BTC/USD & ETH/USD Key Points

- Bitcoin whales increase holdings during market turmoil; institutions maintain adoption despite volatility

- Risk appetite recovered after the early week panic, potentially setting the stage for a continued recovery moving forward.

- BTC/USD remains within its recent range, but the technical outlook for ETH/USD has flipped negative after breaking key support.

Cryptoasset Market News

There was little in the way of major developments in the cryptoasset space last week, but there were some items of note:

- Blockchain analysis revealed that market maker Jump Crypto dumped nearly $200M in ether this week, adding to selling pressure to an already volatile environment.

- Speaking of FTX, the firm’s bankruptcy is proceeding apace, with creditors likely to be reimbursed within two months.

- Vladimir Putin signed a law legalizing crypto mining in Russia starting Nov 1, ’24.

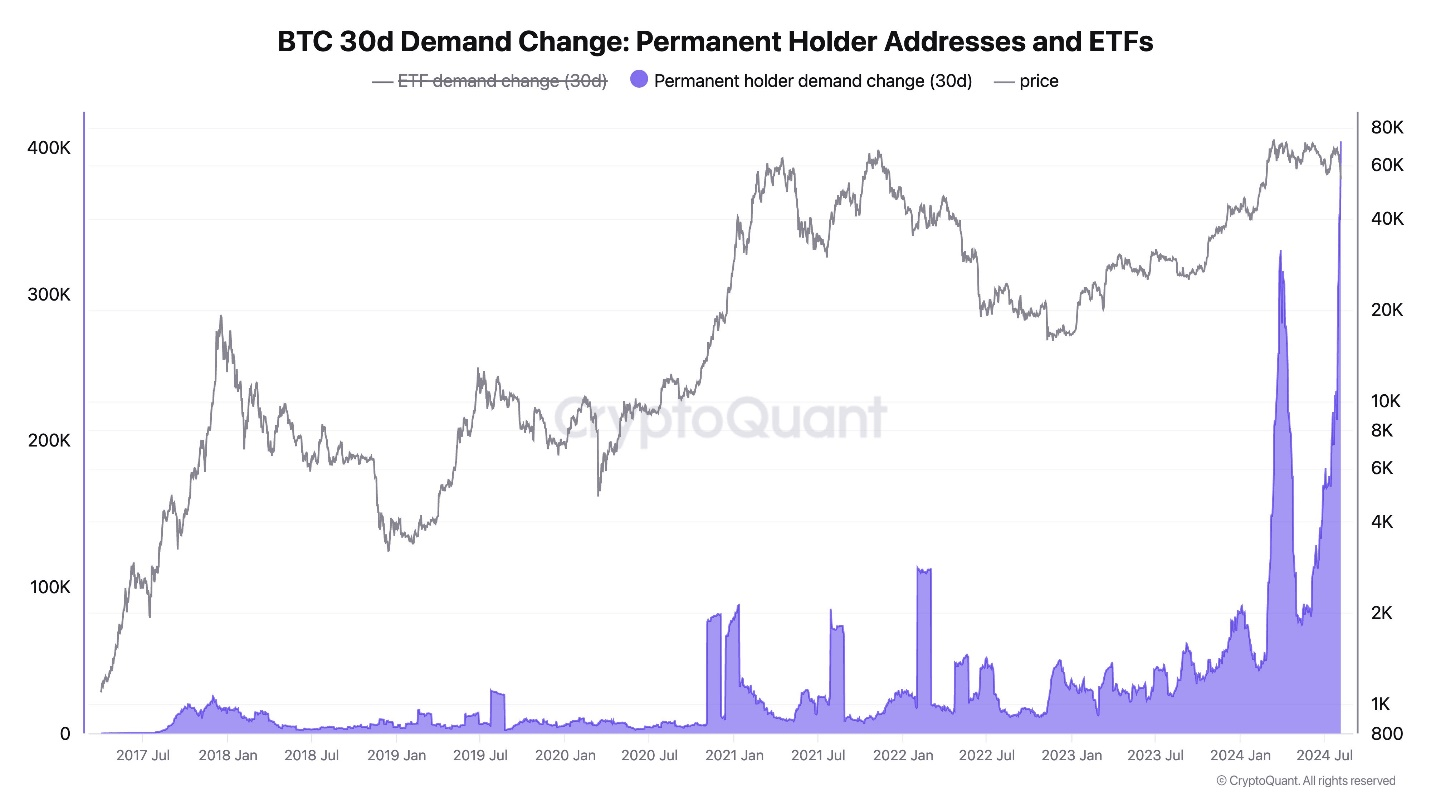

While not “news” per se, so-called “Permanent Holders” of Bitcoin have been ramping up their buying of the cryptocurrency in recent weeks as the chart below shows. Clearly, large, long-term holders haven’t seen their faith in the asset shaken amidst the recent turmoil:

Source: Cryptoquant

Macroeconomic Backdrop

Last week offered little in the way of top-tier new economic data, but that didn’t stop major markets from spasming at the start of the week. The fears stemmed from the previous week’s disappointing NFP report and the potential for a US recession, though in retrospect, those fears now appear exaggerated to say the least. In any event, the VIX (Wall Street’s so-called “fear gauge”) spiked to its 3rd highest level ever as traders sold risk assets first and asked questions later.

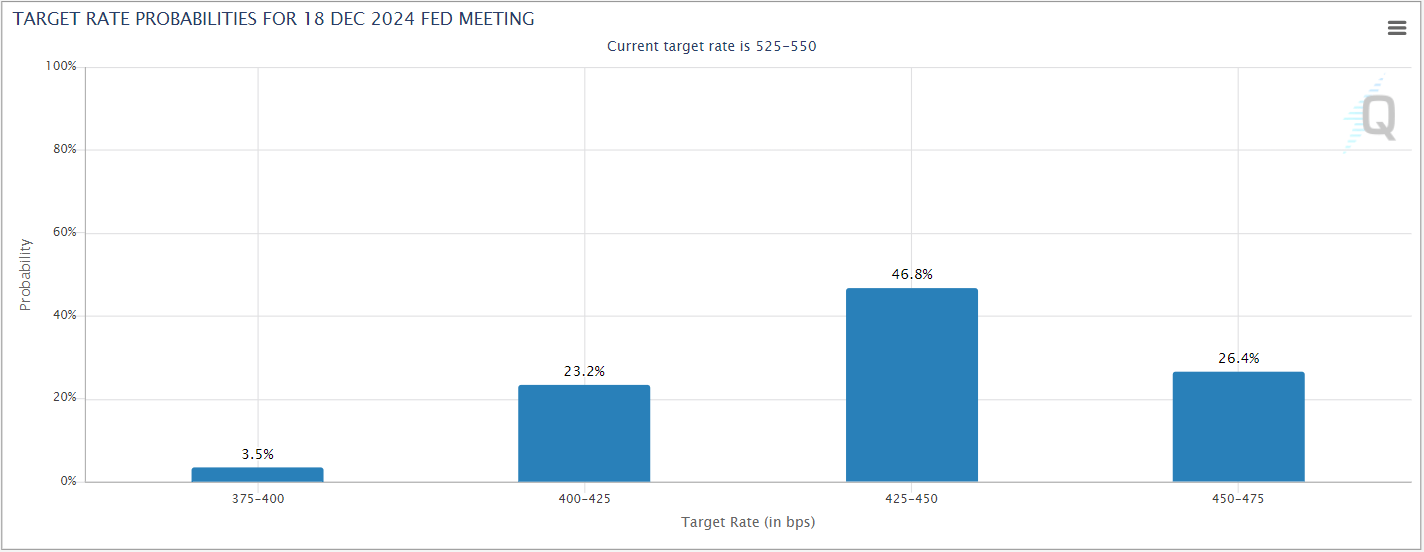

Shortly after the start of the US session however, cooler heads prevailed and risk appetite gradually returned to the market, with most major US indices finishing the week near unchanged levels and Treasury yields closing higher across the board. Traders are now pricing in a slightly lower probability of 125bps+ worth of interest rate cuts from the Fed this year; per CMEFedWatch, the market-implied odds of such a move have fallen from 50% at the start of last week to closer to 25% now.

