British Pound Outlook: GBP/USD

GBP/USD trades below the May low (1.2446) as it extends the decline from earlier this week, and the exchange rate may attempt to test the 2024 low (1.2300) as the bear-flag formation from last year continues to unfold.

British Pound Forecast: GBP/USD Pushes Below May Low to Eye 2024 Low

Keep in mind, GBP/USD failed to hold within the opening range for December as it reversed ahead of the 50-Day SMA (1.2724), and the exchange rate may track the negative slope in the moving average should it continue to trade below the indicator.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, a further decline in GBP/USD may push the Relative Strength Index (RSI) towards oversold territory, and a move below 30 in the oscillator is likely to be accompanied by a further decline in the exchange rate like the price action from 2023.

With that said, GBP/USD may depreciate over the remainder of the week as it starts to carve a series of lower highs and lows, but lack of momentum to test the 2024 low (1.2300) may keep the RSI out of oversold territory.

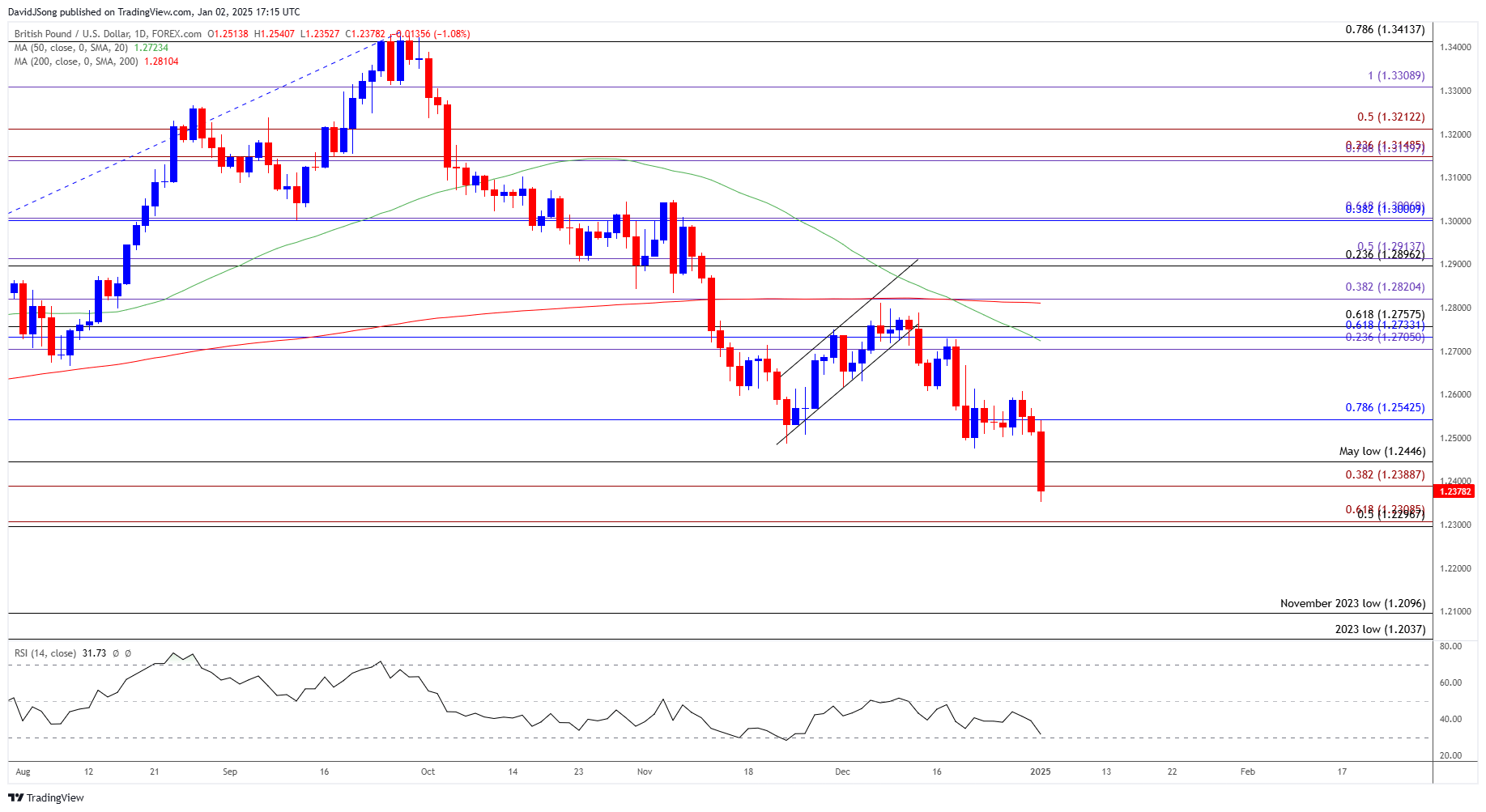

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD fails to hold within the December range as it trades to a fresh weekly low (1.2353), with a close below the 1.2390 (38.2% Fibonacci extension) to 1.2446 (May low) region raising the scope for a test of the 2024 low (1.2300).

- A break/close below the 1.2300 (50% Fibonacci retracement) to 1.2310 (61.8% Fibonacci extension) zone opens up the November 2023 low (1.2096), with the next area of interest coming in around the 2023 low (1.2037).

- At the same time, lack of momentum to test the 2024 low (1.2300) may curb the recent selloff in GBP/USD but need a move back above the 1.2390 (38.2% Fibonacci extension) to 1.2446 (May low) region to bring 1.2540 (78.6% Fibonacci retracement) back on the radar.

Additional Market Outlooks

AUD/USD Vulnerable to Change in RBA Policy

US Economy Proves Stronger-Than-Expected in 2024

2025 Central Bank Outlook Preview

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong