British Pound Technical Outlook: GBP/USD Short-Term Trade Levels

- British Pound marks third consecutive daily decline into confluent downtrend support

- GBP/USD risk for near-term price inflection- U.S. Non-Farm Payrolls on tap

- Resistance 1.1.2337/49, 1.2514, 1.2571-1.2613 (key)- Support 1.2254 (key), 1.2196, 1.2037/84

The British Pound plunged to fresh yearly lows with a three-day sell-off rebounding off key technical support today. The focus is on a reaction off this mark with the immediate short-bias vulnerable while above today’s lows. Battle lines drawn on the GBP/USD short-term technical charts heading into NFPs.

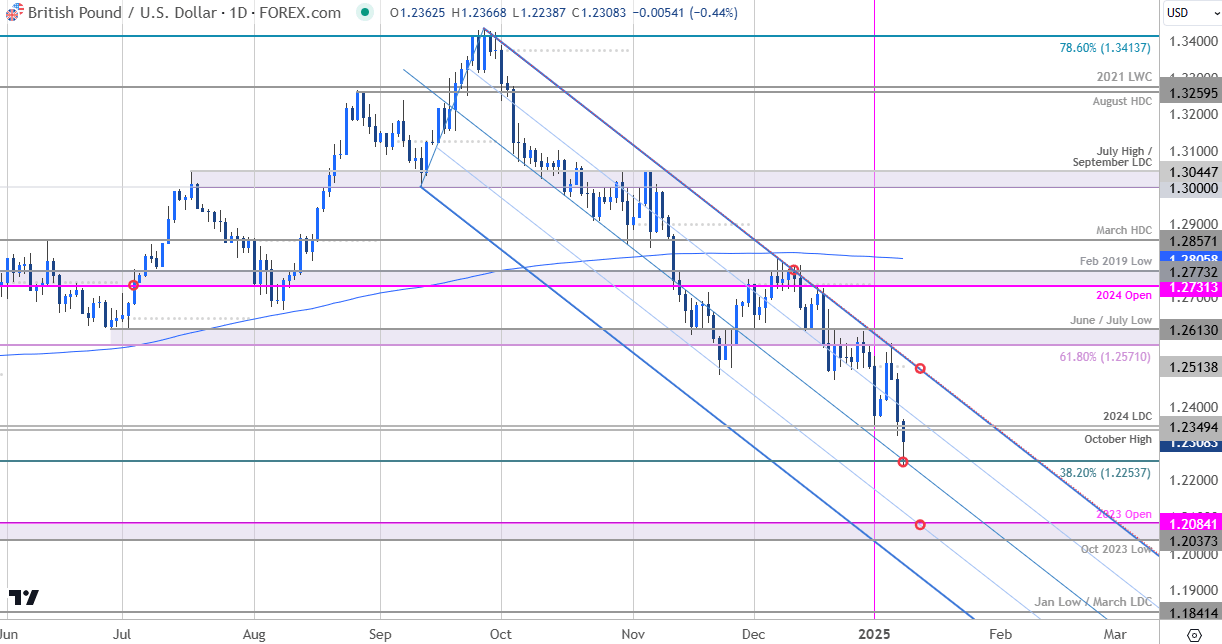

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Sterling technical setup and more. Join live on Monday’s at 8:30am EST.British Pound Price Chart – GBP/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In last month’s British Pound Short-term Outlook, we highlighted the threat for a near-term recovery in GBP/USD with the September downtrend, “vulnerable while above 1.2571. From a trading standpoint, rallies would need to be limited to 1.2880 for the multi-month downtrend to remain viable.” Sterling briefly registered an intraday high at 1.2811 the following day before exhausting with a break below key support on December 19th clearing the way for a decline of nearly 4.5% off the monthly high.

The bears tested confluent support today at the 38.2% retracement of the 2022 advance at 1.2254 (intraday low registered at 1.2239). Note that we have made a slight adjustment to our slope from last month and the median-line now converges on this level into the close of the week. Looking for a possible reaction off this mark into NFPs tomorrow.

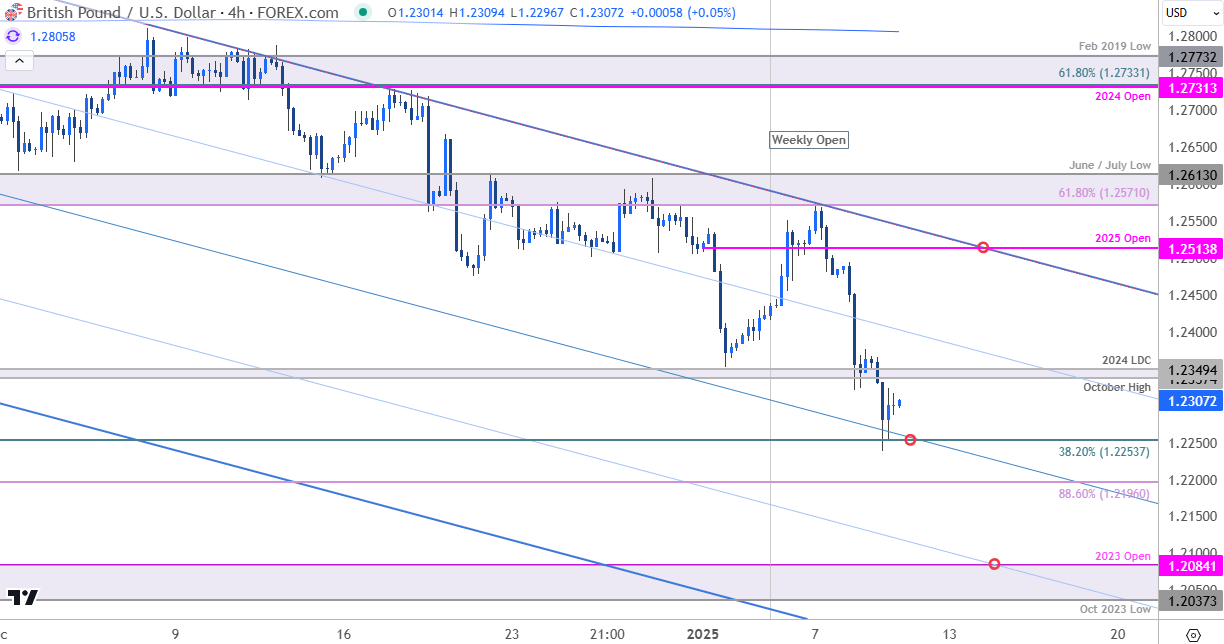

British Pound Price Chart – GBP/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Notes: A closer look at Sterling price action shows GBP/USD rebounding off support today after plunging nearly 2.7% off the weekly high. Initial resistance is eyed at the October high / 2024 low-day close at 1.2337/49 and is backed closely by the 75% parallel (currently near ~1.24) and the objective 2025 yearly open at 1.2514. Broader bearish invalidation now lowered to the 61.8% retracement of the 2023 advance / June & July lows at 1.2571-1.2613.

A break / close below the median-line would threaten another bout of accelerated losses towards the 88.6% retracement at 1.2196 and the next major technical considerations at the 2023 objective yearly open (1.2084) and the October 2023 swing low at 1.2337- both levels of interest for possible downside exhaustion / price inflection IF reached.

Bottom line: The British Pound has responded to confluent support today and we are on the lookout for possible price inflection off this mark. From a trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops – rallies should be limited to the yearly open IF price is heading lower on this stretch with a close below the median-line needed to fuel the next major leg of the decline.

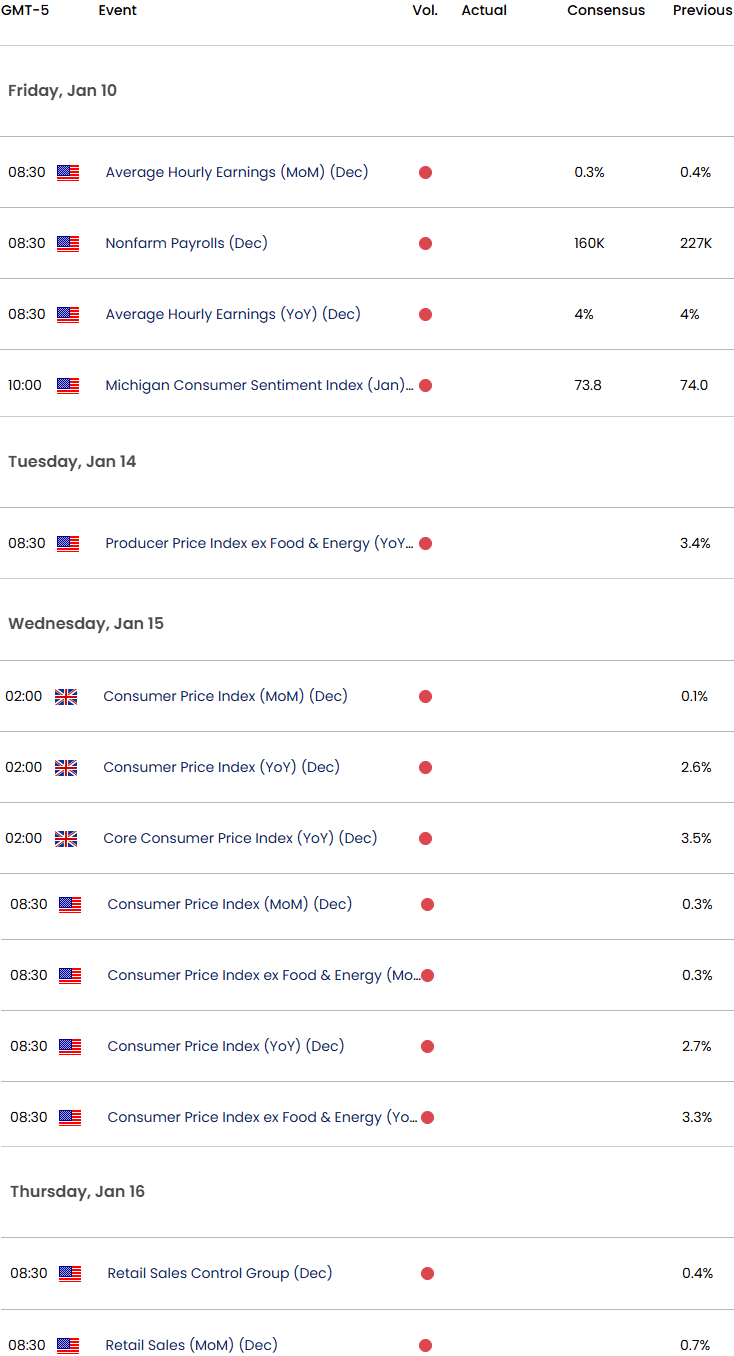

Keep in mind US non-farm payrolls are on tap tomorrow with key UK & US inflation slated for next week- stay nimble into the releases a watch the weekly closes for guidance here. Review my latest British Pound Weekly Forecast for a closer look at the longer-term GBP/USD technical trade levels.

Key GBP/USD Economic Data Releases

Active Short-term Technical Charts

- Gold Short-term Outlook: XAU/USD Poised for Breakout

- US Dollar Short-term Outlook: USD Bulls Rest After Five-Week Run

- Australian Dollar Short-term Outlook: AUD/USD Bears Lay in Wait

- Euro Short-term Outlook: EUR/USD December Range Unfazed by ECB

- Canadian Dollar Short-term Outlook: USD/CAD Bulls Brace for BoC

- Japanese Yen Short-term Outlook: USD/JPY Recovery at Trend Resistance

- Swiss Franc Short-term Outlook: USD/CHF Charge Uptrend Support

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex