Australian Dollar Technical Outlook: AUD/USD Short-term Trade Levels

- AUD/USD reverses from trend resistance- poised to mark sixth-daily decline in past seven

- Australian Dollar bears face first major test of support- US CPI on tap Thursday

- Resistance 6759, 6780s, 6807/19 (key)– Support 6715, 6645, 6575-6600

The Australian Dollar has plunged off fresh yearly highs with AUD/USD down more than 2.8% since the start of October. A turn from uptrend resistance now takes Aussie into the first major test of support and the focus is on a reaction here in the days ahead. These are the updated targets an invalidation levels that matter on the AUD/USD short-term technical charts heading into US CPI.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this AUD/USD technical setup and more. Join live on Monday’s at 8:30am EST.Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: In my last Australian Dollar Short-term Outlook we noted that the, “immediate focus is on possible inflection into a key pivot zone here at 6807/19- a region defined by the weekly open, the 2023 & 2024 yearly opens, and the 61.8% retracement of the 2023 decline. Looking for guidance off this mark.” Aussie registered an intraday low at 6818 that day, before rebounding sharply with the rally faltering days later just above the 69- handle.

AUD/USD plummeted nearly 3.3% off the highs with a loss today marking six-days of declines in the past-seven. The plunge takes Aussie into confluent uptrend support today near the 38.2% retracement of the yearly range at 6715. The focus is on possible inflection into this threshold with the immediate short-bias vulnerable while above the median-line.

Australian Dollar Price Chart – AUD/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Notes: A closer look at Aussie price action shows AUD/USD trading within the confines a descending pitchfork extending off the late-September highs with the lower parallel further highlighting near-term support here at 6715. Initial resistance is eyed with the July high-day close (HDC) at 6759 and is backed by the median-line (currently ~6780s). Broader bearish invalidation is now lowered to 6807/19- a breach / daily close above this mark would be needed to suggest a more significant low is in place.

A break / close below the lower parallel would threaten another bout of accelerated losses with such a scenario exposing the 50% retracement at 6645 and key support around the 61.8% retracement at 6575-6600- look for a larger reaction there IF reached.

Bottom line: A reversal off uptrend resistance is now testing trend support- looking for a reaction into the median-line. From a trading standpoint, a good zone to reduce short-exposure / lower protective stops – rallies would need to be limited to 6819 IF price is heading lower here with a break below 6715 needed to threaten a larger correction / suggest a more significant high was registered last week.

Keep in mind we get the release of key US inflation data on Thursday with the Consumer Price Index on tap. Stay nimble into the release and watch the weekly close for guidance here. Review my latest Australian Dollar Weekly Forecast for a closer look at the longer-term AUD/USD technical trade levels.

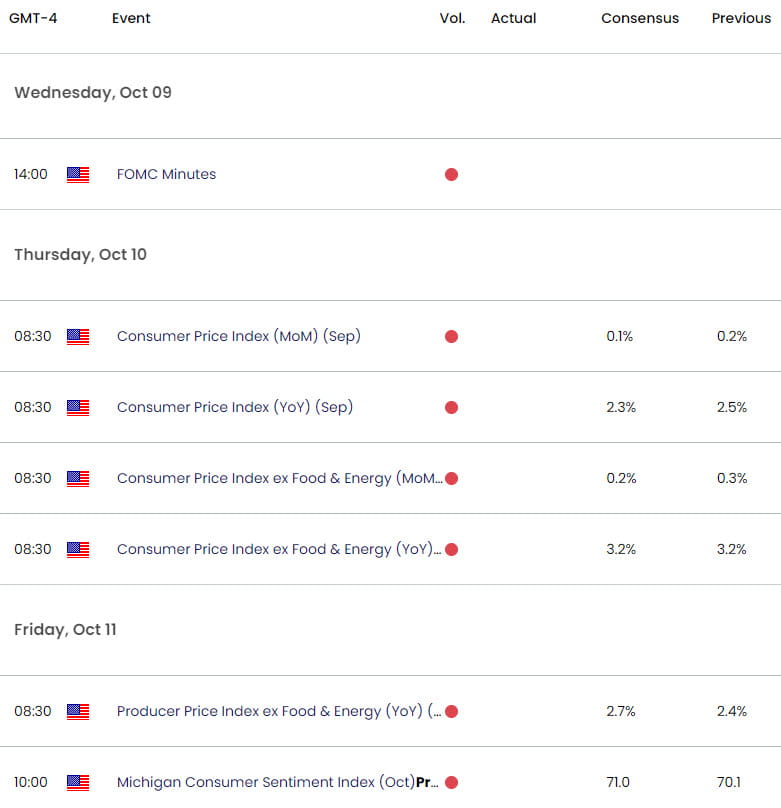

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Canadian Dollar Short-term Outlook: USD/CAD Bulls Charge Ahead of NFP

- Gold Short-term Outlook: XAU/USD Bulls at Major Hurdle Ahead of NFP

- Euro Short-term Technical Outlook: EUR/USD Plunges into October

- US Dollar Short-term Outlook: USD Defends Support at Fresh Yearly Low

- British Pound Short-term Outlook: GBP/USD Breakout Eyes Resistance

Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex