BTC/USD & ETH/USD Key Points

- The Crypto “Fear and Greed” oscillator reaches 94, signaling extreme greed” and essentially the highest level on record.

- Bitcoin probes the key $100K level – will that be a profit-taking area or mere stepping stone on the way to $120K+?

- Ethereum continues to lag – all eyes on $3,400.

Cryptoasset Market News

- MicroStrategy buys $4.6B worth of Bitcoin, plans to buy another $2.6B

- Senator Lummis Proposes the US Buy 1M Bitcoin as part of a “Strategic Reserve”

- CME futures have surged to record levels, with over $21.6 billion in open interest, accounting for a 33% share of the total futures market.

- The CFTC issued a statement clearing the way for listed options on Bitcoin ETFs and they began trading on Blackrock’s Bitcoin ETF, IBIT.

- Tether, Kraken, and Fabric Ventures are backing Quantoz Payments in launching two stablecoins, EURQ and USDQ, compliant with MiCA.

- SEC Commission Chair Gary Gensler, notorious thorn in the crypto communities side, is set to step down from his post on January 20th.

- Multiple firms including Bitwise and VanEck have applied for Solana ETFs.

- Donald Trump's social media company is reportedly close to acquiring Bakkt, a crypto-trading platform. The President plans to meet with Coinbase CEO Armstrong

Sentiment and Flows

The sentiment gauge we watch most closely, the “Crypto Fear and Greed Index,” rose to 94 last week, indicating essentially the highest level “extreme greed” since the index was created in 2018. At the margin, the high level of greed in the market hints at elevated risk for a pullback in the coming week, especially if momentum rolls over:

Source: Alternative.me

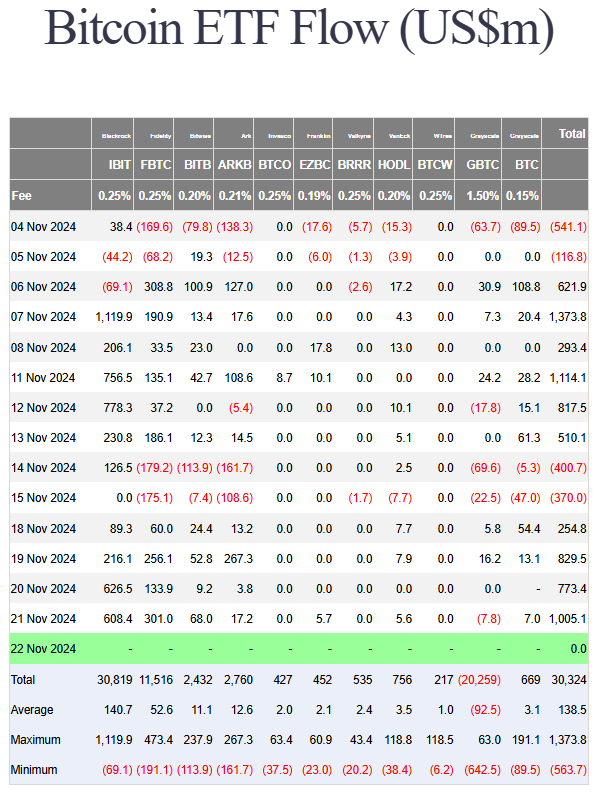

Another way of gauging sentiment, flows into exchange-based cryptoasset investment vehicles, have remained near record highs over the last week. As of writing before the release of Friday’s data, Bitcoin ETFs have seen stellar inflows of nearly $3B over the last four days alone. Over the long-term, inflows from “tradfi” investors provide incremental demand for Bitcoin and could help support the price, as we’ve seen in recent weeks.

Source: Farside Investors

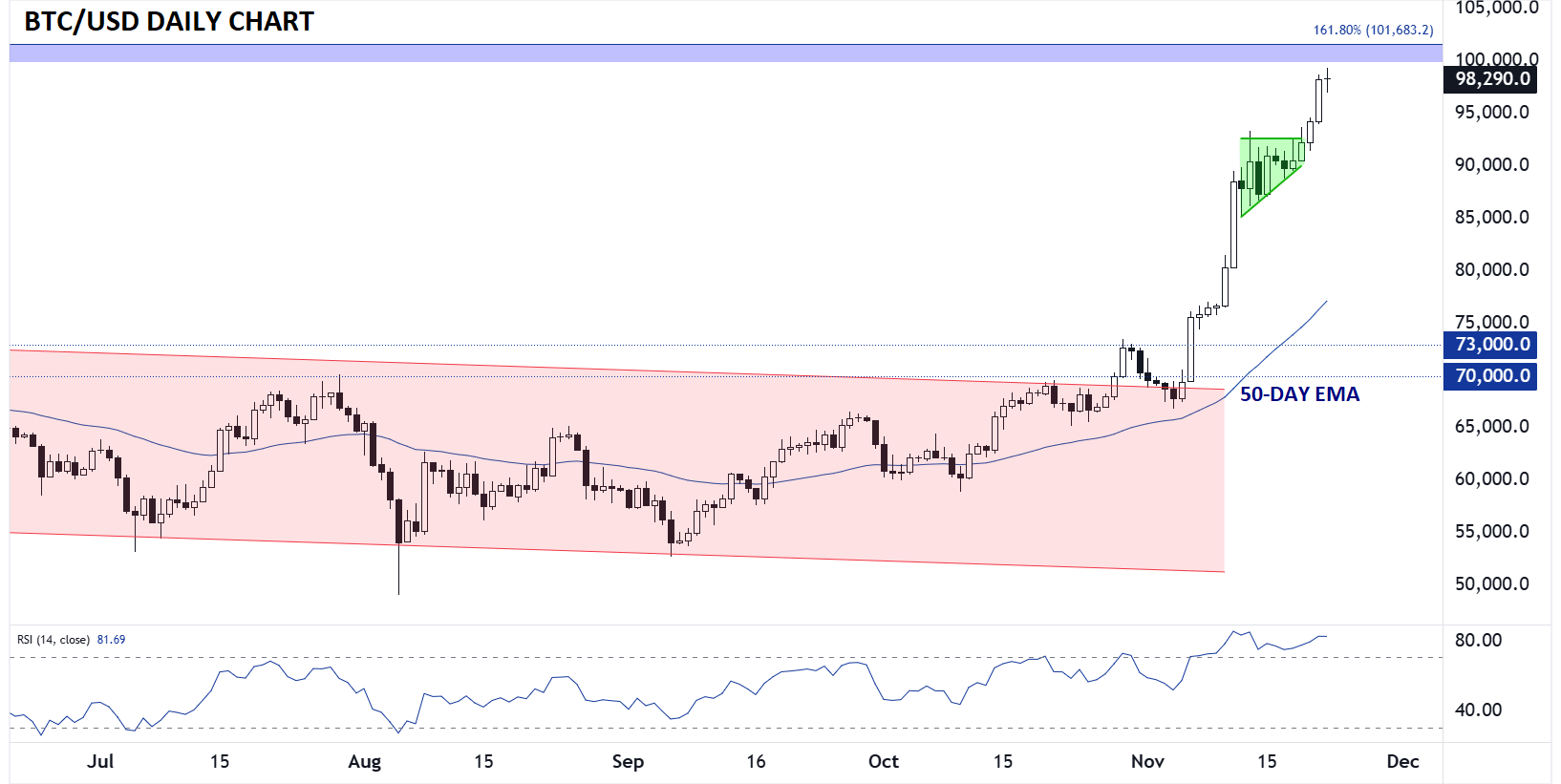

Bitcoin Technical Analysis: BTC/USD Daily Chart

Source: StoneX, TradingView

After a week consolidating around $90K, Bitcoin broke out with a vengeance midway through last week, powering up to a high above $99K as of writing. At this point, the momentum and sentiment are clearly extremely bullish, but it’s worth wondering whether upcoming resistance at $100K (psychologically-significant round number) or $102K (161.8% Fibonacci extension of the 2021-2022 pullback may prompt a round of profit-taking, especially with the RSI showing a potential bearish divergence, though we would need price to roll over to confirm the signal.

Regardless, as we noted last week, big breakouts from long consolidation periods can often run further than expected, so readers may want to be cautious about any counter-trend trades.

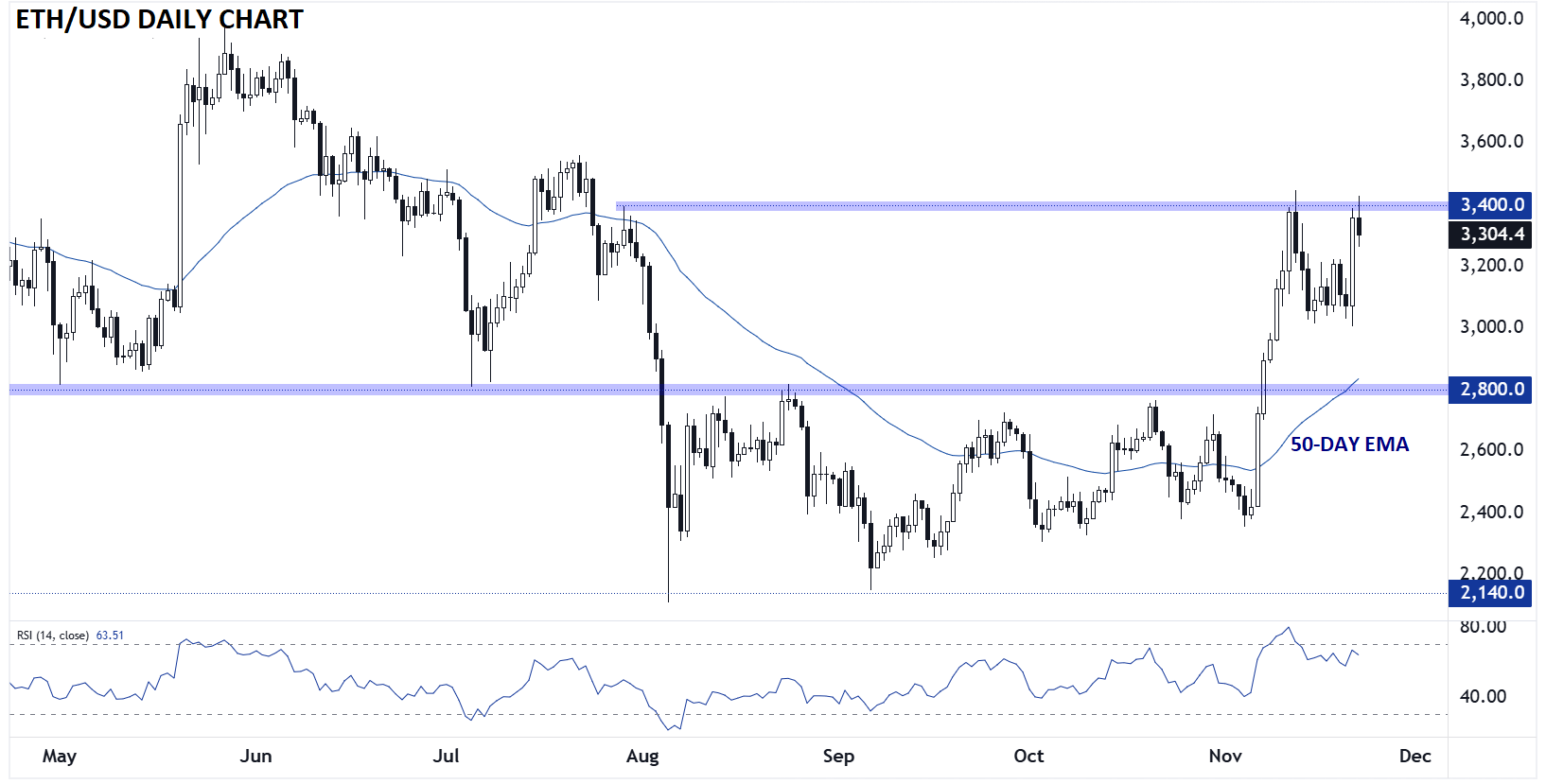

Ethereum Technical Analysis: ETH/USD Daily Chart

Source: StoneX, TradingView

Ether rose on the week as well, helped along by a big bullish rally on Thursday. That said, the world’s second-largest cryptoasset stalled out at the same $3400 level we noted last week, failing to make even a 4-month high while Bitcoin powered toward $100K.

Moving forward, previous-support-turned-resistance-turned-support-again near $2800 will be the key zone to watch. As long ETH/USD remains above that level, the technical bias remains at least modestly bullish in anticipation of a more favorable regulatory environment. Meanwhile, a break above $3400 resistance could signal a potential “catch-up” trade is afoot in Ether.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos and be sure to follow Matt on Twitter: @MWellerFX