Bitcoin Talking Points:

- While many of the Trump bump themes have softened, such as US equities and the USD finding resistance, Bitcoin has remained bullish for the past couple of weeks as it gets closer to the 100k level.

- Given the amount of attention on that 100k level, that can be a tricky matter. For now, the next objective overhead is the 95k level, and for traders looking to impart strategy, the past couple of weeks could offer a bit of guidance.

- I look into Bitcoin each week in the weekly webinar and you’re welcome to join the next: Click here for registration information.

Bitcoin remains the big winner from the 2024 election and at this point buyers are continuing to press prices higher. BTC/USD is now nearing the 95k level and as I looked at last week, it’s been a difficult market to chase, even with the concerted bullish bias.

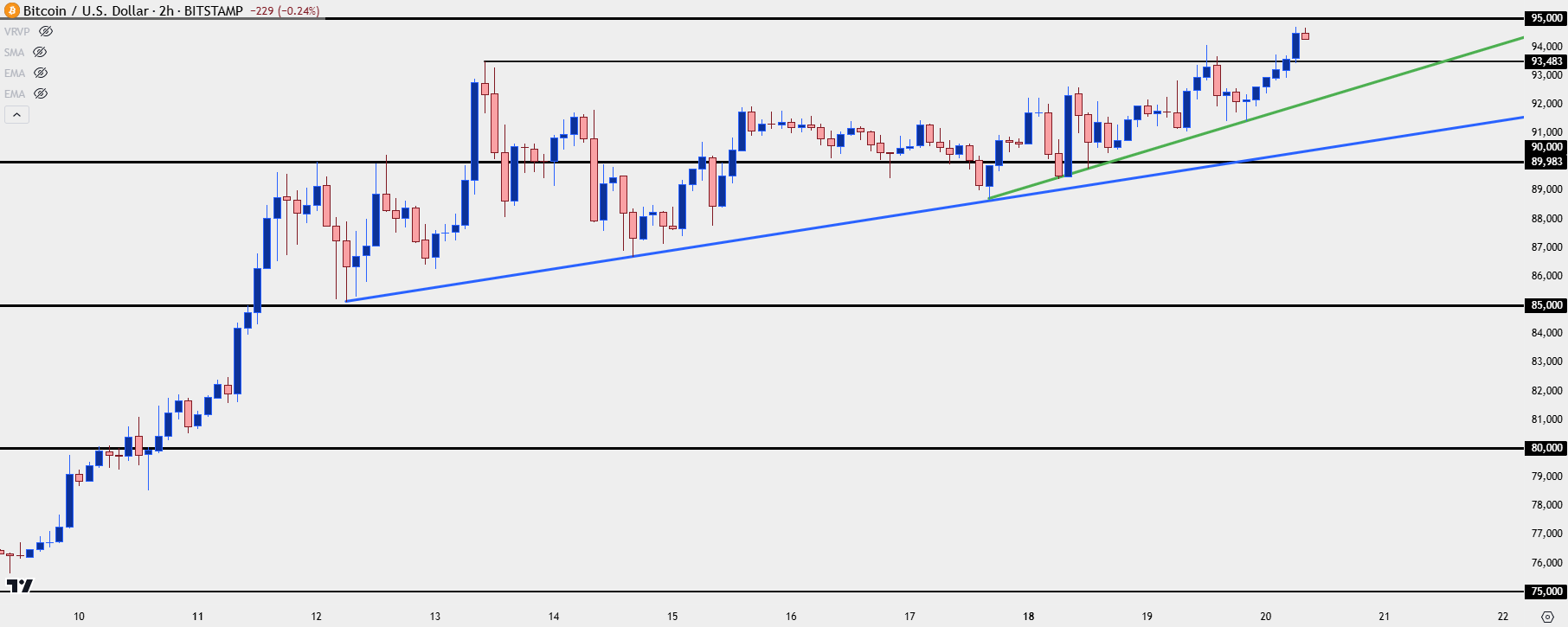

In last week’s article Bitcoin was trying to gain acceptance over the 90k level and as I shared, chasing that fresh breakout could be a difficult way of trying to gain exposure. Sure enough, the market wasn’t done testing 90k and a pullback followed shortly after. Buyers came in to hold a higher-low and that led to another test over 90k, which similarly failed; but that reaction also held another higher-low.

This highlights how buyers have been more aggressive on pullbacks or tests of support than they have been at highs. Yesterday saw a test of the prior high, just inside of the 93,500 level and that similarly brought pullback but this time, bulls wouldn’t allow for a test below 90k and that showed increasing acceptance of the psychological level. Collectively this caution at highs but aggression at higher-low support this helped to form an ascending triangle formation, often approached with aim of bullish breakout, which is taking place this morning.

Bitcoin Two-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Bitcoin 95k

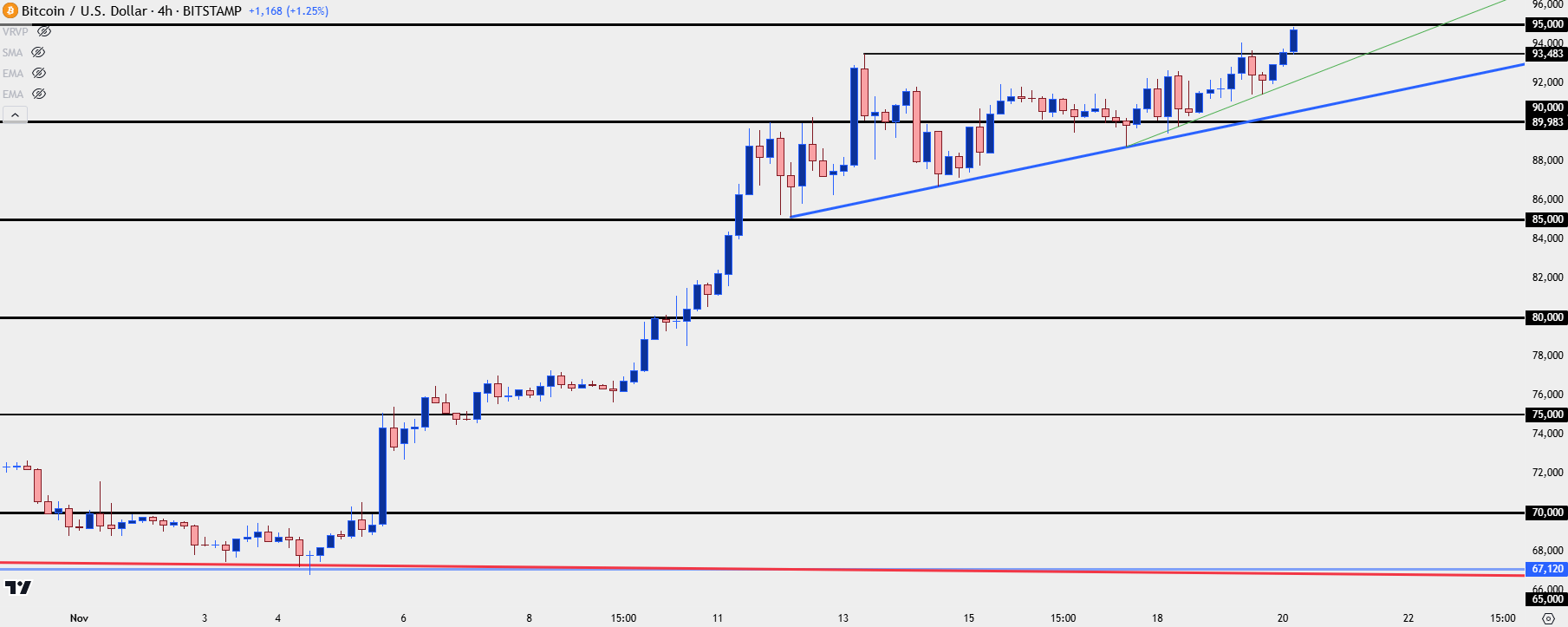

Major psychological levels can take time to work though. Of course, the 100k level is great example and if or when that trades, there will likely be an abundance of headlines on the matter. But, to a smaller degree, levels like 90k, or 85k can similarly bring attention and that attention can help to form inflections.

The breakout on the back of the election hurriedly jumped to 75k, which stalled the move for a bit, but soon turned into support. The 80k level similarly slowed bulls, albeit temporarily.

The test on the way-up at 85k was brief and limited but 90k held as the high for a bit, allowing for a pullback to and defense of that 85,000 price. And it’s been the past week and a half as BTCUSD bulls have been grinding for greater and greater acceptance over that 90k level.

The 95k level is the next major psychological level overhead and that’s almost into the equation, as of this writing.

Bitcoin Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Bitcoin 100k

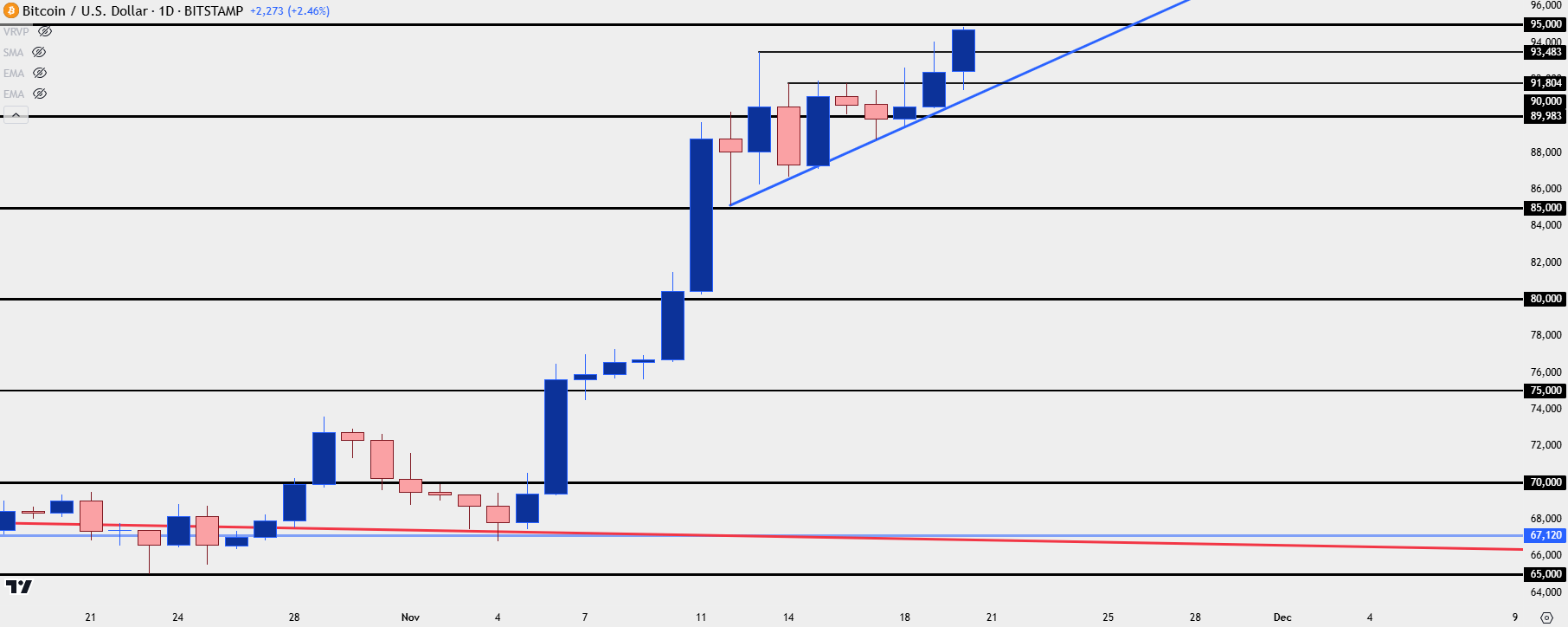

A price like 100k can bring quite a bit of drama. But, for those that aren’t already long the big question is whether that price even matters? And further if it does trade, is that really the best time to look to add exposure?

The same can be said about prices like 90 or 95k, as well, of course, and as I looked at last week, if looking to establish or add bullish exposure, waiting for support could be a more attractive pathway forward.

If we do see 95k trade and bring some element of resistance to the matter, there’s a couple of spots of support potential as taken from prior resistance on the daily chart. Of course 93,500 stands out as this held the highs on two separate occasions, but inside of that at 91,804 another level of prior resistance stands out.

If bulls do fail to hold support above the 90k level, then the topside bias can begin to come into question but if support shows at either of those prior points of resistance, there’s continuation potential remaining in the matter.

Bitcoin Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist