A rise of 7% and 20% respectively by what appears another ETF listing the crypto

We have all heard about cryptocurrencies by now. Some of those have become bitcoin-maxis, so people that will try and push these for whatever it takes, while others are a bit more skeptical with good reason. Not knowing who the creator of the biggest cryptocurrency is, still is something I am trying to get my head around. But nevertheless, bitcoin has seen a rise from 0 to over 77,000 within 11 years. Just in the last 24 hours, Bitcoin rose 6%. The second largest crypto, Ethereum or ETH, rose 18% at the same time.

Alright, even as big firms started to embrace cryptos with the start of Exchange traded funds or ETFs, one can now take part in the crypto movements with a regular brokerage account. And speculators appeared to have piled in, as the ETFs have noted the highest inflows of funds ever in the ETF issuing history. It comes as no surprise, as the way one could own any amount of bitcoin previously, was menial. Also, some sort of “recognition” was created with the advent of issuing ETFs that track the price of bitcoin. With big investment firms now offering these products to their clients, one could think that they surely did their due diligence to offer these products to their clients.

And with it, the potential “trust” that bitcoin is something that is here to stay, was increased. As any investor can now invest in bitcoin.

Now, something similar is happening with Ethereum, the second largest cryptocurrency by market cap. The reason why ETH surged over 18% yesterday was that Bloomberg analyst Eric Balchunas raised the odds of the ETF approval by the SEC from 25% to 75%. This could be indeed a catalyst for further price rises as it did with Bitcoin, solely due to the increase in possible access by retail investors. But that is not sure. Like the Bitcoin ETF there was a leak, 1 day earlier which caused the spike, and so a consequent spike because of the actual approval, didn’t come to fruition.

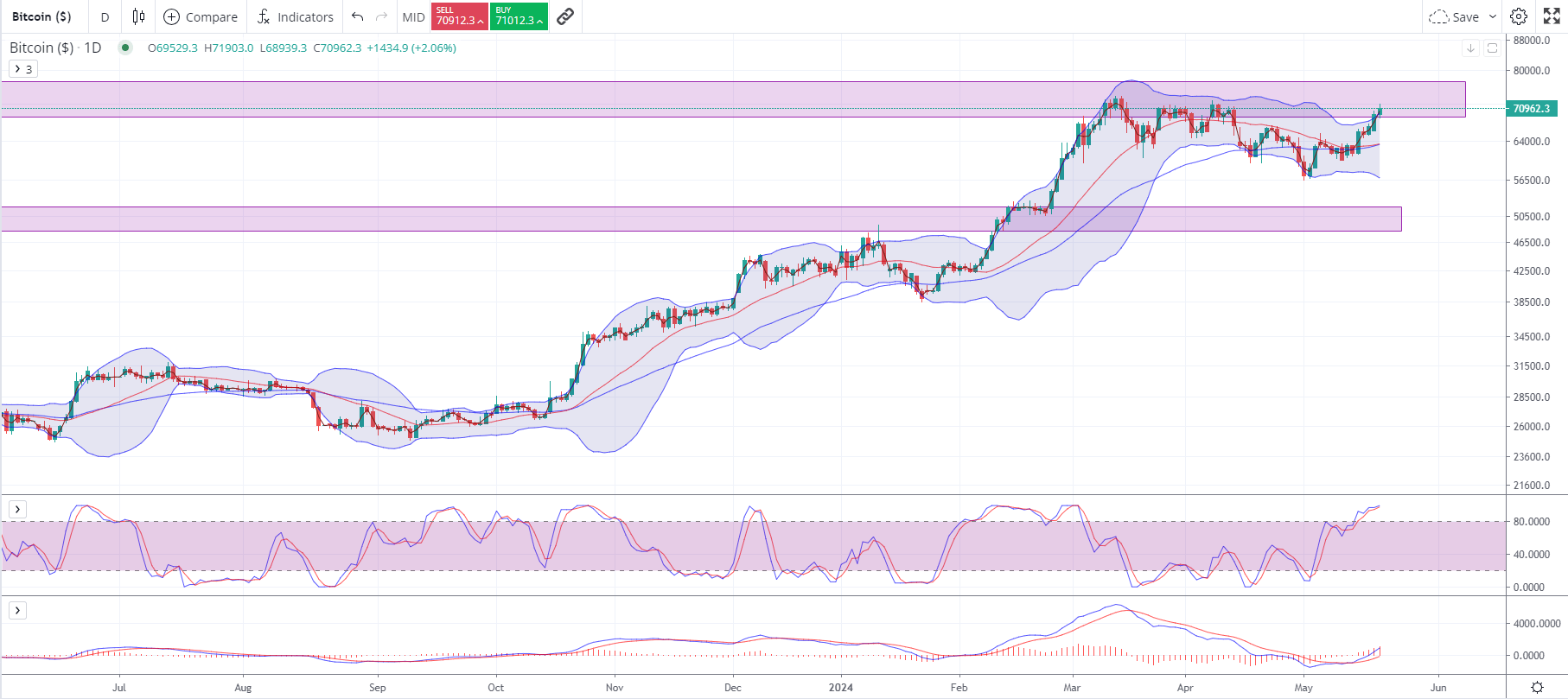

Now however, Bitcoin is rising to the critical levels of previous highs, as it already had broken through some critical Resistance. The Stoch RSI is in extended overbought territory while the MACD just started the slope upwards from negative territory. If a breakdown occurs, then the 63,000 level will act as support due to previous high volumes.

In other news!

This is the longest period of time during 2017–2018 that the S&P 500 has not declined by 2%. It is 311 days. After a rough ride since their top in February 2021, even Chinese equities are beginning to turn around.

An important factor is also enthusiasm for artificial intelligence technology; almost 25% of the gains in the S&P 500 can be attributed to the AI chipmaker Nvidia. These five firms, along with Microsoft, Amazon, Meta, and Alphabet, account for around 53% of the index's increase.

SPX +0.09% at 5,308, NDX +0.69% at 18,674, DJIA -0.50% at 39,807, RUT +0.32% at 2,102.

As the USD/JPY steadily moved above 156.00, there was a repetition of the usual jawboning.

In the absence of any geopolitical escalation and despite pressure across commodities, crude futures declined.

Spot gold calmed down and took a break after its recent record-breaking run and now lingers around the $2,410 level.

Trade smartly,

Philip P