- Australia’s Q1 March inflation report was much hotter-than-expected

- Underlying inflation remains well above the RBA inflation target

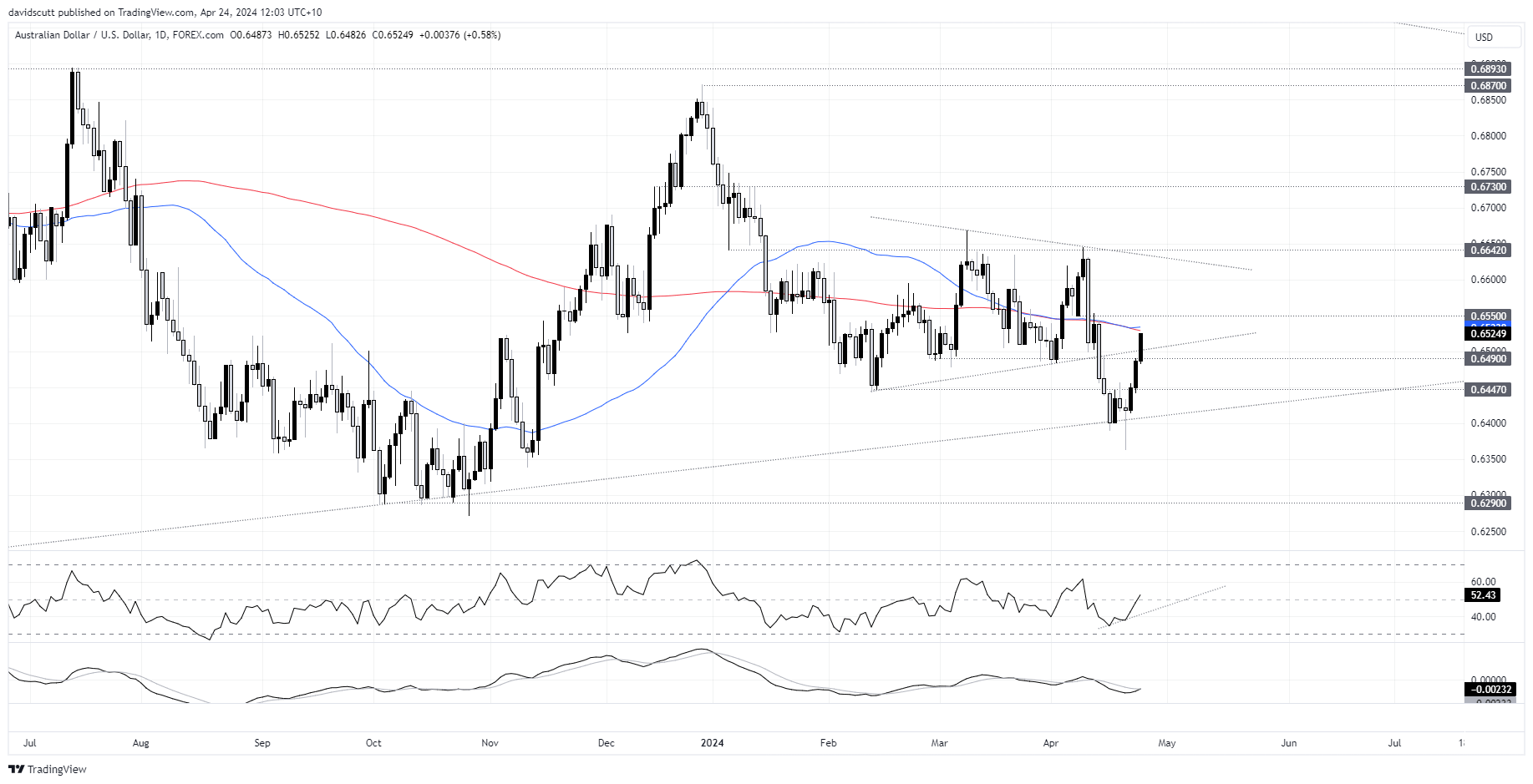

- AUD/USD has broken several resistance levels following the report

AUD/USD is charging higher, powered by a hotter-than-expected Australian March quarter consumer price inflation report that seriously dented the case for rate cuts from the Reserve Bank of Australia this year.

AUD/USD powered by hot, sticky inflation

Markets were looking for headline and trimmed mean inflation to lift 0.8% apiece during the quarter. Instead, both rose 1%, an uncomfortably large increase, especially for the RBA given it was looking for the trimmed mean measure to lift by a smaller 0.8%.

From a year earlier, headline inflation rose 3.6%, down from 4.1%. Trimmed mean inflation increased 4%, down from 4.2% in the December quarter but again two tenths ahead of expectations. As a reminder, the RBA targets 2.5% inflation within a broader 2-3% range.

Source: ABS

Emphasising the sticky inflation message from the key inflation readings, other measures were also uncomfortably high.

