Key Economic Events for Today: BoE and Fed Interest Rate Decisions

BoE Monetary Policy Report (12:00 pm GMT)

BoE Gov Bailey Speaks (12:30 pm GMT)

FOMC Statement (7:00 pm GMT)

FOMC Press Conference (7:30 pm GMT)

1. Bank of England (BoE) Interest Rate Decision – 12:00 pm GMT

- Rate Cut Expected: The BoE is anticipated to announce a 25 basis point rate cut, lowering the bank rate to 4.75%. This decision follows consistent moderation in UK inflation, with headline CPI falling to 1.7% YoY in September, the lowest since April 2021.

- Press Conference at 12:30 pm GMT: Governor Andrew Bailey’s commentary will be crucial for understanding the bank’s stance on future cuts and potential support for the UK economy.

- Expected Market Impact:

-

- Stocks and Indices: Lower rates typically stimulate the economy, which could benefit UK stocks, particularly in housebuilding, hospitality, and consumer discretionary sectors (e.g., Taylor Wimpey, Persimmon, Barratt Developments, easyJet, Marriot International, Whitbread, etc). However, banks like Barclays, HSBC, and Lloyds, etc may face pressure as rate cuts often reduce their net interest income.

- GBP Forex Pairs: Lower rates could weaken the GBP against other major currencies, as reduced interest rates generally decrease currency demand.

2. Federal Reserve (Fed) Interest Rate Decision – 7:00 pm GMT

- Expected Rate Cut: Following a 50-basis point cut in September, the Fed is forecast to lower rates by another 25 basis points, bringing the target range to 4.50% - 4.75%. Fed Chairman Jerome Powell’s press conference at 7:30 pm GMT will then become important, particularly as it follows Trump’s recent election victory, which has spurred market optimism. However due to increased market sentiment, a risk remains that the FED could skip todays interest rate cut.

- Expected Market Impact:

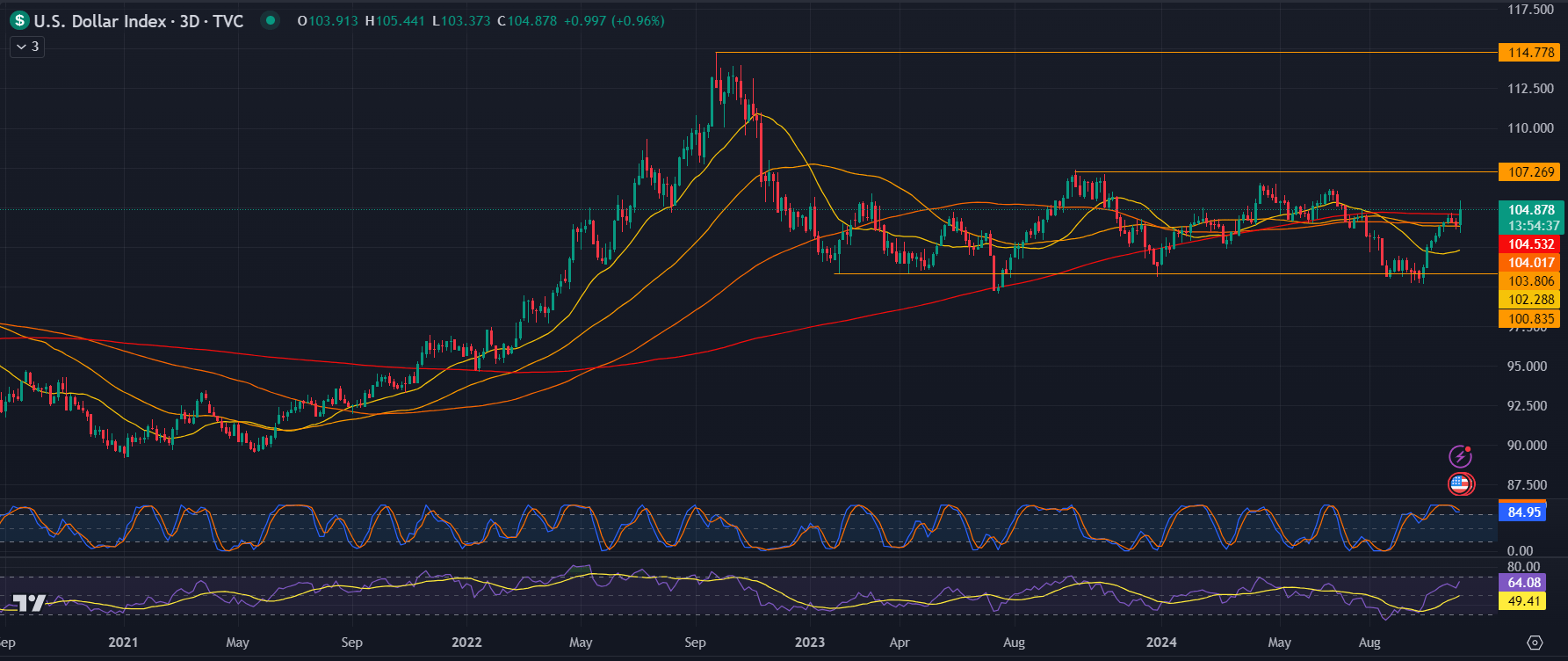

What to Expect for the US Dollar (DXY) - 3Day Chart

The price recently crossed above key moving averages, indicating potential for further bullish movement, but it is approaching significant resistance.

- Resistance:

- The immediate resistance level is 107.269, a level that was tested multiple times in the past and rejected, making it a crucial barrier.

- Above that, a major resistance lies at 114.778, the peak level reached in 2022.

- Support:

- Key support levels are around 104.017 and 102.288, which could serve as areas for price stabilization if a pullback occurs.

- The primary support floor remains at 100.835, where the price previously reversed.

RSI and Stochastic Oscillator:

- The RSI is around 64.08, nearing overbought territory but still indicating room for potential gains. This level suggests a bullish bias with room for further upside.

- The Stochastic Oscillator is at 84.95, signaling overbought conditions, which could lead to a short-term pullback or consolidation.

The chart displays a consolidation pattern between 107.269 and 100.835 over the past year. If the index fails to break through 107.269, it may continue to oscillate within this range, showing lateral movement until a clear trend forms.

Bullish Thesis

- If the DXY breaks above 107.269, it would signal a continuation of the bullish trend with the potential to test 114.778 in the medium term. This scenario would likely be fueled by positive economic data supporting the USD or a global risk-off sentiment.

Bearish Thesis

- Given the overbought Stochastic and the resistance at 107.269, a pullback toward 104.017 or even 102.288 could occur if buyers lose momentum.

- In this case, the DXY may continue to range between 107.269 and 100.835, forming a consolidation pattern until a clear breakout direction is established.

Conclusion

Today’s rate cuts by the BoE and the Fed will likely introduce volatility across stocks and forex pairs, especially GBP and USD pairs. For UK assets, the rate cut could benefit domestic sectors while potentially pressuring the GBP. In the U.S., While the Fed is expected to cut rates, the dollar could see mixed reactions. A rate cut might slightly weaken the USD, yet continued positive data on economic expansion and employment stability could provide support, muting any downside effect. Additionally, Powell’s comments on inflation will be critical, as the Fed is likely to hold off on further cuts until inflation trends sustainably toward 2%.

Follow me on X ex Twitter: PhilipForexCom