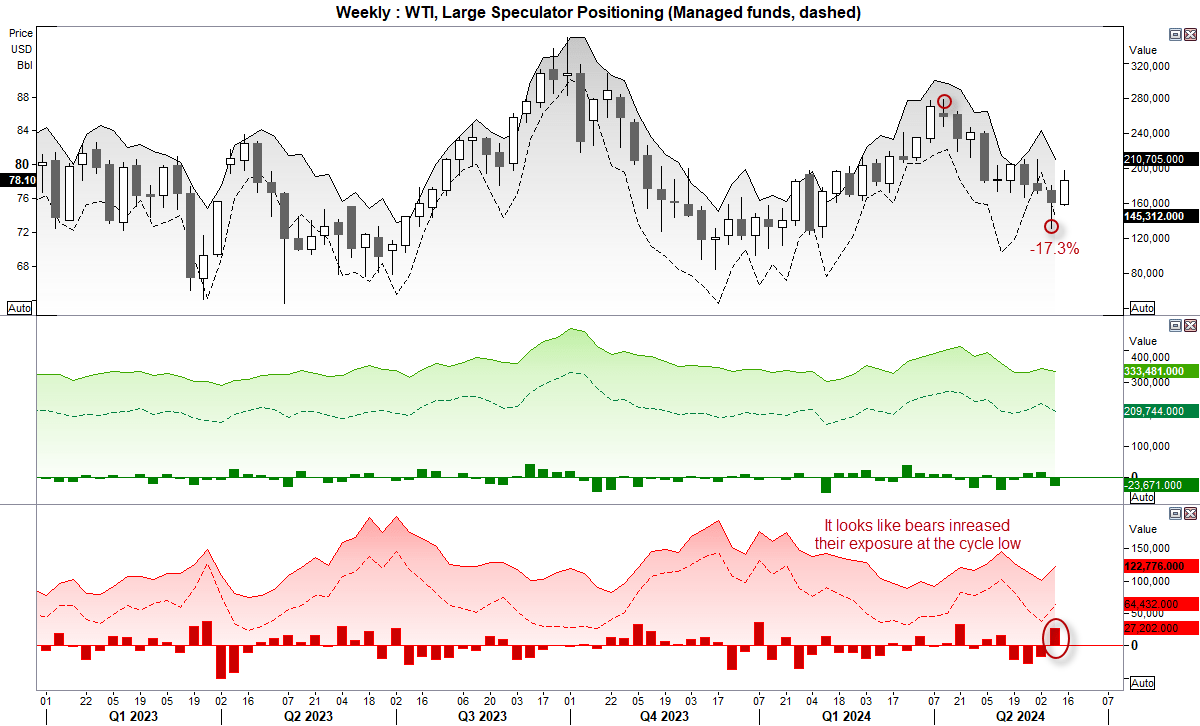

WTI crude oil market positioning – COT report

The Commitment of Traders (COT) report can be particularly useful for identifying sentiment extremes, although, as it is weekly data, patience is a must. Since we aren't currently seeing a sentiment extreme in crude oil exposure, the data is vulnerable to overinterpretation.

With that said, the latest COT data suggests some bears have been caught short at the cycle lows. Last week, managed funds increased gross-short exposure at the fastest weekly pace in six weeks while also trimming longs. Yet, as WTI has also been moving lower over the past nine weeks with a high-to-low move of -17.3%, it suggests the move was perhaps overextended to the downside.

We're over halfway through this week and now on track to form a bullish engulfing week, so we can assume some short covering has taken place.

The question now is whether bulls have a strong enough case to take crude oil prices higher. If the US economy is strong enough to warrant the Fed retaining high rates and "driving" season is underway, demand for fuel could rise in the near term. Yet, the US dollar needs to figure out if it will focus on softer US inflation or a more hawkish-than-liked Fed. OPEC is supporting prices to a degree.

But perhaps we can see all we need to on the weekly chart. WTI crude oil is oscillating in a sideways range, and we may have seen a swing low that favours higher prices for a few weeks.

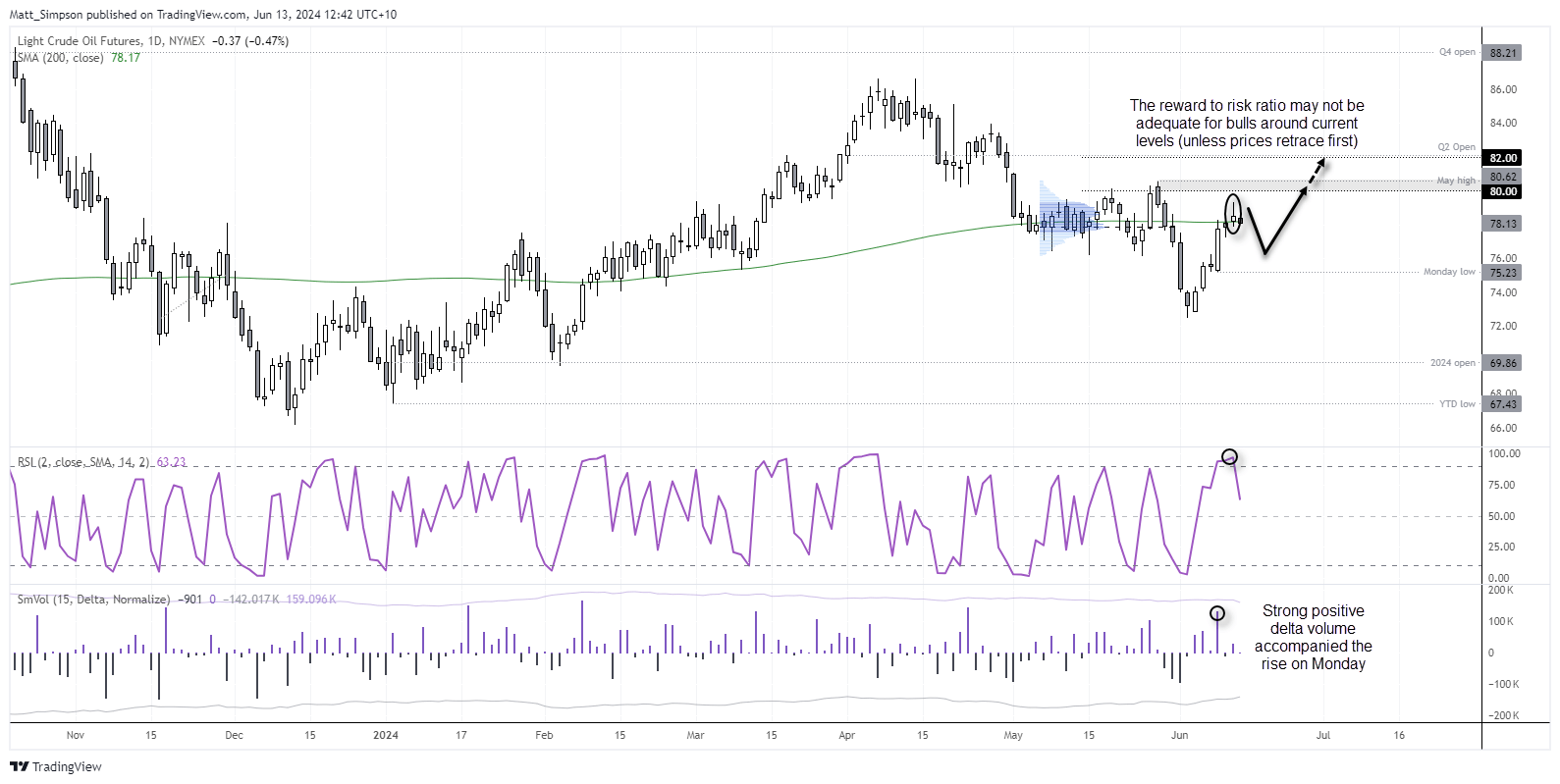

WTI crude oil technical analysis (daily chart):

Oil prices have risen nearly 10% from the June low, and a small bearish shooting star candle formed on Wednesday alongside the 2-day RSI reaching overbought territory. All of which suggests the upward move could be fatigued. It may not pinpoint the exact top, but bulls may want to err on the side of caution with $80 just overhead, as the reward-to-risk ratio may not be favourable.

However, strong positive delta volume (bids - offers) accompanied the strong bullish candle on Monday, so for now, I suspect any retracement lower could hold above the $75 area. Such a retracement could appeal to bulls looking to reload with a more attractive reward-to-risk ratio.

For now, prices are hugging the 200-dayt average, but a break of yesterday’s low will take prices back beneath it.

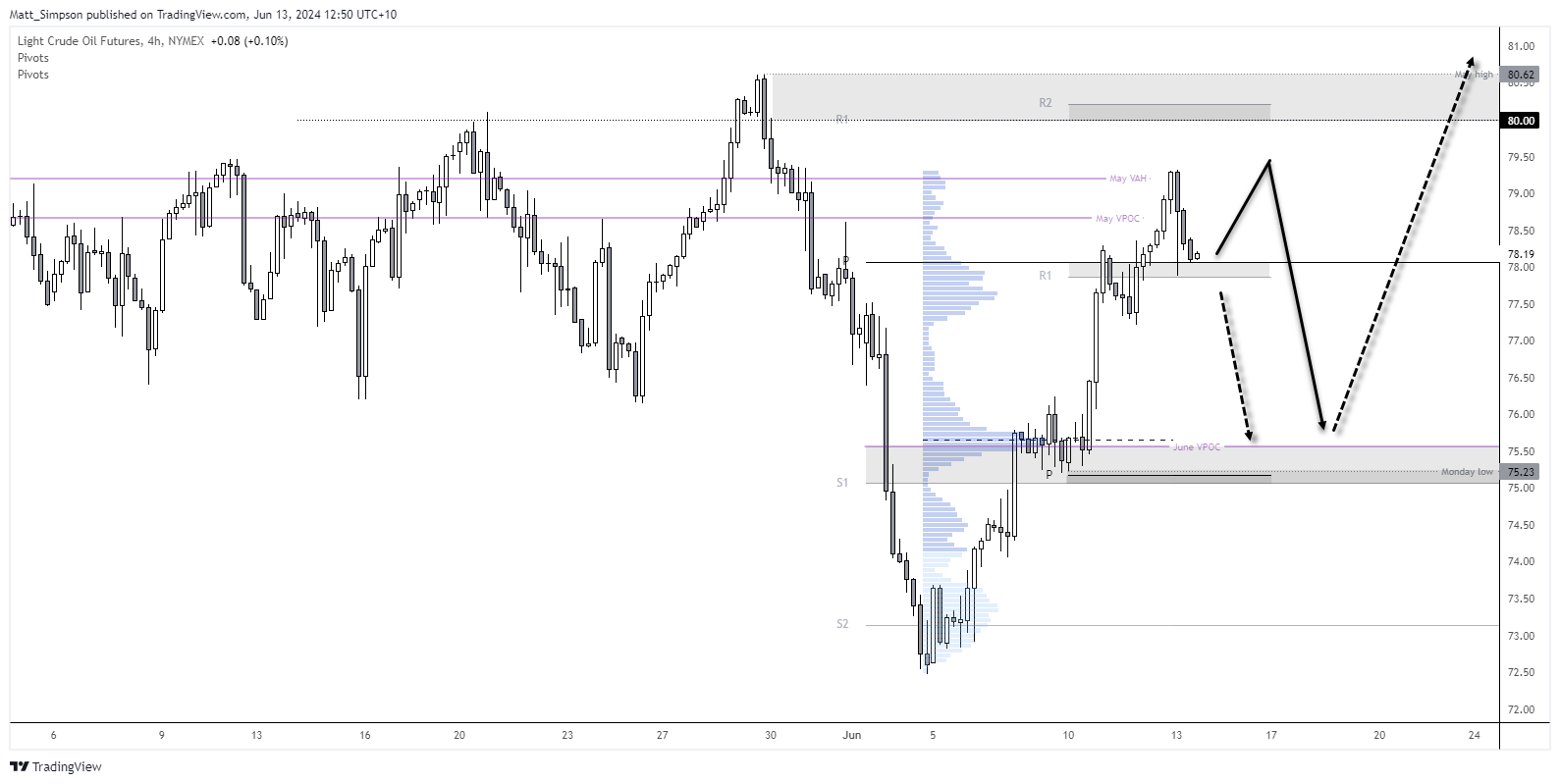

WTI crude oil technical analysis (4-hour chart):

The trend is clearly bullish on the 4-hour chart, although again I note the plethora of resistance overhead. With prices stabilizing around $78, I see the potential for another pop higher. Yet, the bias is to fade into moves up towards or around $80 with a stop-loss above $80.70 / $81 in anticipation of a retracement down towards $75.50.

If the anticipated retracement lower occurs, the bias then switches to seeking bullish setups for a potential break above $80.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge