Canada Dollar Outlook: USD/CAD

USD/CAD trades to a fresh yearly high (1.4200) as it retraces the decline following the Bank of Canada (BoC) meeting, and the exchange rate may track the positive slope in the 50-Day SMA (1.3926) as it holds above the moving average.

Canadian Dollar Forecast: USD/CAD Climbs to Fresh Yearly High

Keep in mind, USD/CAD snapped the recent series of higher highs and lows as the BoC warned that ‘we will be evaluating the need for further reductions in the policy rate one decision at a time’ after delivering a 50bp rate-cut at its last meeting for 2024.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

As a result, the reaction to the BoC rate decision kept the Relative Strength Index (RSI) out of overbought territory, but a move above 70 in the oscillator is likely to be accompanied by a further advance in USD/CAD like the price action from earlier this year.

With that said, USD/CAD may appreciate over the remainder of the week as it bounces back ahead of the weekly low (1.4094), but the RSI may show the bullish momentum abating should it continue to hold below 70.

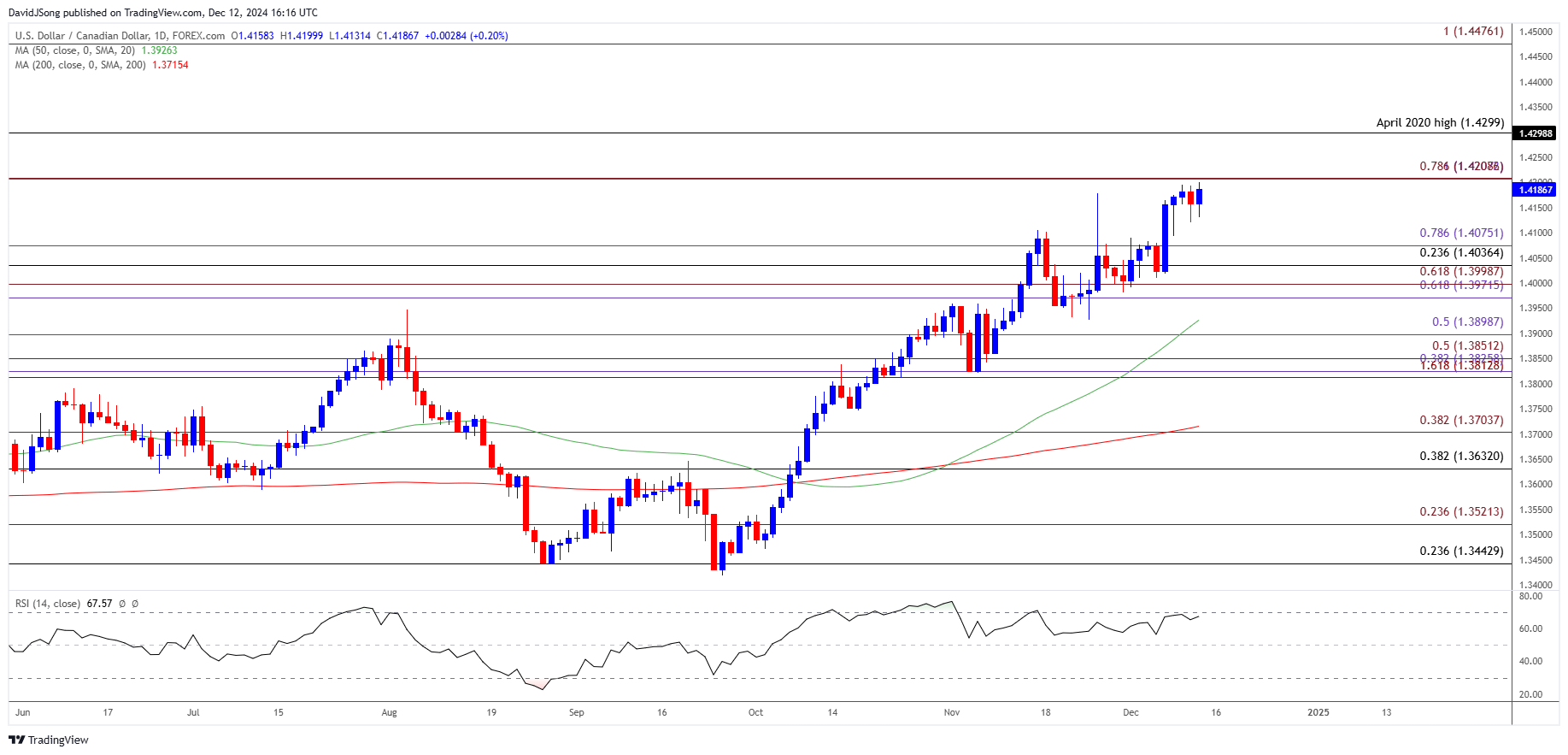

USD/CAD Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD extends the advance from the start of the week to register a fresh yearly high (1.4200), and the exchange rate may exhibit a bullish trend as it appears to be tracking the positive slope in the 50-Day SMA (1.3926).

- A break/close above 1.4210 (78.6% Fibonacci extension) raises the scope for a test of the April 2020 high (1.4299). with the next area of interest coming in around 1.4480 (100% Fibonacci extension).

- At the same time, lack of momentum to a break/close above 1.4210 (78.6% Fibonacci extension) may pull USD/CAD back towards the 1.4040 (23.6% Fibonacci retracement) to 1.4080 (78.6% Fibonacci extension) area, and the exchange rate may threaten the positive slope in the moving average if it fails to hold above the 1.3970 (61.8% Fibonacci extension) to 1.4000 (61.8% Fibonacci extension) zone.

Additional Market Outlooks

GBP/USD Outlook Hinges on Break of December Opening Range

Australian Dollar Forecast: AUD/USD Falls to Fresh Yearly Low

US Dollar Forecast: USD/JPY Rallies Ahead of US CPI Report

EUR/USD Monthly Opening Range Intact Ahead of ECB Rate Decision

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong