Friday appears to be a little calmer than Thursday's spike in global stock markets, which saw the DOW JONES, S&P 500, and DAX reach all time highs. The Bank of Japan also decided to keep rates unchanged at its most recent meeting today. After the sharp increase following the Fed decision, a calmer session is expected for the rest of the day. Data from the UK showed that for August there was a 1% increase in retail sales, and thus exceeding forecasts.

In terms of the economic calendar, only the eurozone consumer confidence and ECB President Lagarde holding a speech shortly after is expected for today, and with a high likelihood we will not need to endure another August…

As such, I have decided to do something a little different for this analysis, and instead I opted to compile an easy-to-read list (hopefully!) with various news and highlights of corporations and what happened this week. Let’s begin!

Corporate News

While it is trying to recover, Intel (INTC) is still down -55.08% year to date. But is currently working on 2 potential high-profile collaborations that might help them regain their footing. The first is a contract by The Department of Defence which has awarded Intel with a $3 billion contract in order to design and manufacture microchips for them. Also, according to various outlets, Amazon (AMZN) and Intel are collaborating on a "multi-billion dollar" project to produce AI chips for Amazon Web Services (AWS) cloud computing division.

Social media and communications platform Snapchat (SNAP) has released their new AR smart glasses called Snapchat Spectacles (5th gen) which will have features like recording videos by means of an integrated camera as well as the capability to sync to your phone. The news comes as the company has been struggling with a low share price and could aid their profitability in the middle to long term if they do catch on.

Talking about social media platforms, Parent company Facebook (META)'s Instagram platform is introducing teen profiles with privacy and parental settings, according to Reuters. This comes after a backlash over the current state of social media and the social media giant having been put on the pedestal over complaints from consumers regarding exploitation. This could help ease fears of the platforms being detrimental to young individuals.

To aerospace. In order to save money during the employee strikes at a Boeing (BA) facility, management had decided to temporarily freeze employment. The business is also planning to soon put staff on furlough in order to save money during the labor strike, according to the newly appointed CEO of Boeing.

Tupperware Brands (TUP) as we all know has confirmed signing for bankruptcy protection. The decision came due to growing losses due to a lack of interest in its formerly well-known food storage containers as well as the related ongoing liquidity constraints. In the bankruptcy filing Tupperware listed around $750 million in assets and $5 Billion in Liabilities.

Drivers of General Motors (GM) vehicles can now use Tesla (TSLA) superchargers for their electric vehicles as long as they purchase an adaptor. This would mean that more vehicles will be able to connect to the 17,800 Tesla charging stations thanks to the new agreement which could be seen as a plus for Tesla.

Apple (AAPL) might need to allow competing technology into their iPhone OS. Under the European Union Digital Markets Act, it is anticipated for Apple to receive a warning, threatening penalties, unless the company opens up its iPhone operating system to competing technology. The European Union want to guarantee that other developers have access to essential elements such as the iPhone's payments chip and Siri. Failure to comply may result in sanctions equivalent to 10% of Apple's annual global turnover. That’s a lot of money.

Shares of FedEx (FDX) fell almost 13% in afterhours trading after the company announced a decline in Q1 earnings as well as declining revenues mainly attributed to a decline in demand for priority services.

A $100 million US military contract was obtained by Palantir (PLTR) to increase access to its AI-powered targeting systems by the US military.

Crypto

Bitcoin hits $64,115. Owing to the Federal Reserve's surprise decision to cut interest rates by 50 basis points which sent the price of bitcoin skyrocketing to a 1 month high. Due to the interest rate cut, the financial system is now more liquid, which has raised investor interest in riskier assets like Bitcoin. The performance of Bitcoin exchange-traded funds (ETFs) and expectations of additional rate reductions are two aspects that are driving the upward trend.

This week the Bitcoin ETFs have also recorded a large net inflow with yesterday alone recording a $166 million inflow into the Bitcoin ETFs. While the highest inflow for this week was recorded on Wednesday with close to $300 million in inflows.

