- AUD/USD failed to capitalise on US dollar weakness following the soft US inflation report

- Instead of tracking cyclical assets, it was heavily influenced by moves in tech stocks

- The real-world relationship between the two is negligible at best

- Favour buying AUD against EUR and GBP near-term

AUD/USD reverses lower despite USD weakness

Considering the rally in cyclical assets following the soft US inflation report for June, the steep reversal in AUD/USD comes across as a little strange. The strong likelihood the Fed will cut multiple times this year should benefit the highly cyclical Aussie, yet after a whirlwind surge in the immediate aftermath of the report, AUD/USD spent the remainder of the session drifting lower.

Upon closer inspection, it spent a large chunk of the session tracking movements in S&P 500 futures which opened higher before also drifting lower, weighed down by big declines in “Magnificent 7” names.

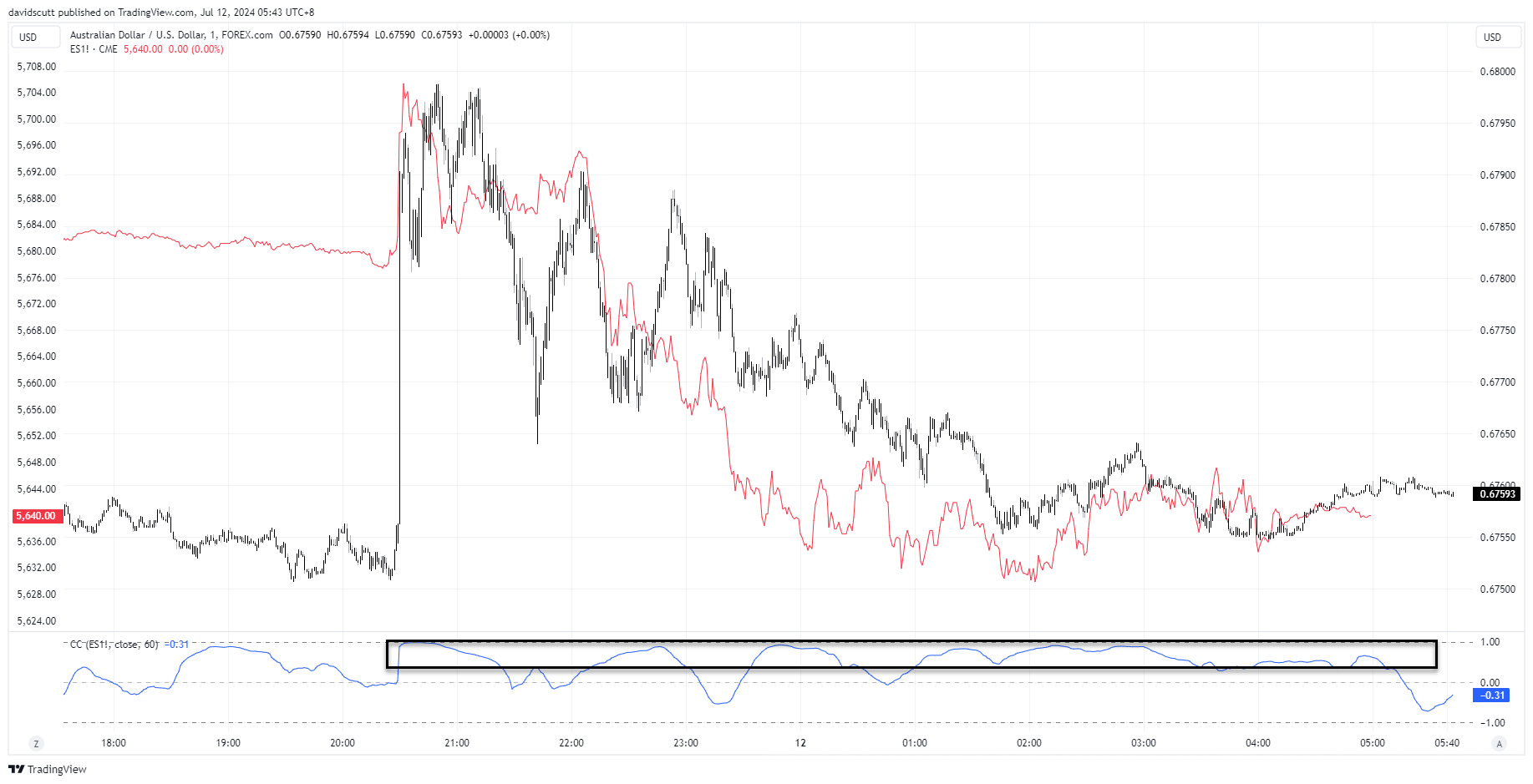

You can see that in the one-minute tick chart AUD/USD is the bar chart in black, S&P 500 E-minis in red. For most of the session, the two had a rolling hourly correlation above 0.5, suggesting moves in US stocks were being influential on the Aussie.

