Corporate news

Super Micro Computer (SMCI) dropped 16% in premarket trading as there is stilll uncertainty around its annual filing timeline which has been postponed for the second time now; History: Earnst and Young (EY) resigned as SMCI's auditor on the 30th of October. SMCI failed to file its annual report (10-K) for fiscal year 2024 which was initially due in August 2024.

Apple (AAPL) faces its first EU Digital Markets Act penalties for antitrust infractions.

Oracle (ORCL) eliminated several hundred Cloud Infrastructure employees in another wave of layoffs.

Boeing (BA) may land after union workers ended the strike on Monday. Since mid-September, over 30,000 workers had been on strike, disrupting Boeing plane manufacturing. Boeing stock was flat following the strike and dipped when markets opened.

Events on the 7th of November

Earnings

- Affirm (AFRM) – Aftermarket

- Airbnb (ABNB) - Aftermarket

- Barrick Gold (GOLD) – Premarket

- Cloudflare (NET) - Aftermarket

- Datadog (DDOG) - Premarket

- DraftKings (DKNG) - Aftermarket

- Dropbox (DBX) - Aftermarket

- GoPro (GPRO) - Aftermarket

- Moderna (MRNA) – Premarket

- Münchener Rück (MUV) – 9:00 am GMT +1

- Pinterest (PINS) - Aftermarket

- Ralph Lauren (RL) - Premarket

- Rivian Automotive (RIVN) - Premarket

- Unity Software (U) - Aftermarket

Calendar events

- BoE Interest Rate Decision (Nov) – expectation to cut rates to 4.75% from 5%.

- Fed Interest Rate Decision – expectation to cut rates to 4.75% from 5%.

Company analysis

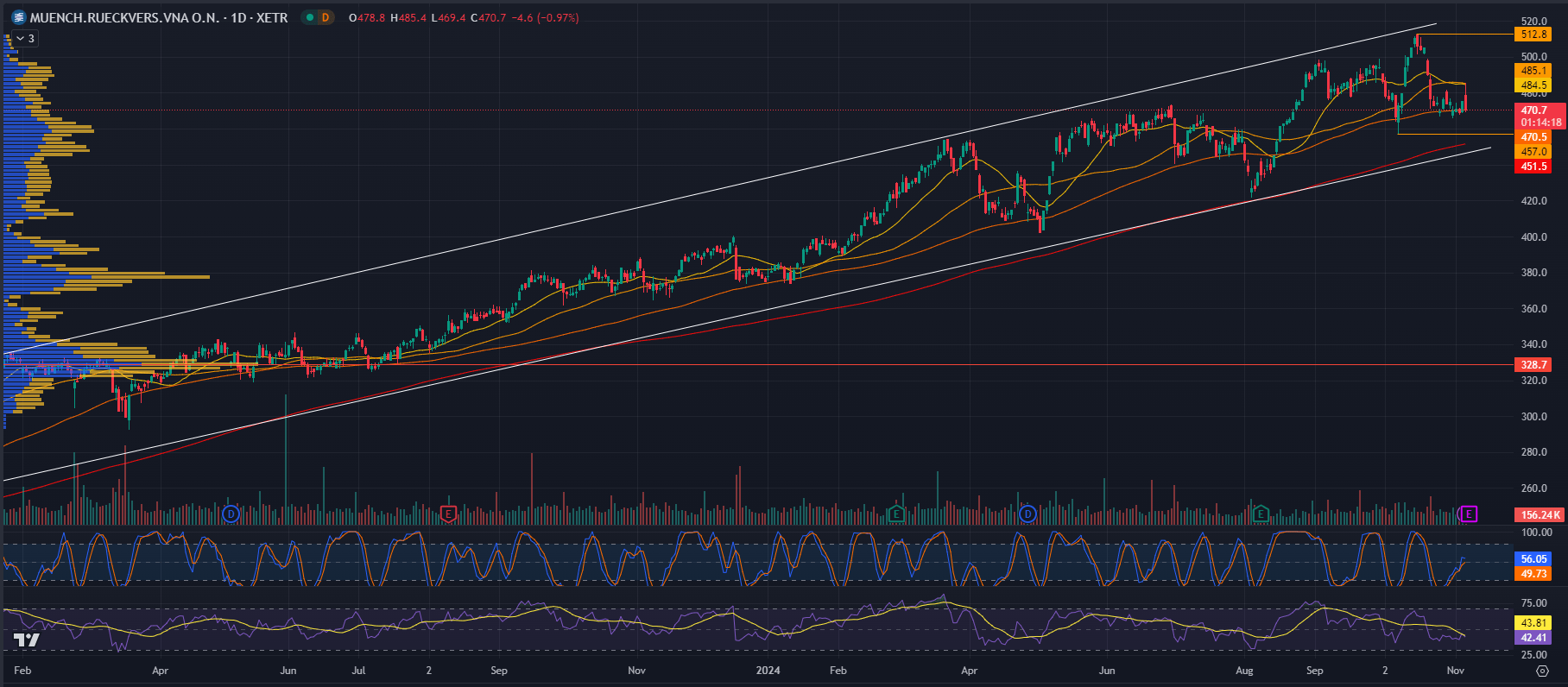

Germany: Münchener Rück Q3 earnings at 9:00 am GMT+1 – Analysis

Münchener Rück is expected to report its Q3 2024 earnings on November 7, 2024. The consensus EPS forecast for the quarter is €9.3. However, Munich Re has already released preliminary results indicating a lower-than-expected performance:

- Preliminary Q3 2024 net profit: approximately €0.9 billion

- Consensus expectations are still: €1.419 billion

This represents a significant underperformance compared to analyst expectations.

Why such a large deviation in earnings projections?

Helene, which devastated the US southeast, cost Munich Re €500 million ($809 million) in the quarter, its largest single claims occurrence.

Storm Boris and widespread flooding in central and eastern Europe, Hurricane Beryl in the US and Caribbean, and three Canadian losses created similar claim expenses.

Münchener Rück AG still places emphasis to exceed its full-year profit target of €5 billion due to “the very good net result” of €4.7 billion for the first nine months. However, Hurricane Milton claims expense is also expected to be high. Munich Re's performance in Q3 2024 could therefore be weaker than in previous quarters of 2024, primarily due to higher-than-average major loss expenditures.

Comparison year to date

25.8% increase Year to date for Münchener Rück AG. While the DAX increased 14%.

Current Business Environment

Munich Re is operating in a challenging environment characterized by:

- Higher-than-average major loss expenditure from natural catastrophes in property-casualty reinsurance.

- Significant impact from specific events:

- Hurricane Helene: Caused approximately €0.5 billion in losses

- Three loss events in Canada: Similar claims expenditure to Hurricane Helene

- Storm Boris and consequent flooding in Central and Eastern Europe

- Hurricane Beryl in the United States and the Caribbean

Positives

- Strong Year-to-Date Performance: Despite Q3 challenges, Munich Re has generated a net result of €4.7 billion in the first nine months of 2024.

- Optimistic Full-Year Outlook: The company still expects to surpass its full-year profit target of €5 billion.

- Operational Strength: Pleasing operational performance across all lines of business in Q3 2024.

- Risk Expertise: Munich Re continues to leverage its unrivalled risk-related expertise and sound financial position.

- Innovation: The company is developing covers for new risks such as rocket launches, renewable energies, cyber risks, and artificial intelligence.

Negatives

- Underperformance in Q3: The preliminary Q3 result of €0.9 billion is significantly below analyst expectations of €1.419 billion.

- Natural Catastrophe Exposure: The company remains vulnerable to major loss events, particularly natural catastrophes.

- Ongoing Economic Uncertainties: The reinsurance market faces considerable uncertainty, with high claims inflation in some segments and significant downside risks in the overall economic environment.

In conclusion, while Munich Re faces challenges in Q3 2024 due to higher-than-expected major loss expenditure, the company's strong year-to-date performance and optimistic full-year outlook suggest resilience in its overall business model. The final Q3 results on November 7 will give us more detailed insights into the company's performance and outlook.

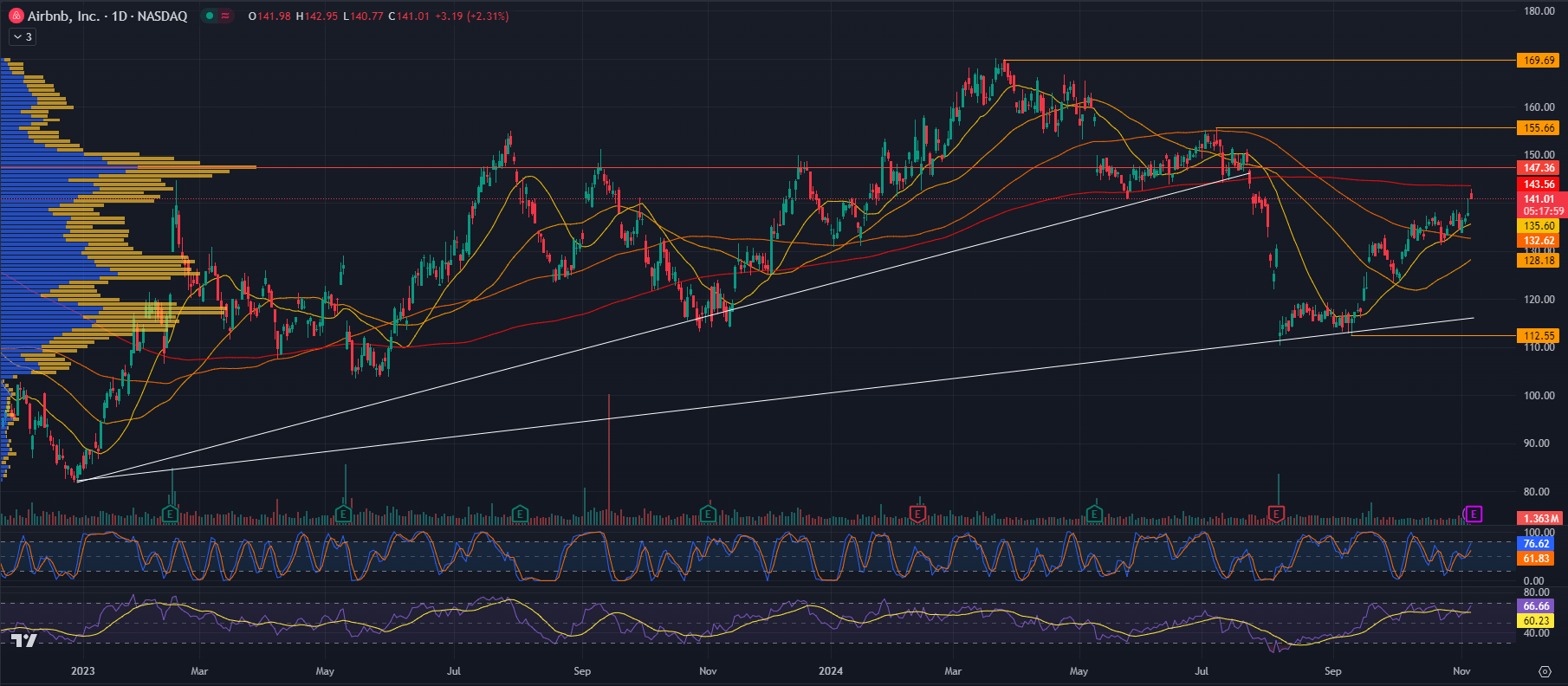

USA: Airbnb (ABNB) Q3 Earnings on the 7th of November

Earnings and Revenue Projections

Airbnb is set to report its Q3 2024 earnings on November 7, 2024. The consensus expectations are:

- Earnings Per Share (EPS): $2.14, down 9.2% year-over-year

- Revenue: $3.72 billion, up 9.7% year-over-year

Compared to Q3 2023 results:

- Q3 2023 EPS: $2.39

- Q3 2023 Revenue: $3.4 billion

Positives

- Strong Revenue Growth: Despite economic uncertainties, Airbnb continues to show robust revenue growth.

- Supply Growth: Active listings grew by 19% year-over-year in Q3 2023, indicating continued expansion of the platform's offerings.

- International Expansion: Airbnb is gaining momentum in under-penetrated markets, particularly in Asia Pacific.

- Mobile App Performance: 53% of gross nights were booked through the Airbnb app in Q3 2023, up from 48% in Q3 2022, showing strong user engagement.

- Profitability: Airbnb has demonstrated strong profitability, with Q3 2023 being its most profitable quarter ever.

Negatives

- Earnings Pressure: The projected 9.2% decline in EPS suggests potential pressure on profitability, possibly due to increased marketing expenses or other operational costs.

- Slowing Growth Rate: While still growing, the projected 9.7% revenue increase for Q3 2024 is lower than the 18% growth seen in Q3 2023.

- Regulatory Challenges: Airbnb continues to face regulatory hurdles in various markets, with notable impacts in cities like New York, Berlin or Spain.

- Economic Uncertainties: Macroeconomic factors such as inflation and potential recession fears could impact travel spending.

Airbnb continues to show strong revenue growth and expansion in its platform, there are signs of potential challenges ahead though. The projected decline in EPS despite revenue growth suggests increasing costs or competitive pressures. Also, a slowdown in customer growth could hit Airbnb’s bottom line and remove it from the 'growth stock' category.

Follow me on X ex Twitter: PhilipForexCom