Natalie Scott-Gray highlights Indonesia's ‘grand strategy’ to support its domestic refining industries, limiting the export of unprocessed raw materials – most notably nickel – and increasing the shipment of refined products which benefit local industry.

Import bans are probable. President Joko Widodo also announced that an import ban on nickel could be imposed this year. “In our grand strategy, we want to downstream all commodities”, adding, “other countries will realise that they must invest here or partner with our companies. That’s the only option.” Tax policy is another tool. A progressive tax has been proposed on Nickel Pig Iron (NPI) and ferronickel, based on the price of nickel (a 2% tax when nickel prices are above $15,000 per ton).

These policies are critical for the Indonesian economy. Nickel and stainless steel are the countries’ third largest exports. If Nickel refining takes place in Indonesia, it could add up to $35 billion to the economy.

Indonesia’s policies have drawn criticism from the World Trade Organization (WTO), which last November upheld EU claims its export ban and domestic processing requirements for nickel ore violated WTO rules. President Widodo was unconcerned: “Even though we lost at the WTO on this nickel issue…it’s okay. I have told the Minister to appeal.”

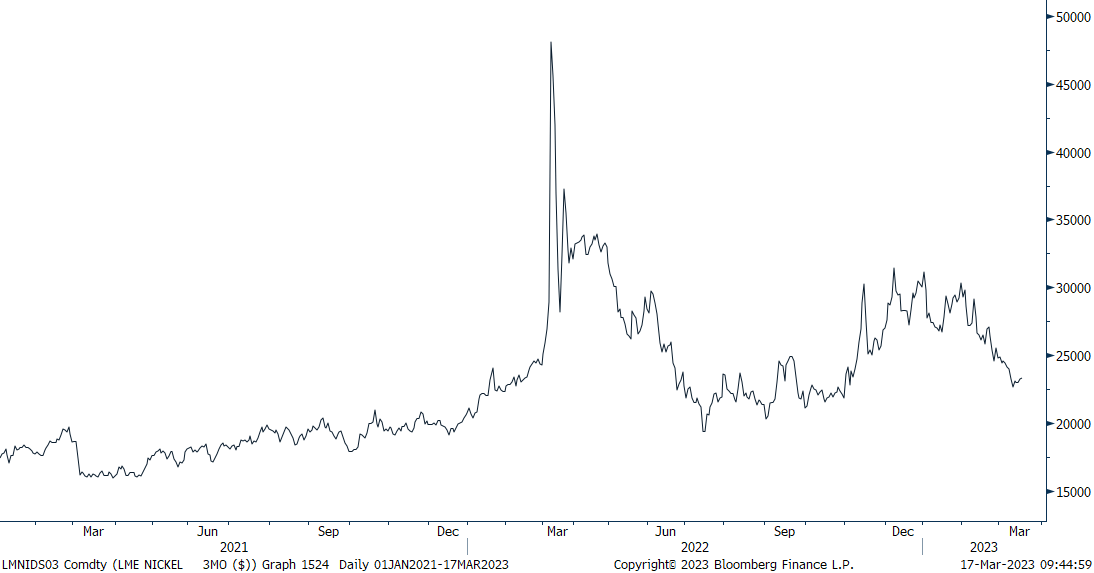

Nickel Price

Source: StoneX

Today Nickel prices are $22,728 per ton, 12% down in the year-to-date. A lot of bad news is in the price, and we expect $26,000 per ton by the end of the year. Forecasts are provided by StoneX Financial Ltd. These forecasts represent the views of the StoneX Metals and Energy teams and not necessarily those of FOREX.com or City Index analysts.

Taken from an analysis by Natalie Scott-Gray, Senior Metals Analyst.

Contact: [email protected]