Key Events

- OPEC reduces 2025 demand forecasts for the fourth consecutive month.

- Trump’s Agenda: Aims to cut energy prices by 50% in 2025.

- IEA Oil Market Report: Scheduled this week.

- Fed Rate Anticipations: expectations for a 25-bps cut rises to 80%

- Chinese Economic Data: Continues to disappoint.

OPEC Forecasts

For the fourth straight month, OPEC has revised its demand growth forecasts downward, adjusting for shifting geopolitical dynamics and the global energy transition. In Tuesday’s report, 2024 demand growth forecasts were lowered from 1.93 million bpd to 1.82 million bpd, and 2025 estimates dropped from 1.64 million bpd to 1.54 million bpd.

Additionally, OPEC delayed any production increases, especially with countries like Iraq and Russia producing above their agreed quotas. Production quotas will be reviewed in the upcoming December 1 meeting.

Is the Chinese Stimulus Effective?

Recent Chinese data on CPI, PPI, and new loans showed disappointing figures, dimming expectations for upcoming industrial production and FDI data on Friday. Deflation risks resurfaced, as CPI dropped to 4-month lows at 0.3% and PPI to an 11-month low at -2.9%. New loans also saw a decline, hitting a 3-month low at 500B, amplifying a bearish demand outlook for oil in 2024 and 2025.

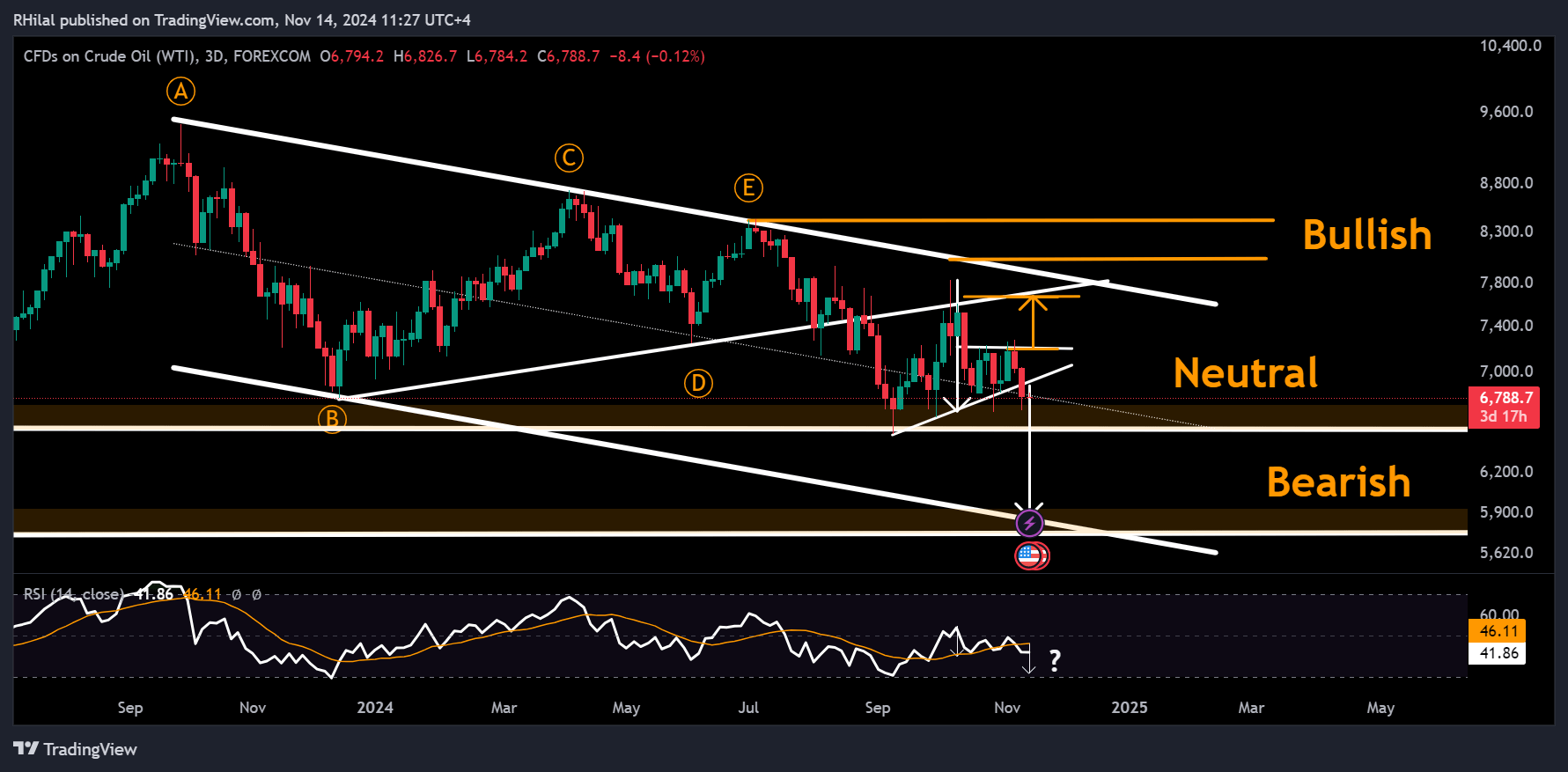

Technical Analysis: Quantifying Uncertainties

Crude Oil Analysis: 3Day Time Frame – Log Scale

Source: Tradingview

Oil’s consolidation pattern, hinting at a potential head-and-shoulders continuation, remains hesitant for a breakout, hovering near the mid-channel trendline within a primary downtrend channel since the 2023 highs. The mid-channel support and the 64-support zone (dating back to 2021), combined with potential supply disruptions and geopolitical risks in late 2024, challenge the continuation of the downtrend.

According to CME Group’s option volume data, call options dominate for 2024, while puts lead for 2025.

Upside risks remain unless a firm breakout below the 64 support occurs, with resistance levels likely at 72.30 and 76, and further extension to 80 and 84 if the trend persists. In the case of a bearish breakout, the 60-58 zone could act as initial support, with the 49 level as a secondary support.

Developments in OPEC revisions, geopolitical events, Chinese economic trends, and anticipated 2025 US policies remain critical factors for oil price direction.

— Written by Razan Hilal, CMT on X: @Rh_waves