Australian Dollar Forecast: AUD/USD Halts Four-Day Selloff

Australian Dollar Outlook: AUD/USD

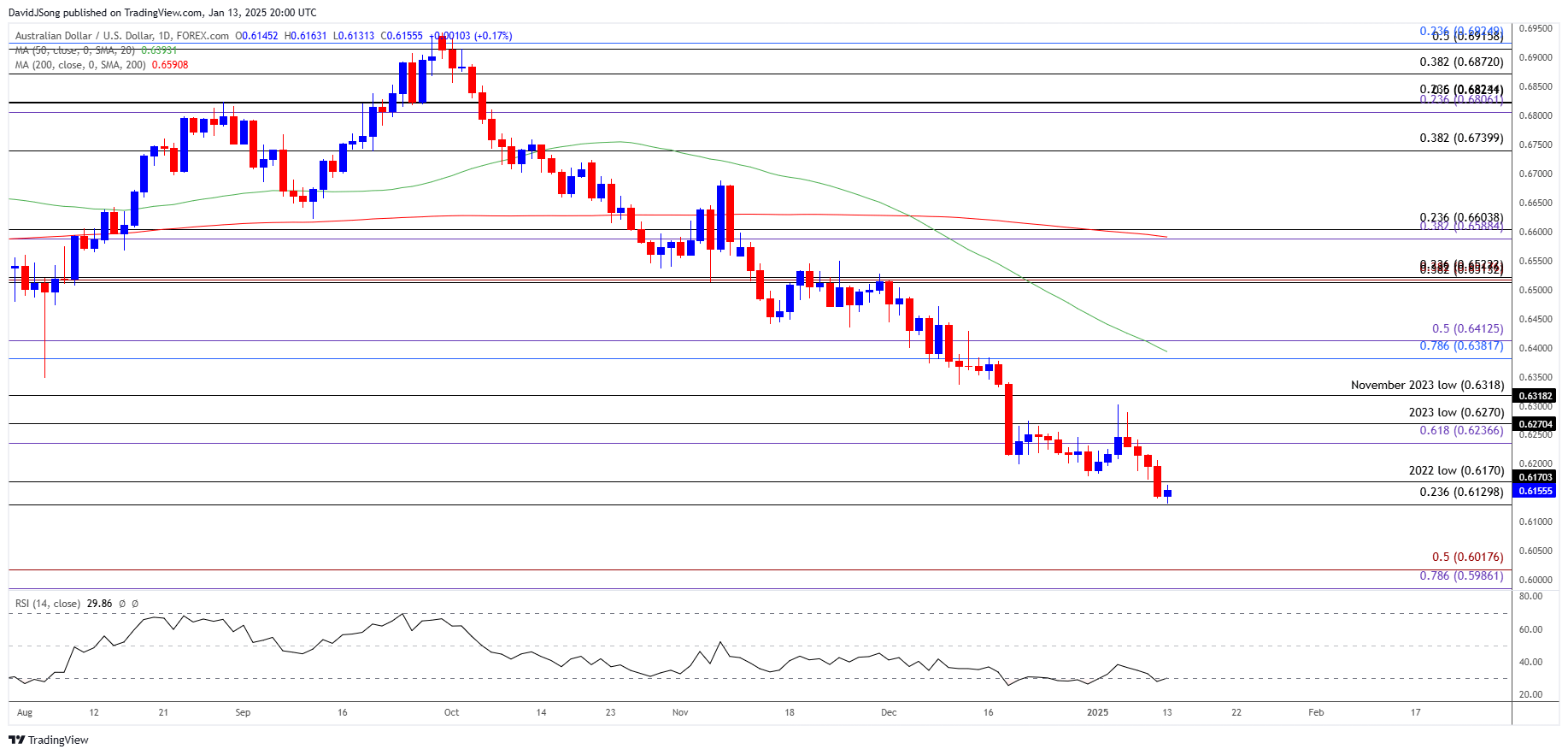

AUD/USD rebounds from a fresh monthly low (0.6131) to pull the Relative Strength Index (RSI) back from oversold territory, but the rebound in the exchange rate may turn out to be temporary as it continues to carve a series of lower highs and lows.

Australian Dollar Forecast: AUD/USD Halts Four-Day Selloff

AUD/USD halts a four-day selloff after failing to defend the 2022 low (0.6170), and the RSI may show the bearish momentum abating as it attempts to climb back above 30.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

However, the US Dollar may continue to outperform against its Australian counterpart as the 256K rise in US Non-Farm Payrolls (NFP) boost the Federal Reserve’s scope to pause its rate-cutting cycle, and the weakness following the US election may persist should AUD/USD continue to track the negative slope in the 50-Day SMA (0.6393).