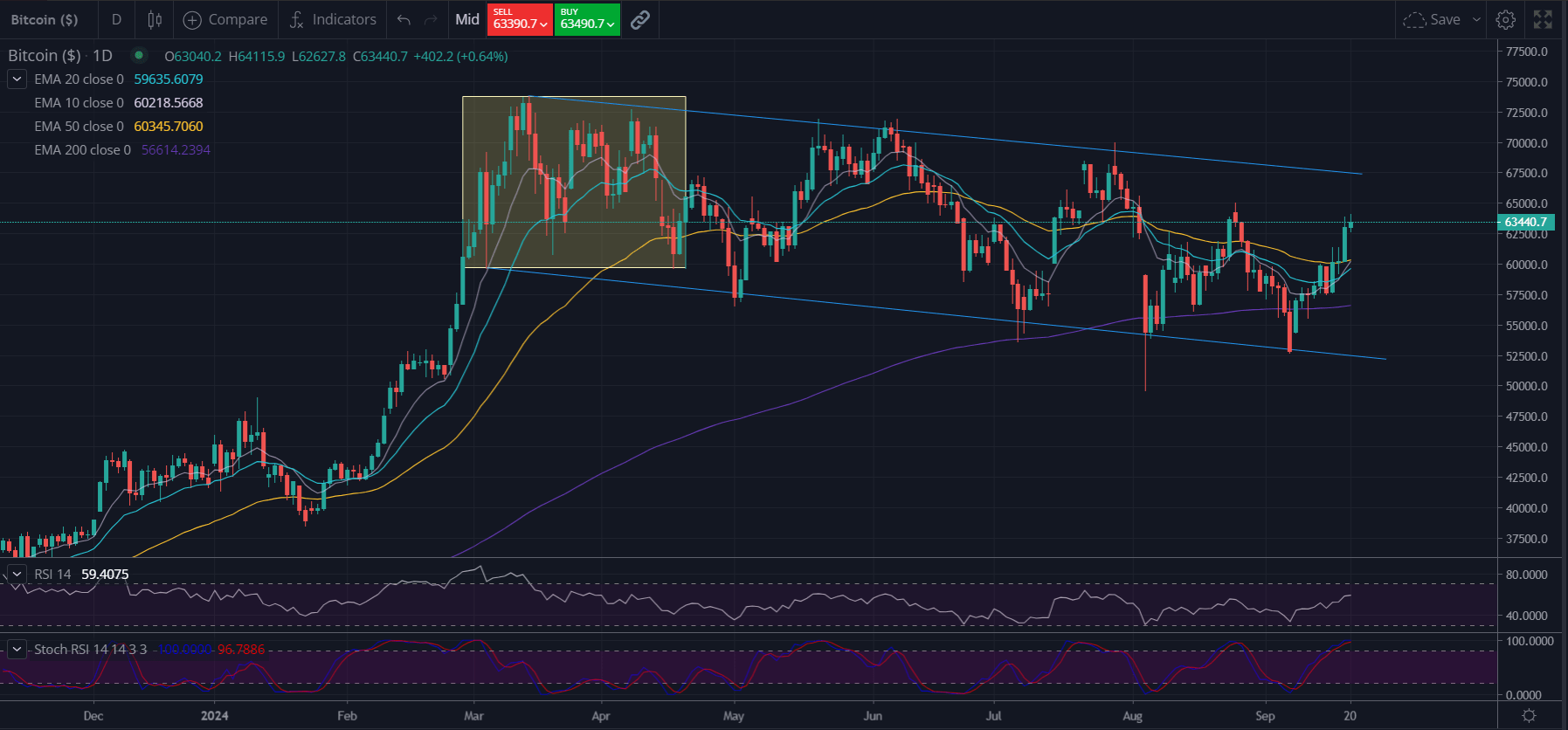

Technically seen from the 1-day chart, the price of bitcoin is moving within a diagonal channel and is currently in the top half of the channel.

The price is over the 10, 20, 50 and 200 EMAs since Wednesday showing bullish momentum unfolding.

The RSI is in bullish territory around the 60 mark, while the Stochastic RSI is in overbought territory potentially showing a weakening upside trend and a potential dip lower or a consolidation.

Written by Philip J Papageorgiou