Source: CME FedWatch

Sentiment and Flows

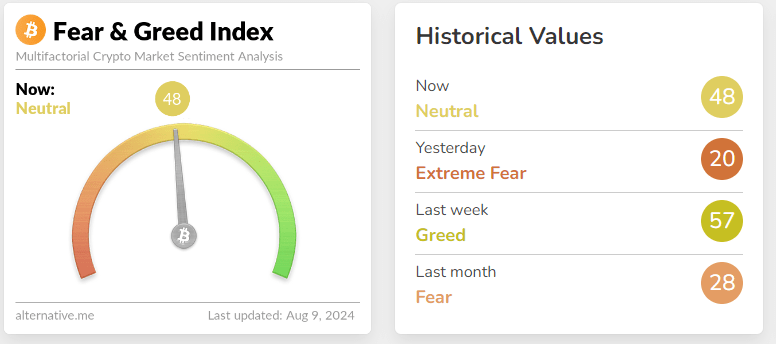

The sentiment gauge we watch most closely, the “Crypto Fear and Greed Index,” went on a rollercoaster ride last week, cratering to a low of just 17 on Monday (lower than during the FTX implosion in Q4 2022) before recovering back toward the middle of its recent range near 48 as we go to press. Overall, it remains in-line with the average range seen over the last year, failing to provide a major contrarian reversal signal (unlike Monday’s big bullish contrarian signal):

Source: Alternative.me

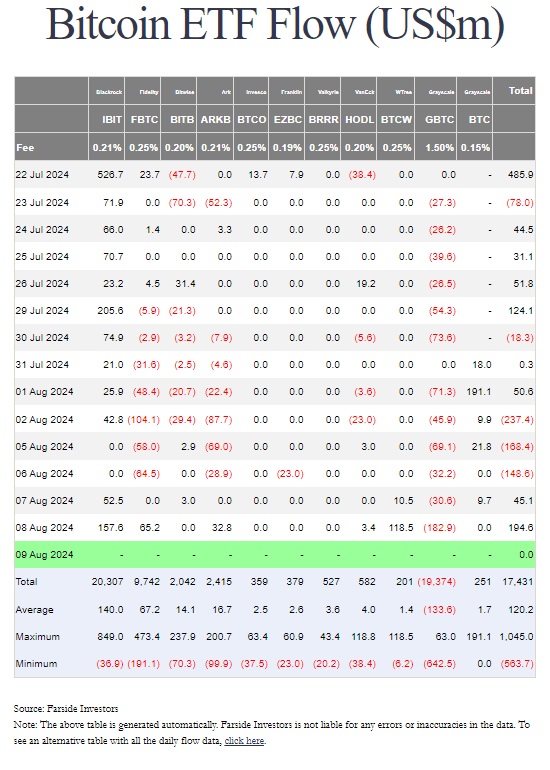

Another way of gauging sentiment, flows into exchange-based cryptoasset investment vehicles, not surprisingly dropped off last week. As of writing before the release of Friday’s data, Bitcoin ETFs have been negative $77M, which isn’t surprising given the big swoon in price; if anything, its surprising how little we’ve seen in the way of meaningful outflows amidst Bitcoin’s worst single day since March. Over the long-term, inflows from “tradfi” investors provide incremental demand for Bitcoin and could help support the price.

Source: Farside Investors

Meanwhile, the outflows from Ether ETFs (namely the higher-fee legacy Grayscale product (ETHE)) have started to moderate slightly. These outflows, which have already totaled over 25% of the fund in just 13 days, could still continue for the next several weeks until it reaches a more appropriate level of assets given its fee structure.

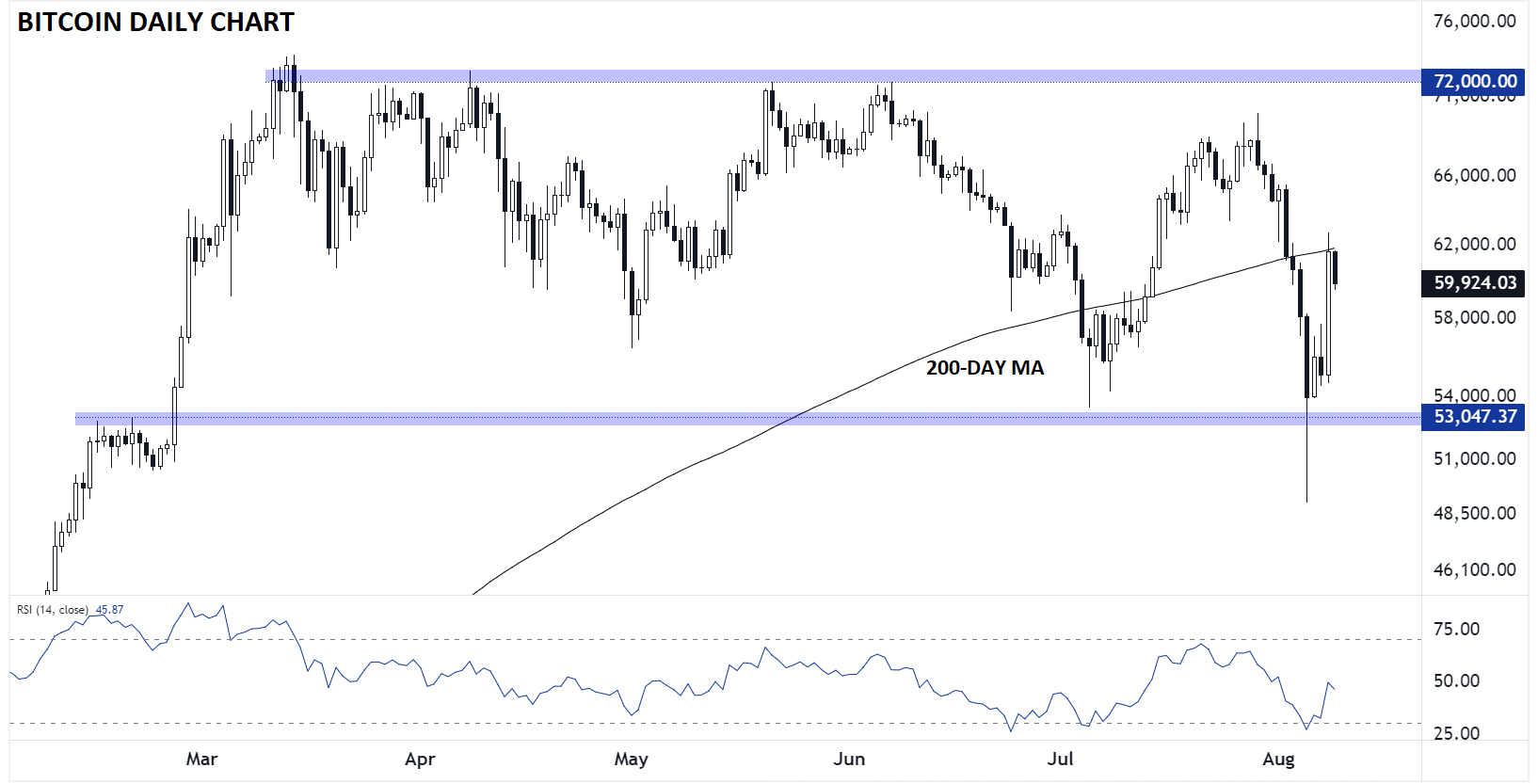

Bitcoin Technical Analysis: BTC/USD Daily Chart

Source: StoneX, TradingView

Like most other risk assets, Bitcoin prices swooned to start last week, briefly falling below $50K to a 6-month low before recovering. That said, it did recover strongly, especially on Thursday, repairing much of the technical damage and leaving the cryptocurrency on track to close higher this week as of writing on Friday afternoon. From a bigger picture perspective, the cryptocurrency continues to consolidate within its broad post-March range, leaving a neutral near-term outlook and a longer-term bullish outlook intact for now, though a break below 53K would call that perspective into question.

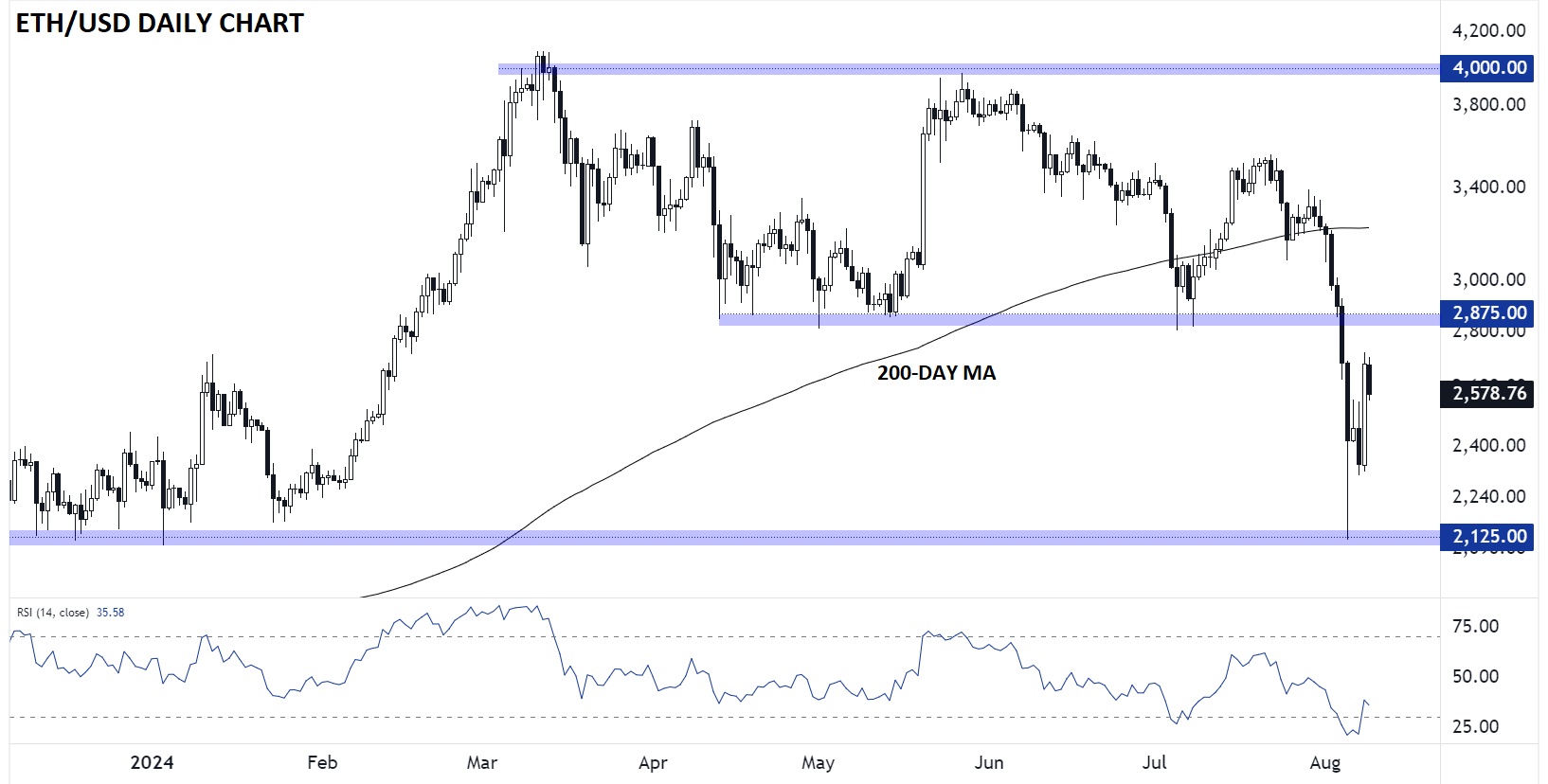

Ethereum Technical Analysis: ETH/USD Daily Chart

Source: StoneX, TradingView

While Ether traced out a similar Monday-Swoon-Then-Recovery-For-The-Rest-Of-The-Week path, the technical outlook for the second largest cryptoasset is decidedly less bullish. ETH/USD is trading well below its 200-day MA, as well as previous-support-turned-resistance at $2875, keeping the near-term bias to the downside for now.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos and be sure to follow Matt on Twitter: @MWellerFX