- AUD/USD was dragged lower with risk on Friday, falling over 1% for the second day of the week

- The Australian dollar was lower against all major currencies, and the weakest FX major on Friday and the week

- It lost notable ground against the yen after the BOJ made hawkish comments through the week

NFP data was mixed on Friday, with the 142k jobs added and unemployment falling to 4.2% (from 4.3%) beating expectation yet average hourly earnings rose 0.4% to show that inflationary pressures remain in place. This makes it questionable as to whether the Fed could cut rates by 50bp in a single meeting, or 100bp by the year end. A late selloff on Wall Street on Friday weighed on sentiment and dragged AUD/USD lower by over 1%.

US inflation data is the standout event for the week, and it could trigger another bout of AUD/USD selling if it ticks higher with traders now questioning how may cuts the Fed can realistically achieve this year.

NAB release their monthly business survey on Tuesday. Sentiment increased for the first month in five according to the July report (released in August) thanks to gains in the employment index, although it remains lower in trend terms. They also noted further easing of inflationary pressures. More of that would be welcomed.

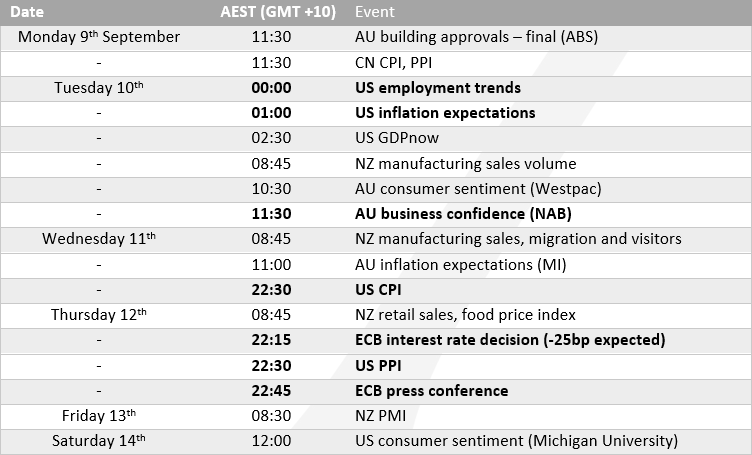

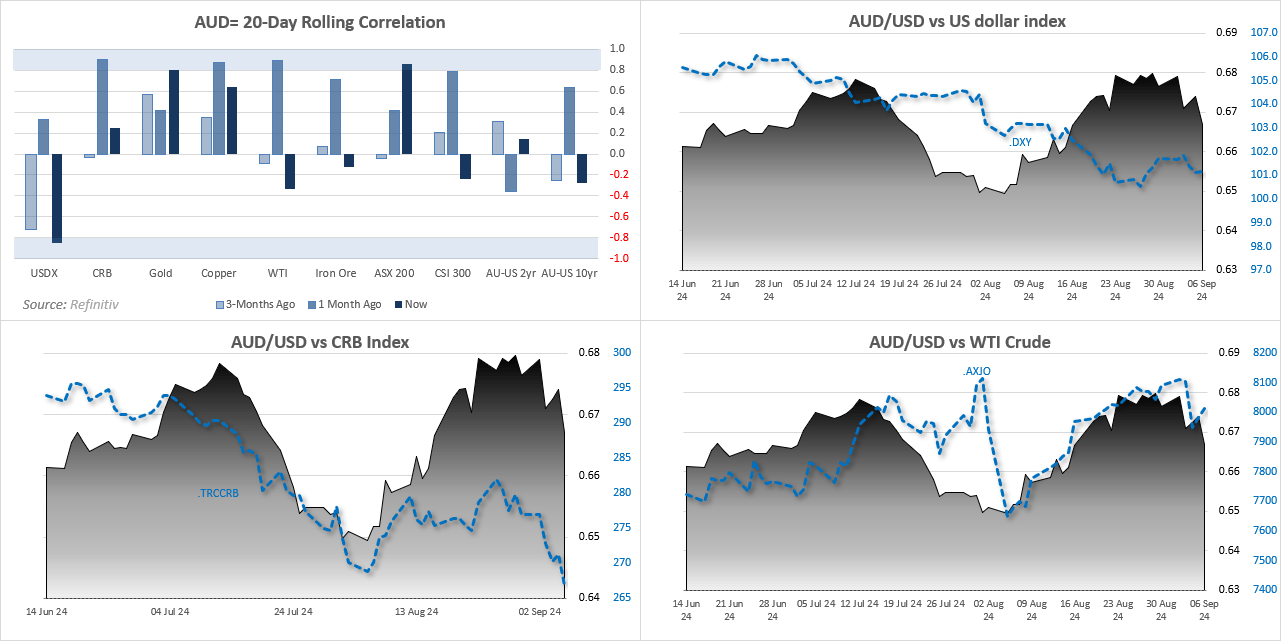

AUD/USD 20-day rolling correlation

- The US dollar and appetite for risk has returned as the primary driver for AUD/USD

- The 20-day correlation between AUD/USD and the US dollar index is now -0.85

- While the correlation figure with the CRB commodities index has dropped to 0.25 over the past 20 day, the correlation has clearly returned in recent data looking at the chart (which should now feed through the correlation score this week)

- Also note the tight relationship between the ASX 200 and AUD/USD, underscoring how appetite for risk is a key factor for the Australian dollar’s direction

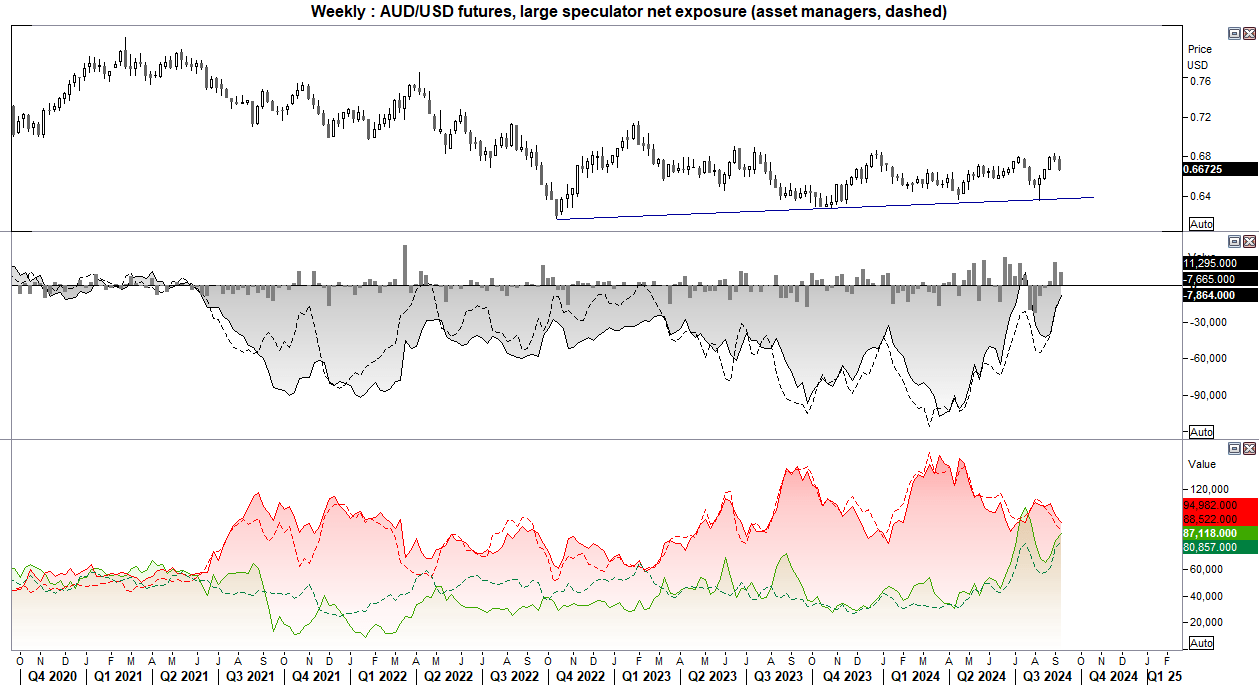

AUD/USD futures – market positioning from the COT report:

- Net-short exposure on AUD/USD futures continued to decline last week, with large speculators and managed funds increasing longs and trimming shorts

- Yet AUD/USD prices were lower for a second week, which diminishes the odds of traders flipping to net-long exposure

- With appetite for risk remaining a key driver, traders should continue to watch the stock market for clues of the Aussie’s direction

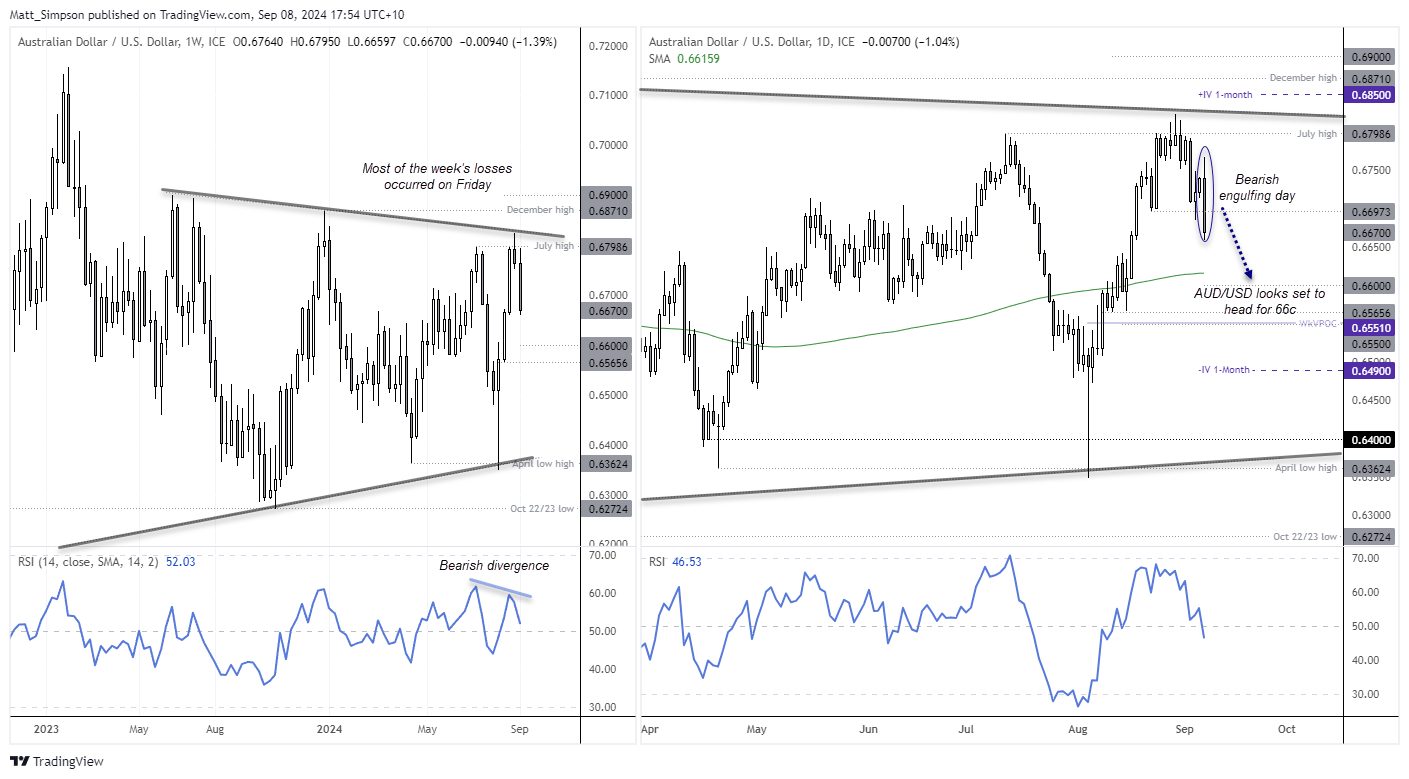

AUD/USD technical analysis

We saw the anticipated pullback last week, although I now cannot say with confidence that we’ll see a retest (let a long a break above) recent swing highs with appetite for risk on the ropes. The weekly chart has a bearish divergence with the RSI (14) and prices remain within the multi-month triangle.

If anything, a retest of the 200-day average just above 66c handle looks more likely over the near-term over a retest of 68c

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge