When will Barclays report Q2 earnings?

Barclays is due to report Q2 earnings ahead of the open on Thursday 28th July.

What to expect?

Barclays will report as the are price underperforms sector peers, down some 29% so far this year. Watch for an 11.3% rise in revenue and a 16.8% fall in pre-tax profit to £4.1 billion.

Further fallout from US blunder

In Q1 Barclays reported a 10% rise in total revenue to £6.5 billion, which went some way to offset higher costs which rose 15% to £4.1 billion. £540 million of those additional costs were set aside to cover a trading breach in the quarter whereby Barclays, in a paperwork blunder sold more structured and exchange-traded notes in the US than it registered.

Barclays announced earlier this week that it will buy back as much as $18.6 billion of the securities in a process starting at the beginning of August and which should determine its losses from the error. There is a good chance that further costs relating to this error will be booked in the Q2 results.

Higher NII

In the second quarter results, Barclays is expected to benefit from rising interest rates in both the US and the UK, which will lift net interest income. The BoE has hiked rates at all its monetary policy meetings this year and the Federal Reserve has lifted rates by 150 basis points. However, there is a good chance that this is already priced in.

Trading operations could be another positive point for the bank. Like its US counterpart Goldman Sachs, Barclays could also see significantly higher trading revenue.

Investment banking & loan growth weakness

However, like its US counterparts, investment banking revenue could weaken as the IPO market dries up and as deal-making volume has fallen steeply over the past few months.

Consumer spending has slowed as the cost-of-living crisis ramped up and loan growth is also likely to slow given rising interest rates and falling confidence.

Where next for Barclays share price?

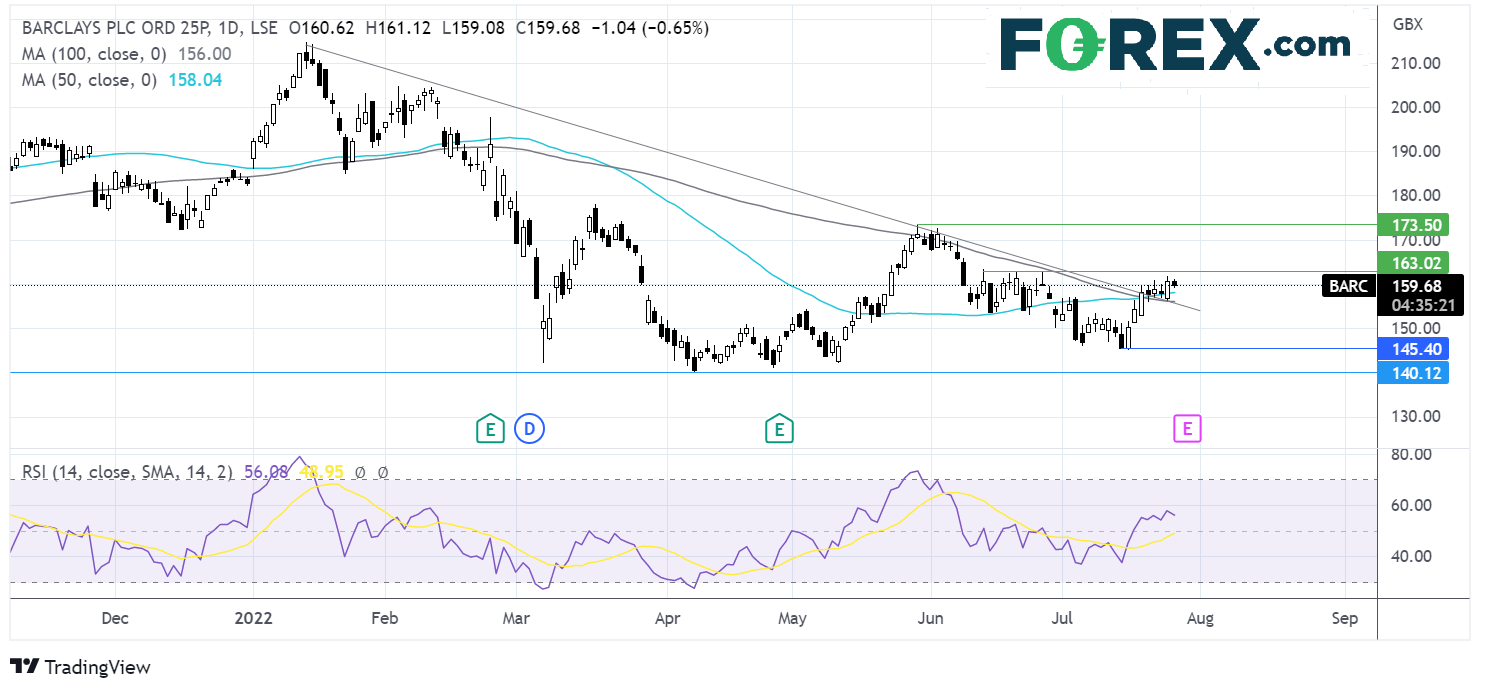

Barclays trades down 19% so far this year, falling from 215p in early January to current levels of 160p. The prices is extending a rebound from 145p the July low, retaking the 50 amd 100 sma whilst also rising above the falling trendline, which with the bullish RSI keeps investors hopeful of further upside.

A breakout above 162p the late June high could open the door to 173p the May high.

On the flip side, failure to hold above the 50 & 100 sma at 156p could see the share price head towards 145p. A break below here is needed to create a lower low.