BITCOIN (BTC)

Bitcoin Surges to All-Time High Following Trump’s Election Win

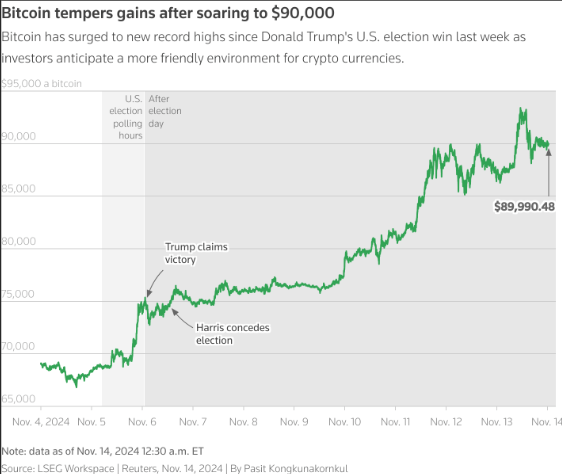

Following the 2024 U.S. presidential election, Bitcoin reached a record high of $93,163. Over $3.2 billion flowed into the top 10 Bitcoin ETFs, bringing Bitcoin's market valuation to $1.752 trillion—surpassing silver’s $1.72 trillion and making it the eighth largest asset globally. This surge is driven by President-elect Donald Trump’s pro-crypto campaign promises, including crypto market liberalization and the establishment of a U.S. Bitcoin Strategic Reserve.

Figure 1: Source – Coinglass. Interpretation: 1 Day after the election, the top 10 Bitcoin ETFS have seen a total inflow of $3.2 Billion. This shows a strong demand for Bitcoin after the certainty of the election outcome.

Factors Fueling Bitcoin’s Surge

Pro-Crypto Policies: Trump’s victory has generated optimism around a favorable regulatory environment, with plans to streamline “unclear” or “tough” laws that have previously hindered the sector.

Institutional Investment: Many institutional investors reduced their crypto exposure prior to the election but are now returning to the market, contributing to the surge in investment flows and boosting prices further.

Strategic Bitcoin Reserve: Trump’s proposed Bitcoin Strategic Reserve signals a major shift in U.S. policy, positioning Bitcoin as a national asset, which has reinforced investor confidence.

Crypto Market Outlook: A New Chapter for Digital Assets

The crypto rally has not been limited to Bitcoin. Altcoins like Cardano (ADA) and Solana (SOL), as well as meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB), have also seen gains, reflecting a broad market boost. Analysts predict that policy certainty and regulatory clarity will encourage Tier-1 banks to integrate crypto services, bringing more institutional investors into the space. This could fuel further gains as more crypto ETFs and investment products become available.

The Path Forward: Key Developments and Challenges

Figure 2: Source – LSEG Workspace. Intepretation: After Trump was confirmed as victorious last week, bitcoin proceeded to rise from an average of 75,000 to its all time high of around 93,000.

Crypto-Friendly Advisory Council: Plans are underway to appoint a presidential advisory council focused on fostering crypto innovation, further supporting the industry’s growth.

Potential Regulatory Changes: Trump’s sweep in battleground states and the pro-crypto majority in Congress could pave the way for SEC Chair Gary Gensler’s departure and reduce obstacles for the crypto market. This regulatory shift may boost confidence and drive higher valuations across digital assets.

Institutional Expansion: Increased certainty around regulations is likely to prompt more institutional adoption, with banks and financial institutions integrating crypto platforms and services.

A Turning Point in U.S. Crypto Policy

Trump’s pro-crypto stance marks a stark departure from his first term, where he criticized Bitcoin as “based on thin air.” Now, he aims to make the U.S. the “crypto capital of the world.” With policy shifts underway and market sentiment at an all-time high, the crypto industry appears poised for an era of growth.

Elon Musk has been appointed by President-elect Donald Trump to lead a newly created Department of Government Efficiency (DOGE), alongside entrepreneur Vivek Ramaswamy. This appointment, announced on November 13, 2024, has had a significant impact on the crypto market, particularly on Dogecoin (DOGE). The meme cryptocurrency, which Musk has long supported, saw a substantial price surge following the news, with its value increasing by as much as 24.6% on Tuesday to nearly $0.44, and maintaining gains above $0.40 on Wednesday.

This rally has pushed Dogecoin's market cap to around $60 billion, surpassing that of major companies like Ford and Delta Air Lines. The broader crypto market has also reacted positively to this news, as it's seen as a sign of potential crypto-friendly policies under the upcoming Trump administration. Musk's appointment to a government role, combined with his well-known advocacy for Dogecoin, has created a unique situation where a government department's acronym (DOGE) aligns with a major cryptocurrency, further fueling market excitement and speculation about the future of crypto regulations and adoption in the United States.

Bitcoin – Technical Analysis – 1D

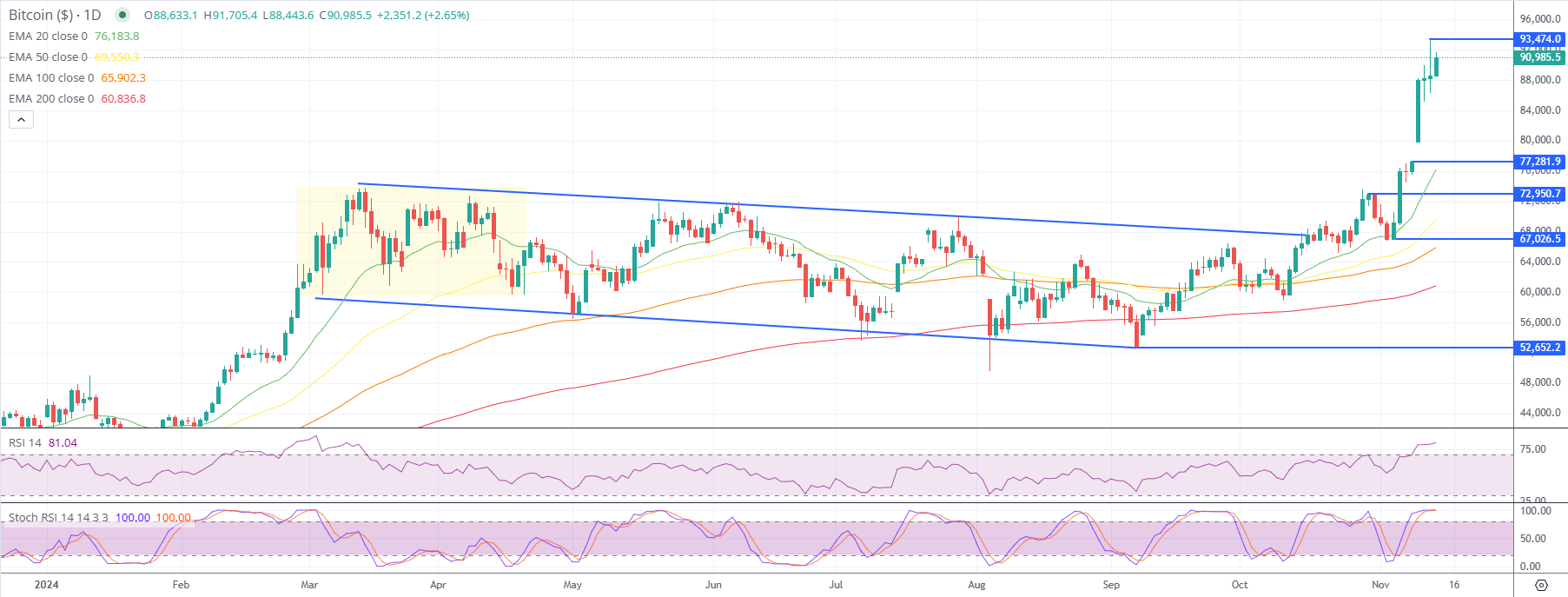

1. Current Price Action and Trend:

Bitcoin is currently showing strong bullish momentum with a recent breakout from the consolidation channel.

The price has surged significantly over the past days, reaching near-term resistance levels and pushing towards new highs.

2. Support and Resistance Levels:

Resistance:

The immediate resistance is at 93,474.0, which represents a potential cap for the current rally.

A breakout above this level would likely signal further upside, potentially opening up new highs as momentum builds.

Support:

The first support level is around 77,300, which marks the start of the upwards gap candle and could act as a stabilization point if there’s a pullback.

The second support level is around 73,000, which marks the top of the previous channel and could act as the second stabilization point if there’s a further pullback below the first support level.

Stronger support lies at 60,000 which forms the average price since April, and is represented by the EMA 200. This would be a significant high volume area in case of a deeper correction.

3. Moving Averages

Bitcoin is trading well above all major EMAs, indicating strong bullish momentum. The alignment of the EMAs shows a robust bullish structure, with each average trending upwards below the price.

4. RSI and Stochastic RSI:

The RSI is at 80.93, indicating overbought conditions. This suggests that while the trend remains bullish, the current rally might be due for a cooling-off period or a brief consolidation.

The Stochastic RSI is maxed out at 100.00, highlighting overbought conditions. This could imply that a short-term pullback or sideways movement might be on the near term horizon.

Scenario 1: Bullish Continuation

If Bitcoin continues its rally and breaks above 93,474.0, the uptrend could gain momentum, possibly leading to new all-time highs.

The strong alignment of the EMAs and bullish momentum supports this scenario, especially if the price stays above 76,168.0 (EMA 20) on any pullbacks.

Scenario 2 - Short-term Pullback and Consolidation

Given the overbought conditions on both the RSI and Stochastic RSI, Bitcoin may experience a short-term pullback or consolidation. If this happens, 77,300 would be a key level to watch for support.

If you would like to know more about our Crypto offering, then please follow this link: https://www.forex.com/ie/markets-to-trade/cryptocurrency-trading/

--Written by Philip Papageorgiou – Market Analyst

-Follow me on X ex Twitter: PhilipForexCom