Australia Economic Calendar

Nevertheless, the update to Australia’s Employment report may influence AUD/USD as the economy is projected to add 15.0K jobs in December, and evidence of a strong labor market may encourage the Reserve Bank of Australia (RBA) to keep the cash rate on hold as ‘returning inflation to target remains the Board’s highest priority.’

In turn, a positive development may generate a bullish reaction in the Australian Dollar as the RBA appears to be in no rush to switch gears, but a weaker-than-expected employment report may produce headwinds for the Australian Dollar as it puts pressure on Governor Michele Bullock and Co. to implement lower interest rates.

With that said, AUD/USD continue to track the negative slope in the 50-Day SMA (0.6393) as it holds below the moving average, but the exchange rate may stage a larger rebound should it snap the bearish price series carried over from last week.

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- The recent series of lower highs and lows pushed AUD/USD below the 2022 low (0.6170), with a close below the 0.6130 (23.6% Fibonacci retracement) to 0.6170 (2022 low) zone bringing the 0.5990 (78.6% Fibonacci extension) to 0.6020 (50% Fibonacci extension) region on the radar.

- Next area of interest comes in around April 2020 low (0.5980), but AUD/USD may snap the bearish price series should it struggle to close below the 0.6130 (23.6% Fibonacci retracement) to 0.6170 (2022 low) zone.

- A move above the 0.6240 (61.8% Fibonacci extension) to 0.6270 (2023 low) region may push AUD/USD back towards the November 2023 low (0.6318), with the next area of interest coming in around 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension).

Additional Market Outlooks

USD/JPY Pulls Back to Keep RSI Below Overbought Zone

US Dollar Forecast: USD/CHF Climbs Towards 2024 High

GBP/USD Approaches November 2023 Low

Gold Price Recovery Eyes December High

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong

StoneX Europe Ltd may make third party material available on this website which may contain information included but not limited to the conditions of financial markets. The material is for information purposes only and does not contain, and should not be construed as containing, investment advice and/or investment recommendation and/or an investment research and/or an offer of or solicitation for any transactions in financial instruments; any decision to enter into a specific transaction shall be made by the client following an assessment by him/her of their situation.

StoneX Europe Ltd makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. We are not under any obligation to update any such material. Any opinion made may be personal to the author and may not reflect the opinion of StoneX Europe Ltd.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please ensure you fully understand the risks involved by reading our full risk warning.

FOREX.com is a trading name of StoneX Europe Limited, and FOREX.com/ie is a domain operated by StoneX Europe Ltd, a member of StoneX Group Inc. StoneX Europe Ltd, is a Cyprus Investment Firm (CIF) company registered to the Department of Registrar of Companies and Official Receiver with a Registration Number HE409708, and authorized and regulated by the Cyprus Securities & Exchange Commission (CySEC) under license number 400/21. StoneX Europe is a Member of the Investor Compensation Fund (ICF) and has its registered address at Nikokreontos 2, 5th Floor, 1066 Nicosia, Cyprus.

StoneX Europe Limited is registered with the German Federal Financial Supervisory Authority (BaFin). BaFin registration ID: 10160255

FOREX.com is a trademark of StoneX Europe Ltd, a member of StoneX Group Inc.

The statistical data and the awards received refer to the Global FOREX.com brand.

This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our Privacy Policy.

Through passporting, StoneX Europe is allowed to provide its services and products on a cross-border basis to the following European Economic Area ("EEA") states: Austria, Bulgaria, Croatia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

Additionally, StoneX Europe Ltd is allowed to provide Investment and Ancillary Services to the following non-EU jurisdiction: Switzerland.

StoneX Europe Ltd products, services and information are not intended for residents other than the ones stated above.

Tied Agent Information: KQ Markets Europe Ltd with Company No. HE427857.

Address: Athalassas 62, Mezzanine, Strovolos, Nicosia Cyprus.

Services Provided: Reception and Transmission of Orders.

Commencement Date: 06/12/2022

Website: KQ Markets - CFD Trading | KQ Markets

We may pay inducements, such as commissions or fees, to affiliates or third-party introducers for referring clients to us. This is in line with regulatory guidelines and fully disclosed where applicable.

StoneX Europe Ltd may make third party material available on this website which may contain information included but not limited to the conditions of financial markets. The material is for information purposes only and does not contain, and should not be construed as containing, investment advice and/or investment recommendation and/or an investment research and/or an offer of or solicitation for any transactions in financial instruments; any decision to enter into a specific transaction shall be made by the client following an assessment by him/her of their situation. StoneX Europe Ltd makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. We are not under any obligation to update any such material. Any opinion made may be personal to the author and may not reflect the opinion of StoneX Europe Ltd.

© FOREX.COM 2025