Price action not wrong but questionable

Now, we know AUD/USD is often used as a barometer for broader risk appetite, but I must question why it should be dancing to the tune of megacap tech names when the real-world relationship is close to non-existent. It comes across as a little silly. It's not like the AUD tracked tech stocks higher, right?

As long as economic growth holds up, the prospect of multiple rate cuts from the Fed in the coming months should provide tailwinds for cyclicals. Therefore, the reversal in the Aussie comes across as going completely against fundamentals.

Avoiding USD near-term after likely BOJ intervention

But I want to avoid trades involving the USD in the near-term following the suspected intervention from the Bank of Japan to support the yen on Thursday. In past episodes, the market has hoovered USD/JPY straight back up, acting to strengthen the dollar against most other currency names.

However, when you look at moves in some Aussie dollar crosses, such as EUR/AUD and GBP/AUD, its noticeable the EUR and GBP held most of their gains against the dollar during the session. That’s where the opportunity to fade looks more appealing. When prospects for the global economy are improving, it’s rare for the euro and pound to outperform the Aussie.

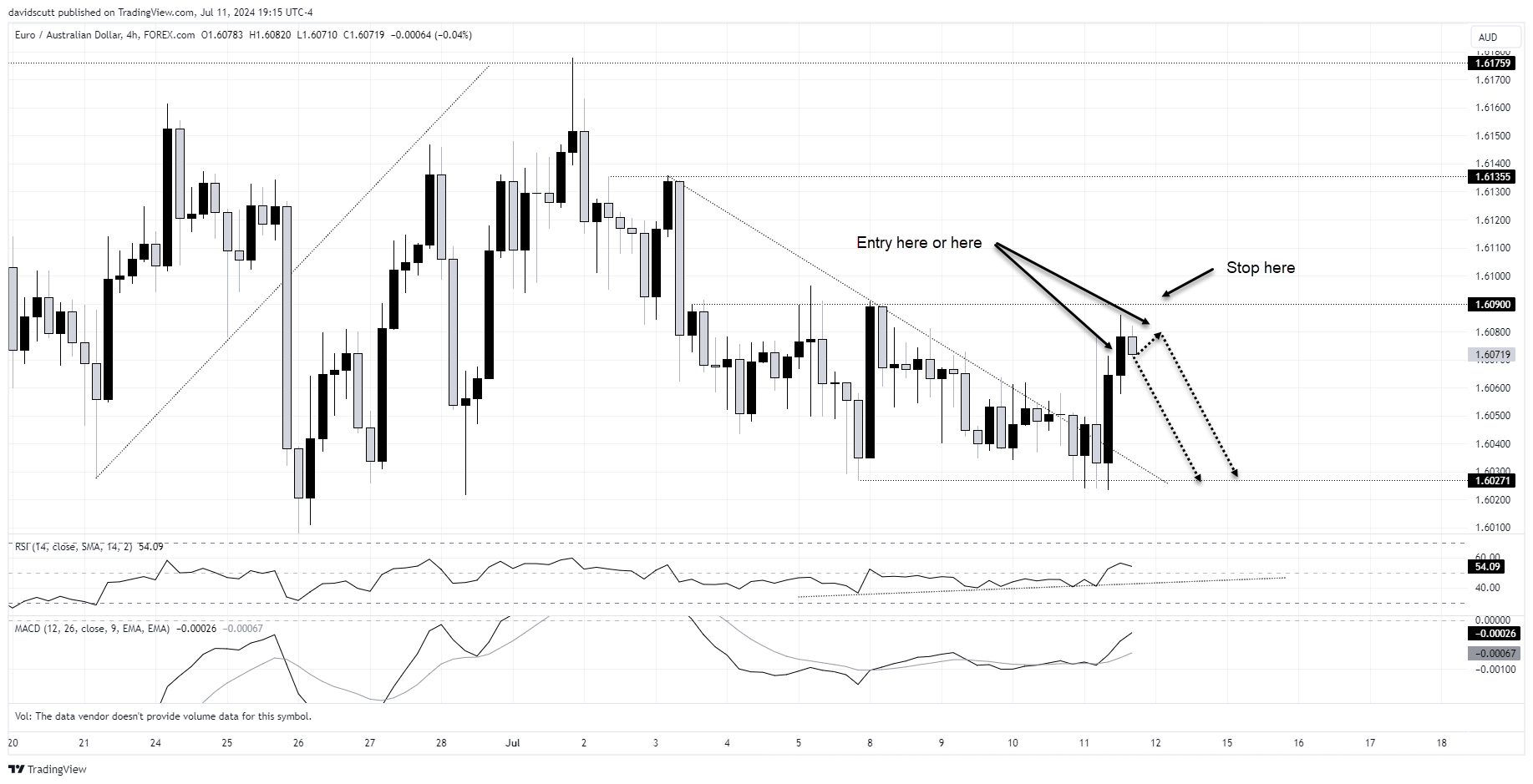

EUR/AUD bounce creates short setup

Looking at EUR/AUD on the four hourly timeframe, you could sell here or wait for a potential squeeze higher above 1.6080, allowing for a stop loss to be placed above 1.6090 for protection. The trade target would be the bottom of the existing range at 1.60271.

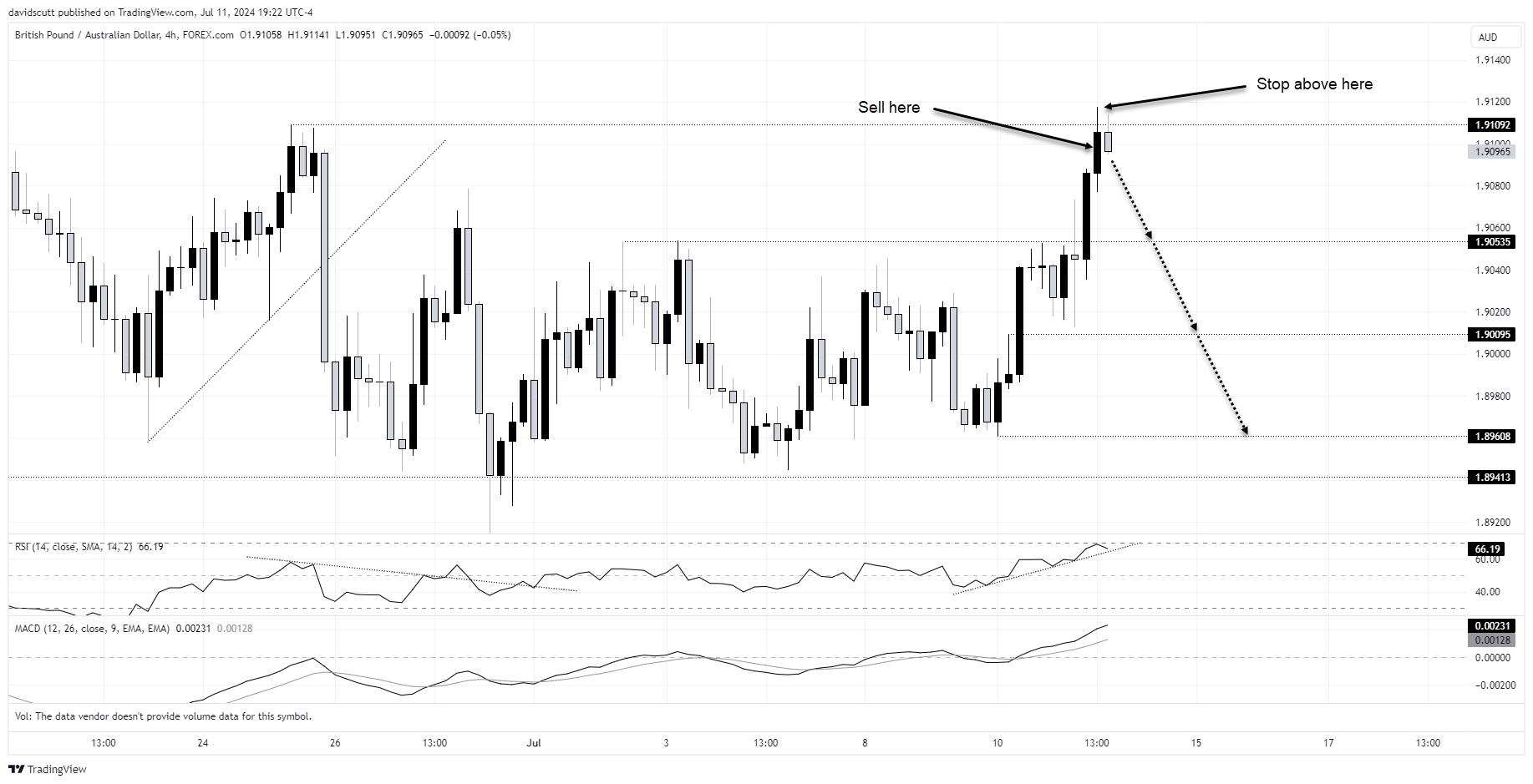

GBP/AUD fails again above 1.9100

Looking at GBP/AUD on the same timeframe, I’m inclined to sell at these levels with a stop above 1.9120 for protection, targeting a reversal through the 50-day moving average to horizontal support at 1.90535. If the target is reached, I’d assess whether to hold or cut. Realistically, if cyclicals get a tailwind behind them, there could be a lot more downside to come with 1.9000 and 1.8960 in focus.

If you take on either idea, consider lowering your stop loss or using a trailing stop should the trade move in your favour. Good luck!

-- Written by David Scutt

Follow David on Twitter @scutty