Commodity markets continued to face pressures as on concerns of a slowing global economy and lower emerging market stocks. On one hand this alleviates inflationary pressures, but if demand expectations are dented too much it could indicate concerns of a recession (which tends to be highly deflationary). The Bloomberg commodity index was lower for a fifth day and appears on track to break below 100 for the first time since May 2nd.

The US dollar managed the expected bounce from 104 on Tuesday, although it seems to be technical repositioning as opposed to fundamentally driven. The dollar index remains trapped between the 104 handle and 200-day average, and it is a range I doubt prices will be in this time tomorrow looking at the data lined up for today.

- WTI crude oil was lower for a fifth day, and closed below $73 at its lowest level since early February.

- A bearish engulfing day formed on spot gold prices, although outlined in yesterday’s article the bias remains for a pop higher towards $2380 over the near-term.

- Silver futures formed a more impressive bearish engulfing day to close below $30 to a 13day low.

AUD was broadly lower alongside commodity prices, and also felt some heat from weak corporate profits (-2.5% q/q vs -0.9% expected), a negative quarterly current account at -439 billion (5.6 billion expected) and soft net export contributions lowering expectations for today’s GDP report.

Economic events (times in AEST)

We have a host of economic data points with ADP employment helping to shape the tone for Friday’s NFP report. But the main event is easily the ISM services report. The weak manufacturing report on Monday sent the US dollar and yields sharply lower, and these moves could just as easily be extended as they are reversed following the ISM read. Simple binary outcomes include the headline ISM services print rising back above 50 (expansion) with higher prices paid, as that points to growth and persistent inflation at the expense of Fed cut. Whereas what doves (and therefore USD bears) want to see is a weaker services PMI below 50 and lower prices paid to justify cuts. However, if they fall too hard it will likely spook equity markets on concerns of a potential recession, just as we saw with Monday’s manufacturing report.

For APAC, Australia’s GDP report warrants a look but it tends not to be a huge market mover. But looking at yesterday’s weak company profits, softer retail sales and net-export contributions, were on guard for a softer growth report which could rekindle hopes of RBA easing at some point in the future. (Just don’t hold your breath).

- 08:45 – New Zealand terms of trade

- 09:00 – Australian manufacturing, construction index (AIG), final services PMI (S&P global)

- 09:30 – Japan’s wage, final services PMI (S&P global)

- 10:30 – Hong Kong final services PMI

- 11:30 – Australian Q1 GDP (ABS)

- 11:45 – China’s final services PMI

- 15:00 – Singapore retail sales

- 17:55 – German final PMIs

- 18:00 – Eurozone final PMIs

- 18:30 – UK final PMIs

- 19:00 – Eurozone PPI

- 22:15 – US ADP employment

- 23:45 – US final PMIs

- 23:45 – BOC cash rate decision, statement

- 00:00 – ISM services PMI

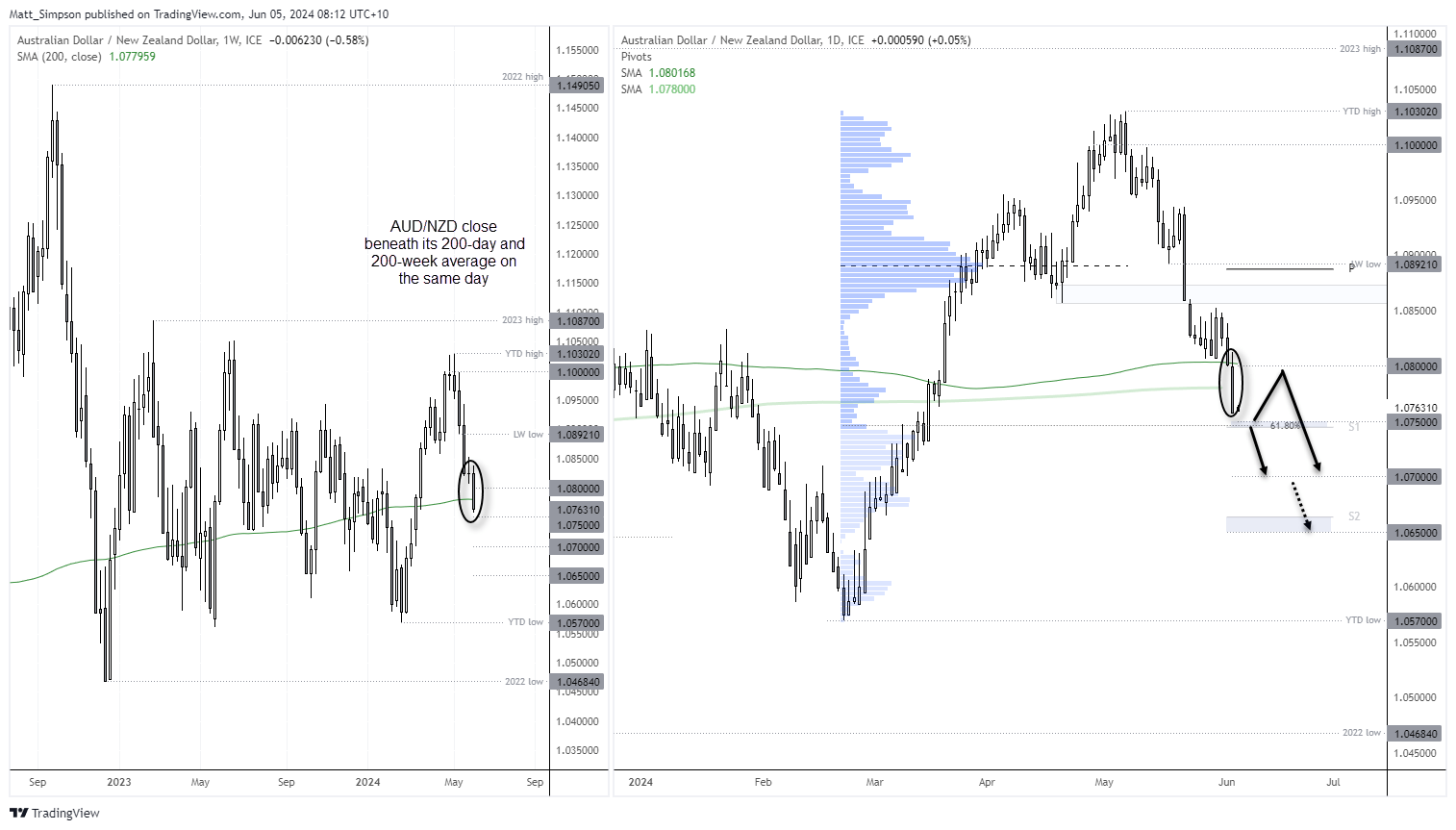

AUD/NZD technical analysis:

The hawkish twist of the RBNZ plays a large part of AUD/NZD’s demise over the past few weeks, although softer data is also seeing hopes of an RBA cut resurface (even if only slightly). Still, AUD/NZD unravelled and is now within its sixth consecutive bearish week. Moreover, the cross closed beneath its 200-day and 200-week moving average, which is not something you see every day.

Prices closed at the low of the day, but support likely resides near the 1.075 handle, 61.8% Fibonacci level and weekly S1 pivot. If we’re treated to a small bounce, bears could seek to fade into moves below the 200-day and 200-week averages in anticipation of a move lower to 1.07 or the weekly S2 pivot, 1.065.

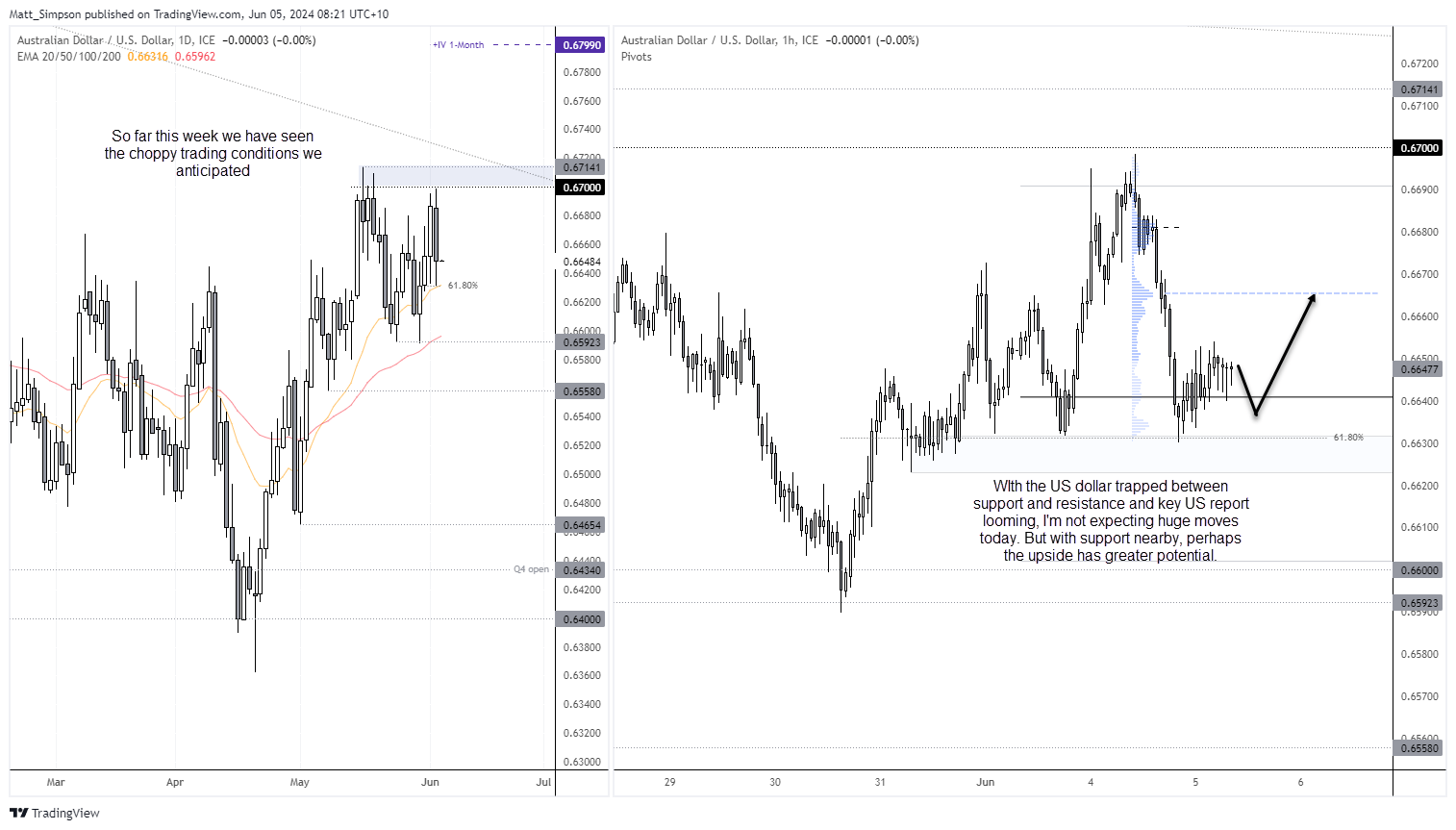

AUD/USD technical analysis:

A two-bar bearish reversal formed on AUD/USD, after it failed to breach. Usually this would have me on guard for a sharp mover lower, but we have to factor in the calendar and the potential for the looming ISM services repot to suppress volatility. Ultimately, we’re seeing the choppy trading conditions anticipated. But for us to expect a sharp move lower likely requires a particularly soft AU GDP report and strong set of ISM figures over the next 24 hours.

The 1-hour chart shows a cluster of support levels propping up prices. A double bottom has formed at a 61.8% Fibonacci level and prices are now back above the weekly pivot. If I had to take a punt, I suspect the path of least resistance for today’s session could be to the upside. Bulls could seek dips within the lower support levels with a move to the 0.6660/65 area.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge