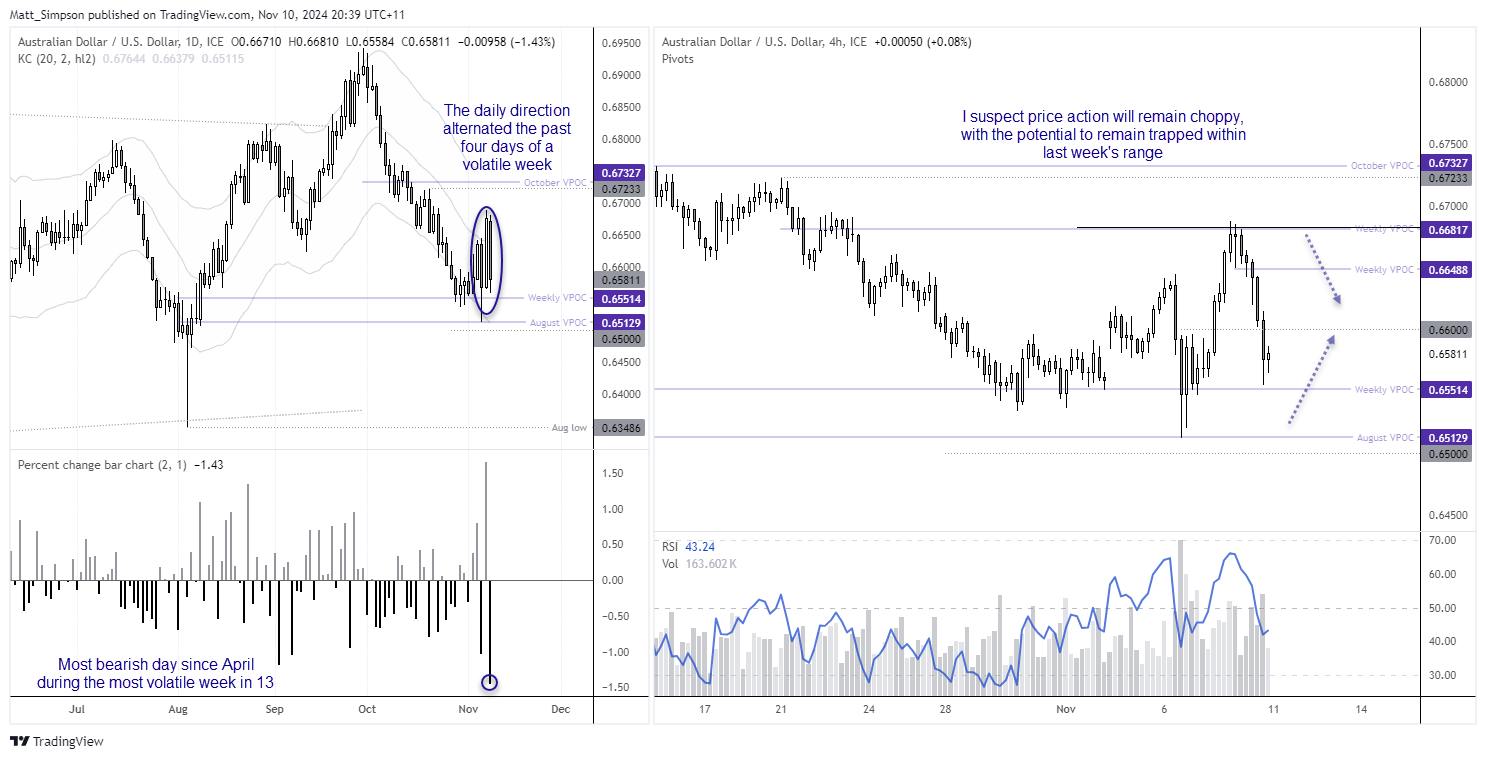

- A volatile week for markets in general around the US election

- Australia’s wage price index and employment report are the main domestic events

- US CPI, PPI and any headlines involving Trump are the main drivers from the US this week

- China’s loan data, house prices and industrial production also of interest following the latest stimulus

With Donald Trump set to return to the Whitehouse, he will likely remain a key driver for sentiment and therefor AUD/USD. It also means AUD/USD will likely retain its strong positive correlation with the Chinese yuan, which will make it sensitive to headline risk surrounding US and China relations. We have a host of Fed members speaking, who now have even less reason to be overly dovish given Trump 2.0 on the horizon.

I doubt Australia’s wage price index will tell us anything more than the hotter-then-expected CPI and PPI reports haven’t already, but it is the biggest domestic economic figure released this week. Also note that the RBA governor speaks this week at the ASIC annual forum.

US CPI is the biggest release from the US, with some headlines suggesting it will move sideways in this month’s report. And that will do little to move the needle for the Fed, and it remains up in the air as to whether we can expect another cut in December. Of course, a hot report likely weighs on AUD/USD on bets of a more hawkish Fed, or sends it higher should it come in soft. US retails sales warrants a look, but overall economic data remains strong outside of the NFP report.

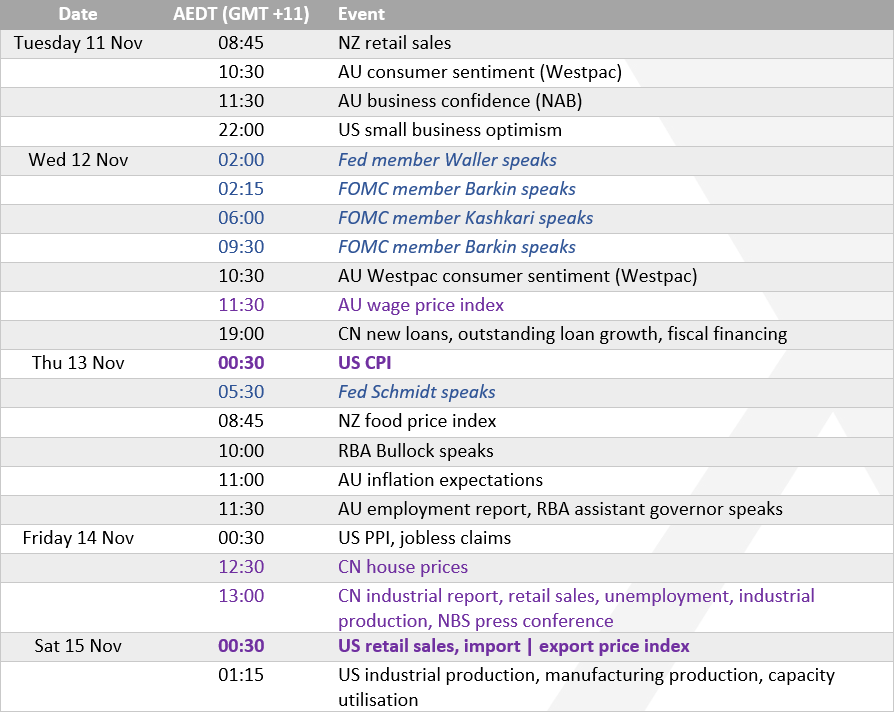

AUD/USD 20-day rolling correlation

- AUD/USD seems to have the tightest relationship with iron ore, given its strong positive readings across the 20, 10 and 3-day timeframes

- The USD index is the next best, with strong negative correlations across the 60 and 3-day correlations

- The CRB is then the next in line, with strong positive correlations across the 10 and 3-day timeframes

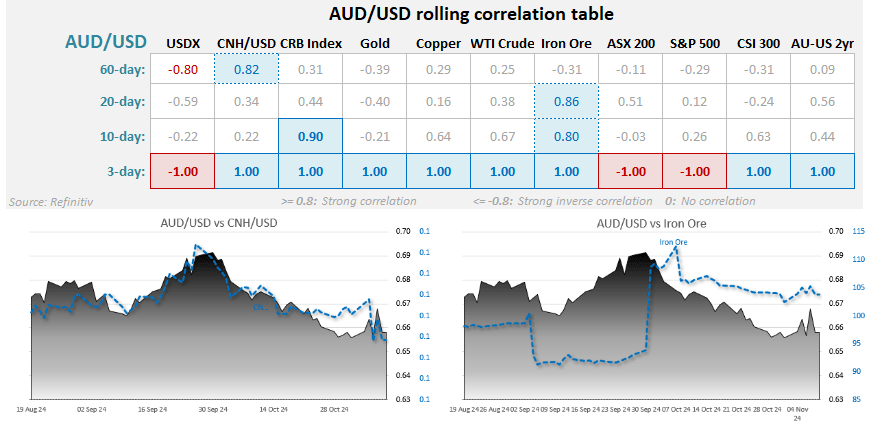

AUD/USD futures – market positioning from the COT report:

- Large speculators increased their net-long exposure to a 4-week high

- However, they trimmed longs by -2.3% (2.2k contracts) and also reduced longs by -8.5% (-5.7k contracts)

- Asset managers trimmed net-short exposure for the first week in four, by -8.5k contracts

- They marginally increased longs by 3.1% (1.5k contracts) and reduced shorts by -9.5% (-7k contracts)

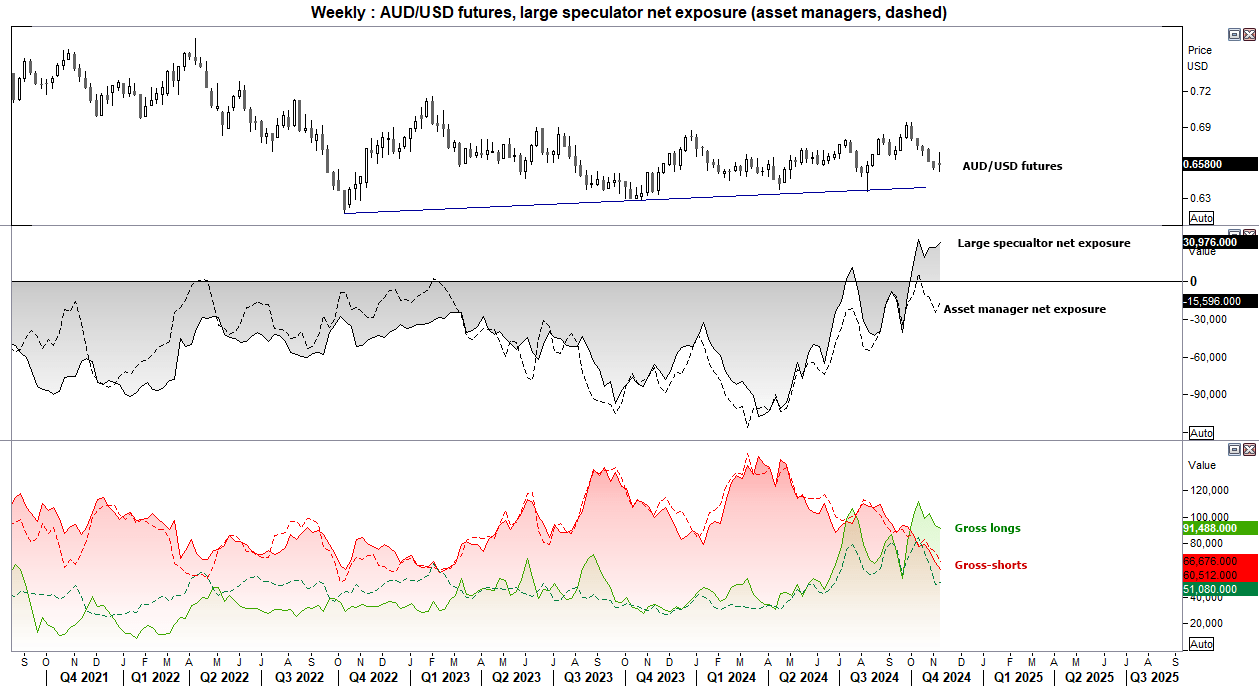

AUD/USD technical analysis

AUD/USD snapped its five-week losing streak as I suspect it would. Even if it only increased by a mere 0.34% for the week. It was, however, its most volatile week in 13 with a high-to-low range of 175 pips, or 2.6%. The direction of AUD/USD also alternated between bullish and bearish for the last four days and remains elevated, with Friday’s -1.34% selloff almost erasing Thursday’s 1.65% gain.

I’m now entering this week without much conviction for where it is headed next. If I had to make an assumption, it is that volatility will recede somewhat, yet prices could remain contained within last week’s range. If so, it could see bulls seeking dips around lows and bears fading into rallies towards the highs. But until we get a clear idea of whether a Trump presidency is good or bad for international trade, price action might remain twitchy and vulnerable to headlines.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge