CB Leading Index m/m

The composite economic indicators are critical components of an analytic system meant to identify business cycle peaks and troughs.

The indexes, which combine numerous independent data, provide a better and more persuasive summary of economic trends than individual components.

The CEI represents current economic conditions and has a strong correlation with real GDP. The LEI is a prediction instrument that forecasts—or "leads"—turning points in the business cycle by around five months.

Measures

Change in the level of a composite index calculated using eight economic indicators.

Usual Effect

'Actual' greater than 'Forecast' is beneficial for currency;

Derived via

The eight components of the Leading Economic Index® for China are:

Consumer Expectation Index

PMI: Mfg: New Export Order

5000 Industrial Enterprises Survey: Profitability

Logistics Prosperity Index

Loan: Medium & Long Term

Floor Space Started

City Labor Market: Demand

Imports: Machinery and Transport Equipment

Upcoming: August 26

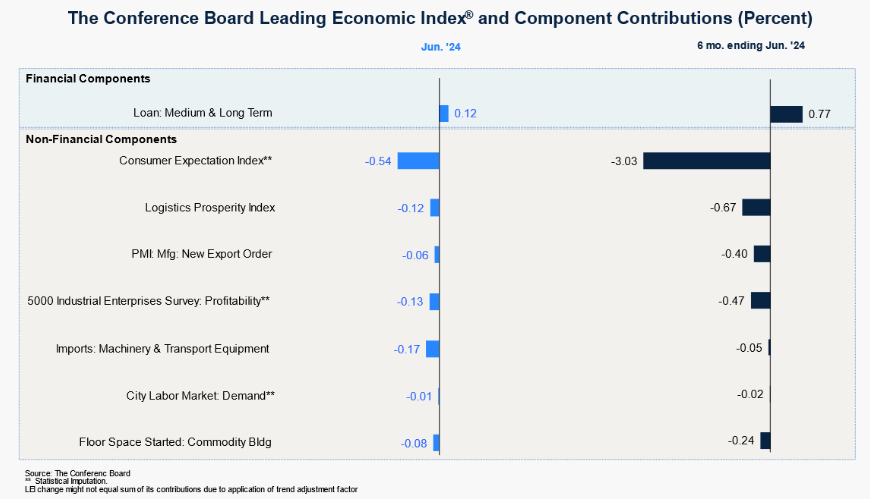

In June 2024, the Conference Board Leading Economic Index® (LEI) for China fell by 0.7% to 149.0 (2016=100), following a 0.5% drop in May. As a result, the LEI fell by 2.1 percent in the first half of 2024, matching the rate of contraction seen in the second half of 2023.

"The LEI for China declined in June, continuing the downward trend that began more than two years ago," said Ian Hu, Economic Research Associate at The Conference Board. "All components except medium- and long-term loans contributed negatively to the Index. Notably, low consumer expectations remained the primary source of weakness in the LEI.

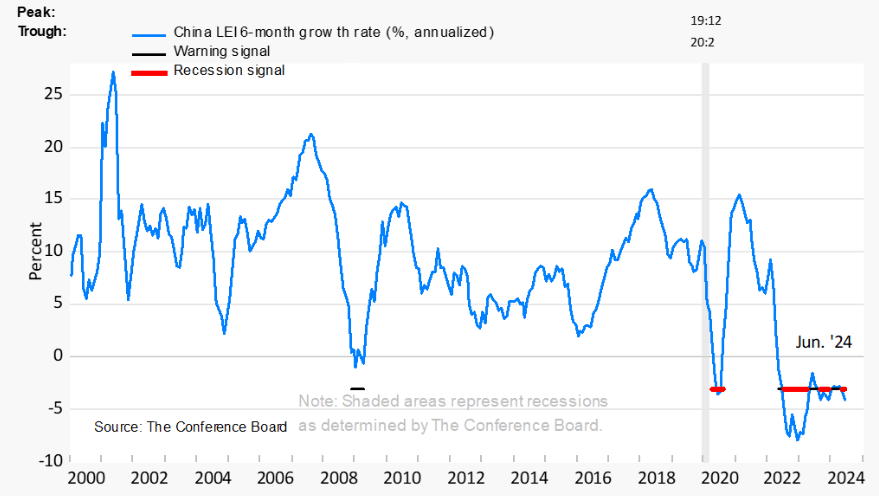

According to the National Bureau of Statistics in China, real GDP growth slowed to 4.7 percent year on year in Q2 2024, down from 5.3 percent in Q1. The somewhat higher negative readings of the LEI's six- and twelve-month growth rates indicate additional downside risks to economic growth in the near term. Going forward, however, increased public stimulus is likely to offset headwinds until the end of this year. Overall, the Conference Board expects annual real GDP growth of 5.0 percent in 2024.

Non-financial components fueled the decrease in China's LEI

The six-month growth rate of the China LEI remained in recession signal territory, suggesting economic risks ahead.

Conclusion

Given the current economic situation, just today announcements from within China were made that the US China trade wars will escalate further. Also, this year’s problems at Evergrande and further problems with Chinese consumers being pressed further came out. This makes me believe that the LEI will not be confident in a recovery for this year’s release.