- Highlights from the OPEC Monthly Oil Report

- Chinese Economic Data

- Updates from the IEA Report

OPEC Report Updates

Summer demand remains in the headlines as a positive factor along oil’s current trends. The latest OPEC report highlighted strong oil demand for 2024, with a support from air travel this summer. Global oil demand levels remained unchanged from the previous report, and global economic growth levels have been revised upward to 2.9% for both 2024 and 2025.

Factors contributing to this revision, along with anticipated support for a healthy oil demand environment, include:

- The anticipated rebound in major economies, with positive momentum expected to continue through the end of the year

- Upcoming easing of monetary policies and increasing levels of real income.

IEA Oil Market Updates

In contrast to the views in the OPEC report, IEA statistics reflect a slowing demand growth momentum for oil in 2024, coupled with muted growth in economic levels and the accelerated deployment of clean energy technologies.

Chinese Economic Data

The latest Chinese Industrial Production and GDP figures dropped below previous levels. With respect to oil, the concerns over the overall growth trend of the Chinese economy can potentially impact the anticipated levels of Chinese oil demand.

Upcoming Indicators

- A speech by Jerome Powell is awaited for updates on monetary policy following further cooling of US inflation data.

- With respect to US crude oil inventory data on Wednesday, two consecutive drops were observed beyond expectations in July, amid the high demand potential of the summer season.

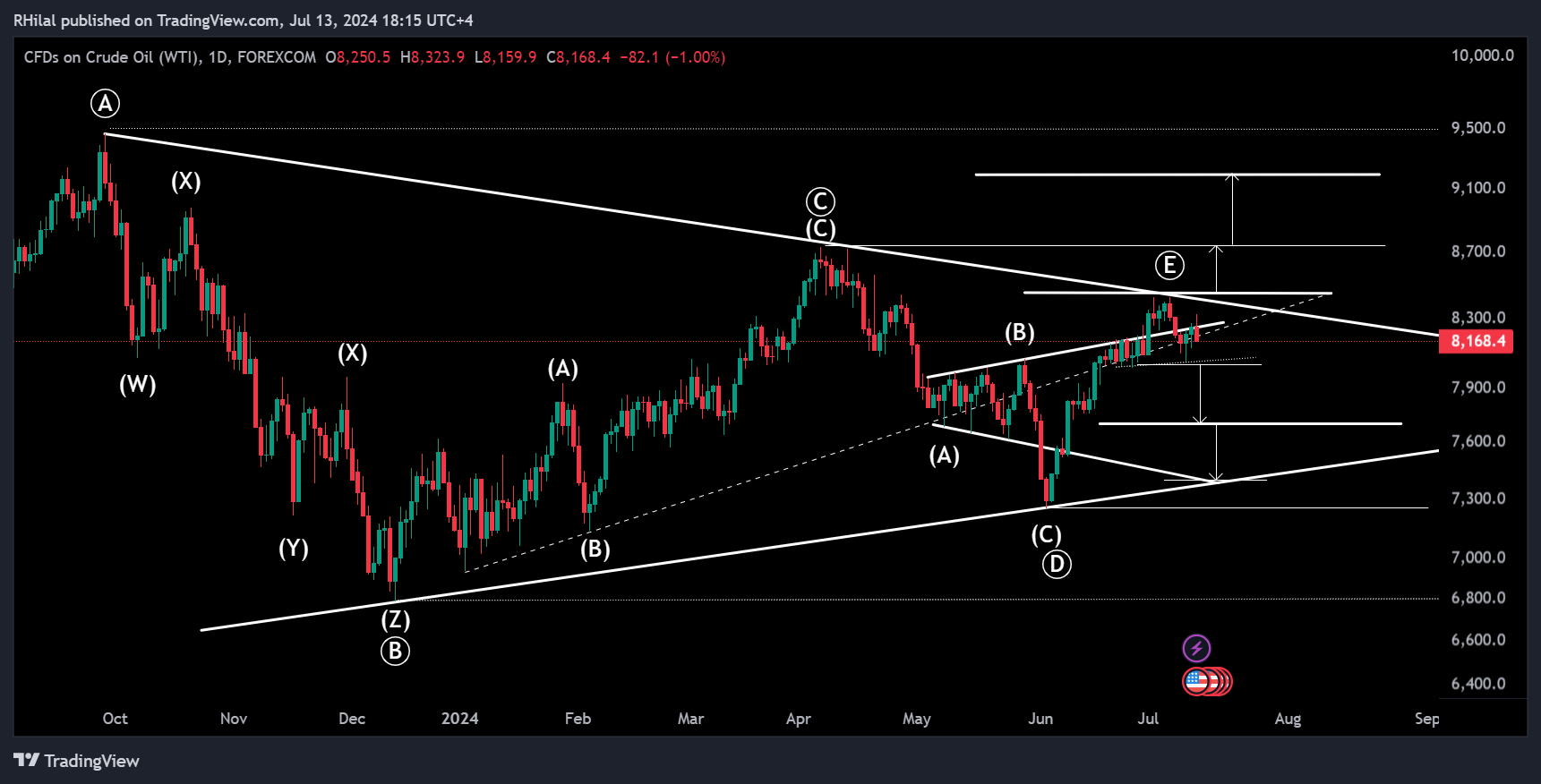

Crude Oil Analysis: USOIL – Daily Time Frame – Logarithmic Scale

Source: Tradingview

Friday's daily candle on the oil chart reflected un-sustained daily highs, closing down with a bearish engulfing pattern compared to the previous small body candles. Within the larger indecisive and consolidating pattern, a minor consolidation can be seen near the trendline connecting the consecutive highs of May 2024, with a neutral to bearish sentiment.

Bearish Scenario:

Breaking below levels 80 and 77 can pave the way towards a deeper drop to the bottom end of the triangle and possibly towards the yearly lows. A possible pause can be seen at the 77 level as it aligns with the 0.618 Fibonacci retracement level of the uptrend between the lows of June 2024 and the highs of July 2024.

Bullish Scenario:

The latest uptrend for oil is facing challenges at the upper border of the consolidation, within the resistance zone of 84.30 and 85.70. A close above this zone is needed to confirm the trend towards the 2024 highs at 87.30 and potentially back towards the 90 zone, with possible resistance near 92.

Fundamental Perspective:

Economic contractions, higher interest rates, and a shift towards renewable energies can support the bearish trends for oil. Conversely, economic expansions, lower interest rate levels, and a weaker dollar and can boost demand and support a positive trend for oil from a medium-term perspective.

--- Written by Razan Hilal, CMT