- The popular TLT ETF has lost around 8% since late December

- Last week, the price action turned decidedly bearish following several hot inflation reports

- Federal Reserve signalling on the path for the funds rate will be important for bond markets this week

Long bond bulls will not like the message coming from the recent price action in the TLT ETF, warning of the potential for higher yields and increased capital losses. With little technical support below where it currently sits, it places even more importance on the Fed chooses to signal this week.

TLT ETF 101

While many investors would be familiar with the TLT ETF, for those who are not familiar, it tracks the price of a basket of US government bonds that have at least 20 years until maturity, providing exposure to a part of the US Treasury market previously dominated by institutional investors.

However, investing in bonds that don’t mature for decades comes with multiple risks. Given we’re talking about the US government, the main concern investors need to be aware is known as duration risk.

Duration risk measures the sensitivity of a bond's price to changes in interest rates, remembering that bond prices move inversely to yields. The longer until it matures, the greater its sensitivity to interest rate changes. When you’re investing in TLT, its performance is highly influenced by fluctuations in rates.

TLT struggling in 2024

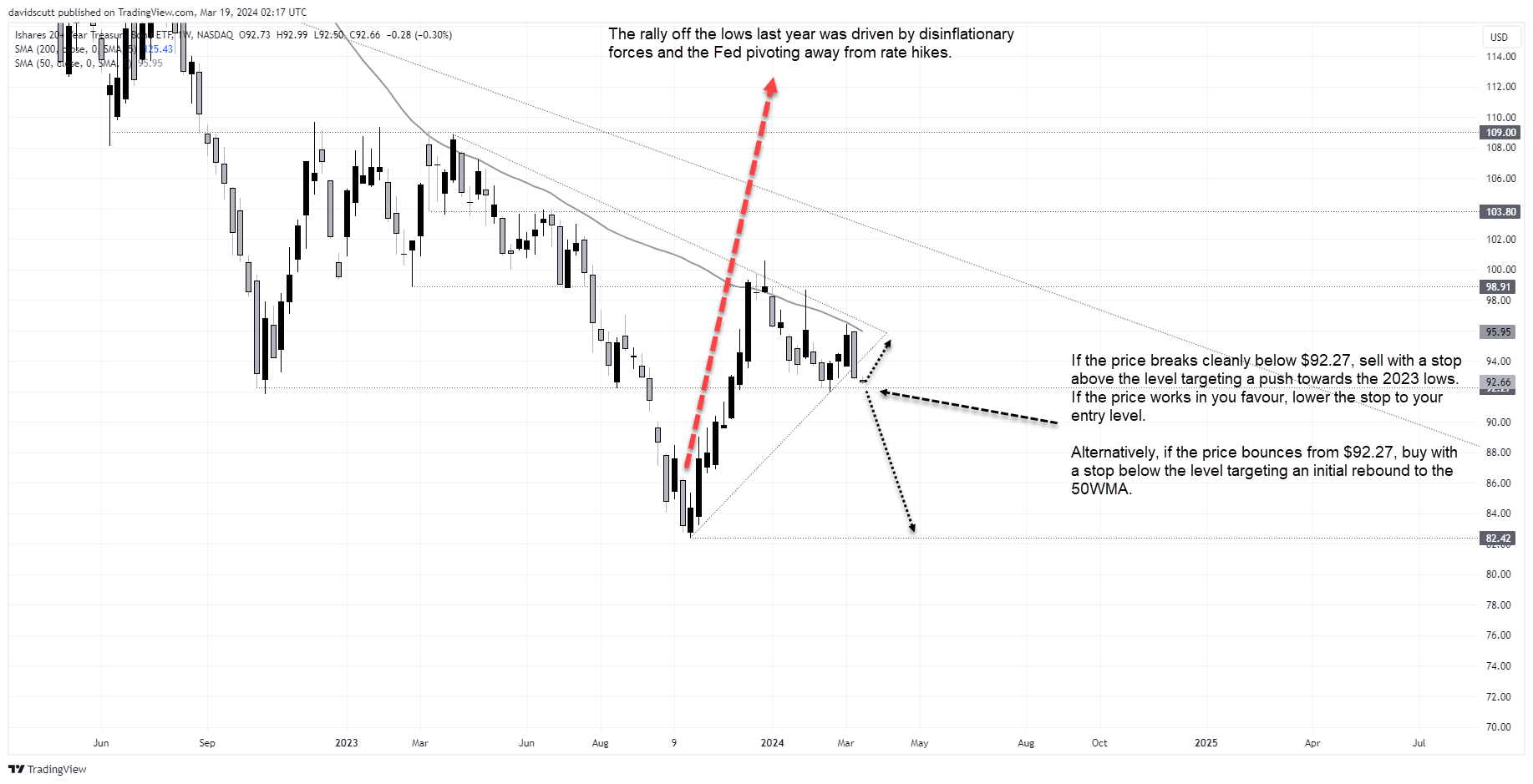

Looking at the weekly chart of TLT below, you can see duration risk in action with its value down around 8% from the highs hit in late December. The problem for long bond bulls is the technical picture is darkening by the day.

After trading in a triangle pattern since September last year, the price performed a significant reversal last week following multiple hot US inflation readings, not only delivering a bearish engulfing candle but also breaking uptrend support. TLTs constant rejection at the 50-week moving average provides another warning that directional risks may be lower still.

TLT trade ideas

After the bearish break last week, attention now turns to horizontal support at $92.27, a level TLT tagged on six separate occasions either side of the bond bloodbath in the third quarter last year. Should that level give way, there’s not a lot of technical support visible until the lows hit in September.

Traders could short TLT on a clean break of $92.27, using a stop above the level for protection against reversal. Alternatively, should the price hold $92.27 and bounce, you could buy looking initially for a return to the 50-week moving average currently located at $95.95.

Fed’s influence needs to be considered

Aside from technicals which are warning of downside risks, TLTs near-term performance will likely be determined by what the Fed signals on the path for US interest rates this week. Will it stick with the three cuts FOMC members signaled in December or acknowledge continued stickiness in inflationary pressures, reducing the number of cuts signaled to two or less?

With concerns among market participants growing that the Fed is unwilling to finish the inflation fight, the risk for long bonds appears skewed towards higher yields should it stick with three cuts this year. Flagging the risk of few cuts may help long bond prices, reducing the perceived risk of inflation remaining elevated for a prolonged period.

-- Written by David Scutt

Follow David on Twitter @scutty