The immediate response in the commodities space to the Republican’s clean sweep victory has been a bearish one - especially for industrial metals. Copper and silver fell over 4% each, tracking weaker iron ore prices, while gold was off by around 3%. Crude prices fell too but came sharply off their earlier lows. In light of Trump’s clean sweep, the crude oil forecast has turned modestly bearish as I will explain in this short article.

Crude oil forecast undermined by Trump victory

While campaigning, Trump promised to lift restrictions on domestic fossil-fuel production, and said he plans a wide range of tariffs on imported goods. Crude oil could come under pressure because of potential for increased drilling activity could lead to more US oil production. Today, the downside has been limited so far because of the risk rally with US indices hitting record levels. But oil is more likely to test recent lows I would say, and the trigger would be if WTI breaks Friday’s low around $69.29. As well as increased drilling in the U.S., and a stronger U.S. dollar, tariffs could hurt demand in key markets such as China.

If commodities remain under pressure given Trump’s promise of tariffs on imported goods, especially from China, this should also be a factor that crude oil traders will take into account. Industrial metals could be a particular weak spot and we have seen copper and iron ore being hurt sharply today. The stronger USD and yields are also hurting gold as the opportunity cost of holding the non-interest-bearing asset climb.

There is now the risk that the FOMC may slow its rate-cutting pace. This is because inflation may re-ignite with Trump’s policies. If interest rates remain high, this could ultimately weigh on demand for oil.

Dollar rally may also hold back oil

Today’s big rally on the dollar is an additional factor hurting commodities, as well as the threat of tariffs hitting demand. With the Republicans having also taken a majority in the Senate, Trump has been given a powerful mandate and platform to implement his policies, including tax cuts. This could boost inflationary pressures and result in a slower pace of rate cuts from the Fed relative to other central banks. It could even prevent the Fed from cutting rates significantly in 2025 should the disinflation process stops and reverses. This is why the US dollar has rallied as we had expected. A strong dollar could keep crude oil under pressure as it will make it costlier for foreign buyers.

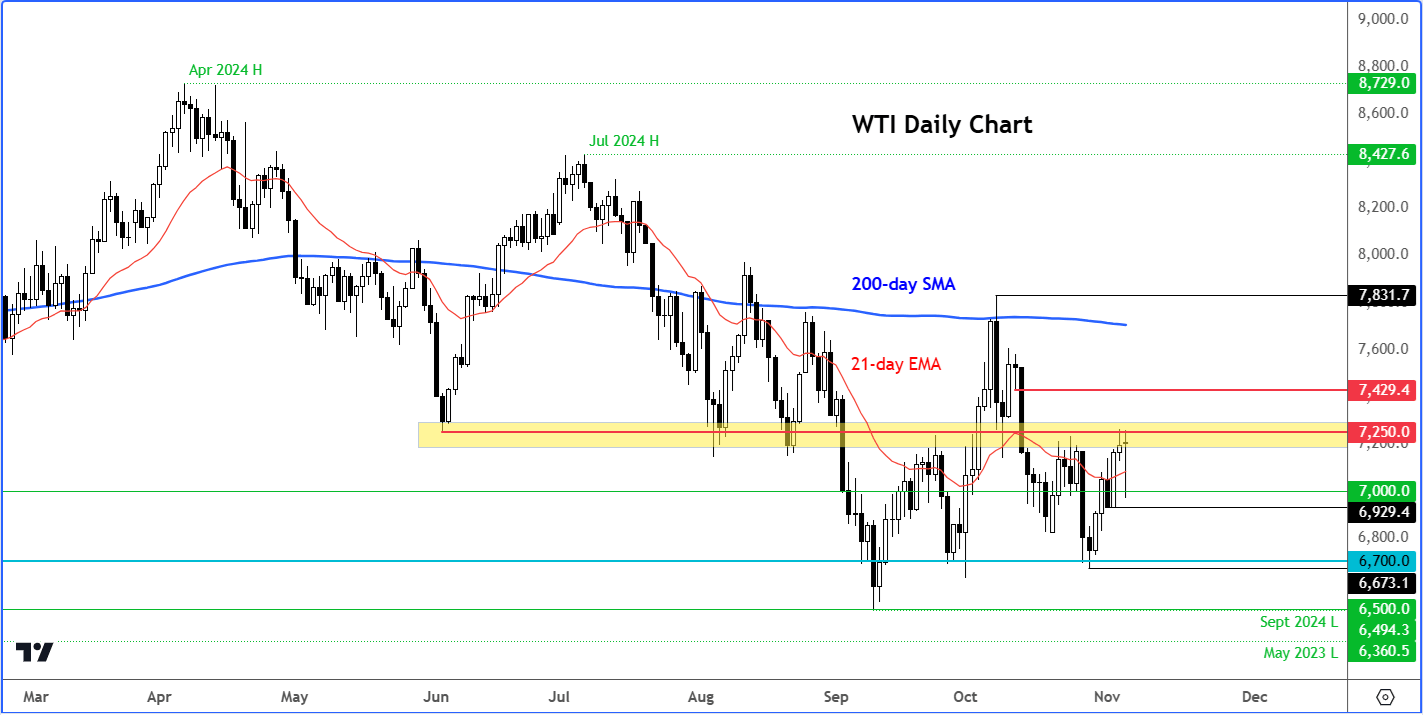

WTI technical analysis and levels to watch

Source: TradingView.com

WTI was testing resistance around $72.50 at the time of writing, after managing to recover from its earlier lows. As mentioned, a potential break in the coming days below Friday’s low of $69.29 could trigger a potential drop towards $67.00 if not lower. On the upside, the next potential resistance comes in around $74.30, followed by $76.00 and then the 200-dy average at $77.00.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R