Key Events

- OPEC Monthly Report vs IEA Short-term energy outlook

- US PPI and CPI Reports

- Crude Oil Inventories

OPEC Monthly Report

The latest report by OPEC highlighted a decreased outlook for global oil demand for 2024 and 2025, supported by declining demand projections from the Chinese economy and the Middle East. This report aligns with the latest highs on oil, slightly below the 80-barrier.

US PPI and CPI Reports

The latest Producer Price Inflation (PPI) figures fell below expectations, adding further confirmation towards an upcoming rate cut and stimulating bearish sentiment on the US Dollar Index.

The next key indicator to watch is the Consumer Price Index (CPI) on Wednesday, which is expected to influence the rate cut magnitude in September.

Given the magnitude of volatility surrounding the US CPI, the impact of crude oil inventories is expected to be minimal.

Technical Outlook

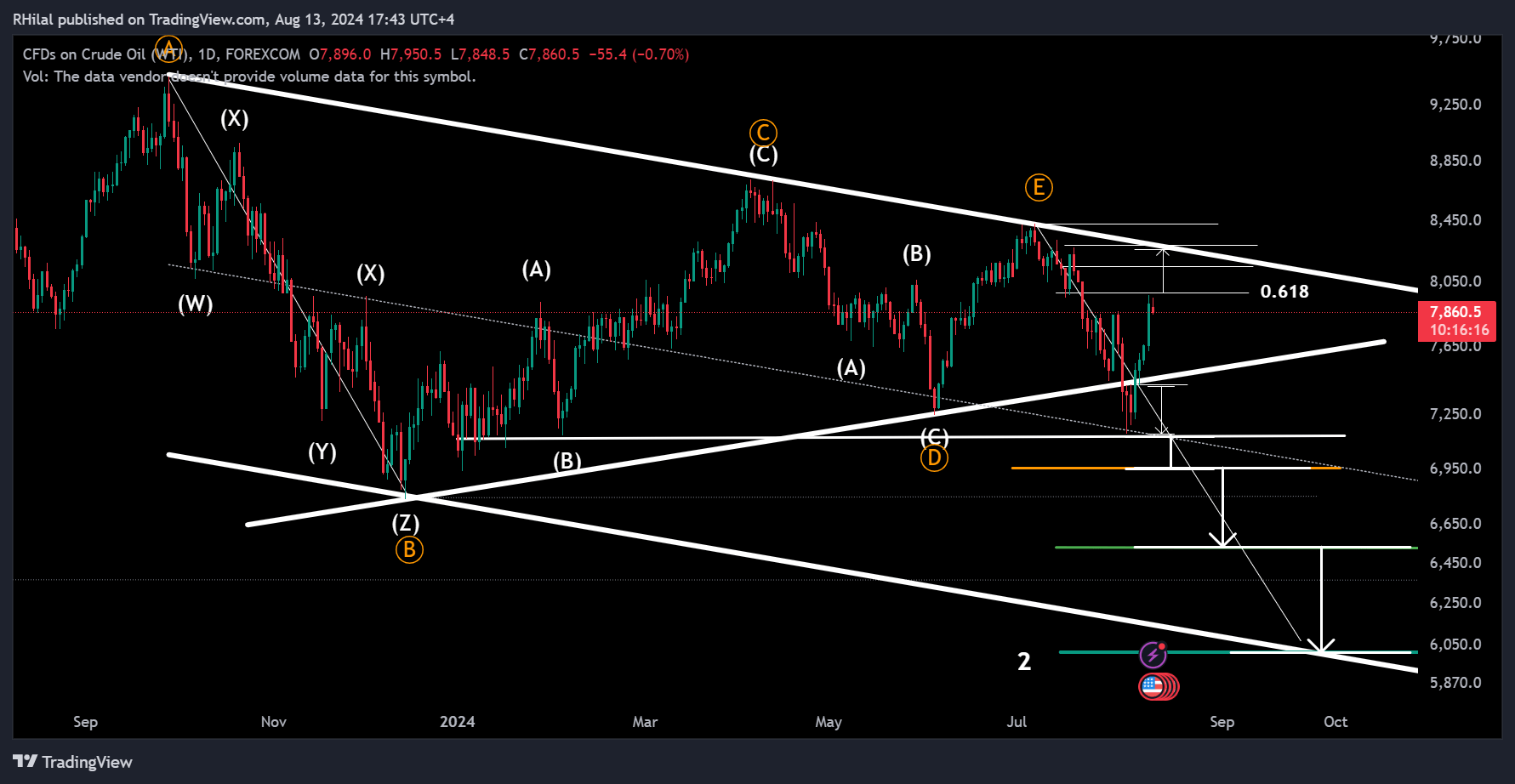

Crude Oil Analysis: USOIL – Daily Time Frame – Log Scale

Source: Tradingview

Source: Tradingview

Climbing back inside its consolidation range, the upside potential for crude oil is set to be limited below the 2024 highs. However, further developments can alter the forecast.

Trading cautiously ahead of the CPI data, crude oil has reached the previously mentioned 79-zone. Positive projections from the IEA report and geopolitical tensions boosted oil prices up until the negative projections from the OPEC report near the 80 zone barrier.

Upside Potential: A close above the 80 barrier could lead oil prices to retest levels at 81.50, 83, and 84.30, respectively.

Downside Potential: As the latest high aligns with the 0.618 Fibonacci retracement level of the drop between the July 2024 high and August 2024 low, oil could resume its downtrend back towards the lower border of the consolidation at 75.30. A close below this border and under the 75 level could drag oil prices back towards the 71.40 level.

--- Written by Razan Hilal, CMT – on X: @Rh_waves