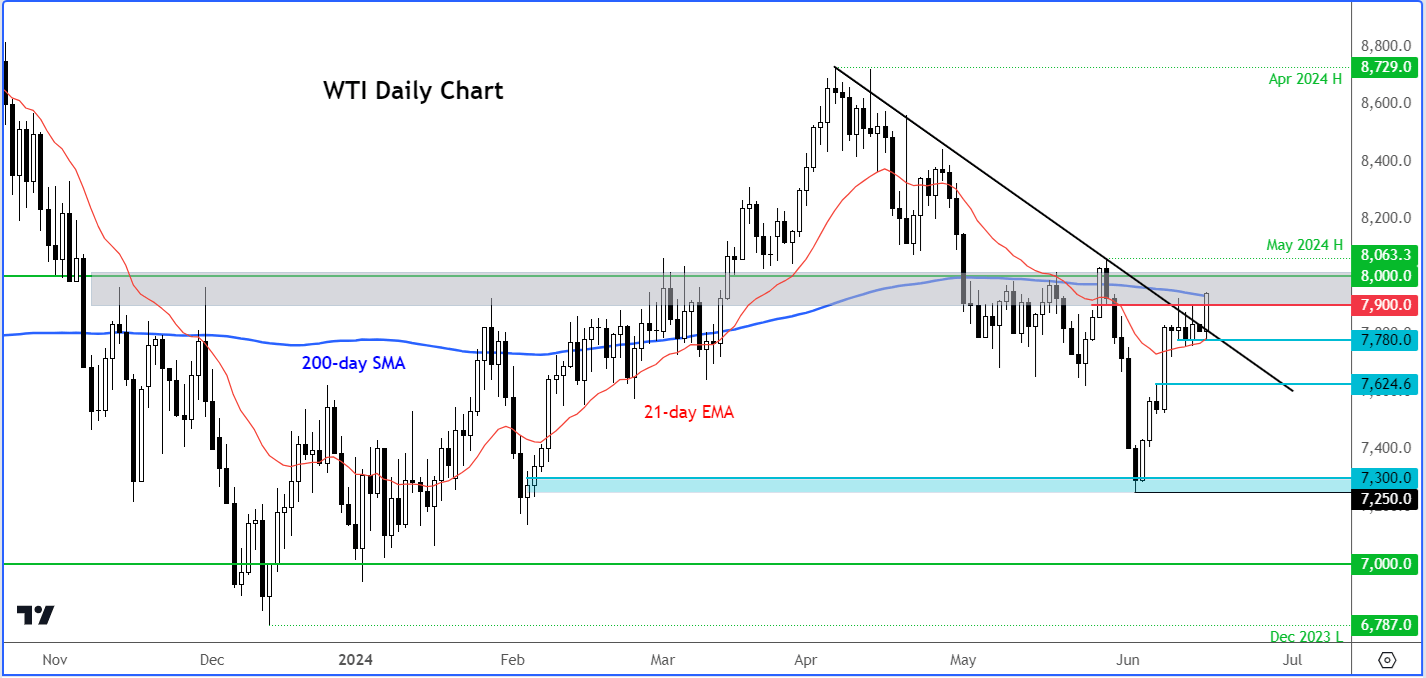

Thanks to the oil rally, WTI has broken its bearish trendline that had been in place since April, finding good support around $77.80 where we have the 21-day exponential moving average coming into play. Today's rally has lifted WTI to its 200-day moving average, just below the $79.50 level. It had previously struggled in the range between $79.50 to $80.00.

In light of last week's V-shaped recovery and the subsequent break above the bearish trendline, the crude oil bulls would now like to see a move above May's high of $80.63. If this condition is met, then we will have had our first higher high in place and therefore a confirmed bullish reversal signal on WTI.

Conversely, if in the coming days oil prices turn lower and head back below the breakout area of $77.80ish, then, in that case, the bearish trend would most likely resume, paving the way for further technical selling.

However, the bullish scenario appears the more likely scenario to me.

In summary

This crude oil forecast highlights the recent resilience in WTI prices despite weaker Chinese industrial data. The technical analysis suggests a bullish outlook if key resistance levels are broken. Traders should monitor upcoming inventories data and retail sales, as well as general price movements, closely to stay informed on potential shifts in crude oil trends.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R