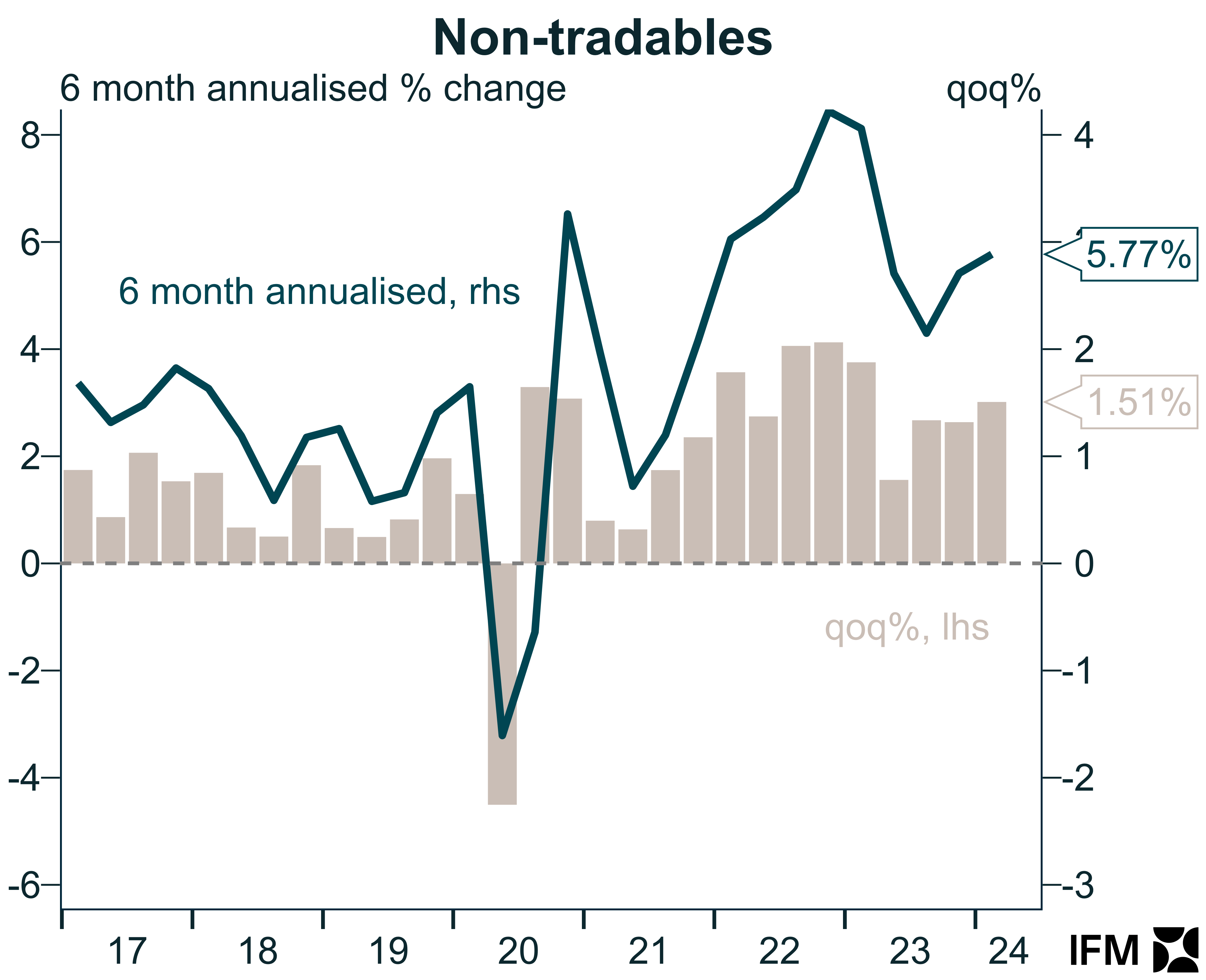

The weighted median measure – another underlying inflation reading – rose 1.1% for the quarter and 4.4% over the year. Non-tradable inflation – which is heavily influenced by domestic factors – grew at double the RBA’s target at 5%, down from 5.4% in the prior quarter. Rents, new dwelling purchases by owner occupiers, education, insurance and tobacco contributed to the lift in non-tradable prices.

Source: IFM Investors, X

Services inflation – which is often seen as a lead indicator on domestic wage pressures – also grew 4.3% from a year earlier.

RBA 2024 rate cuts bets evaporating

Already evaporating quickly before the inflation report, the data has seen markets pare expectations for RBA rate cuts in 2024 further, narrowing interest rate differentials and sending the Australian dollar sharply higher.

Prior to the report, cash rate futures had 17 basis points of cuts priced into the 2024 curve. That now sits at just eight. That's a huge shift from just a few months ago where over two cuts were priced with the first move expected in June. Unless there's a dramatic deterioration in the global economy, that now looks a distant prospect. And if the present trajectory for underlying inflation is maintained, there's every chance markets may move to price in the risk of rate hikes again.

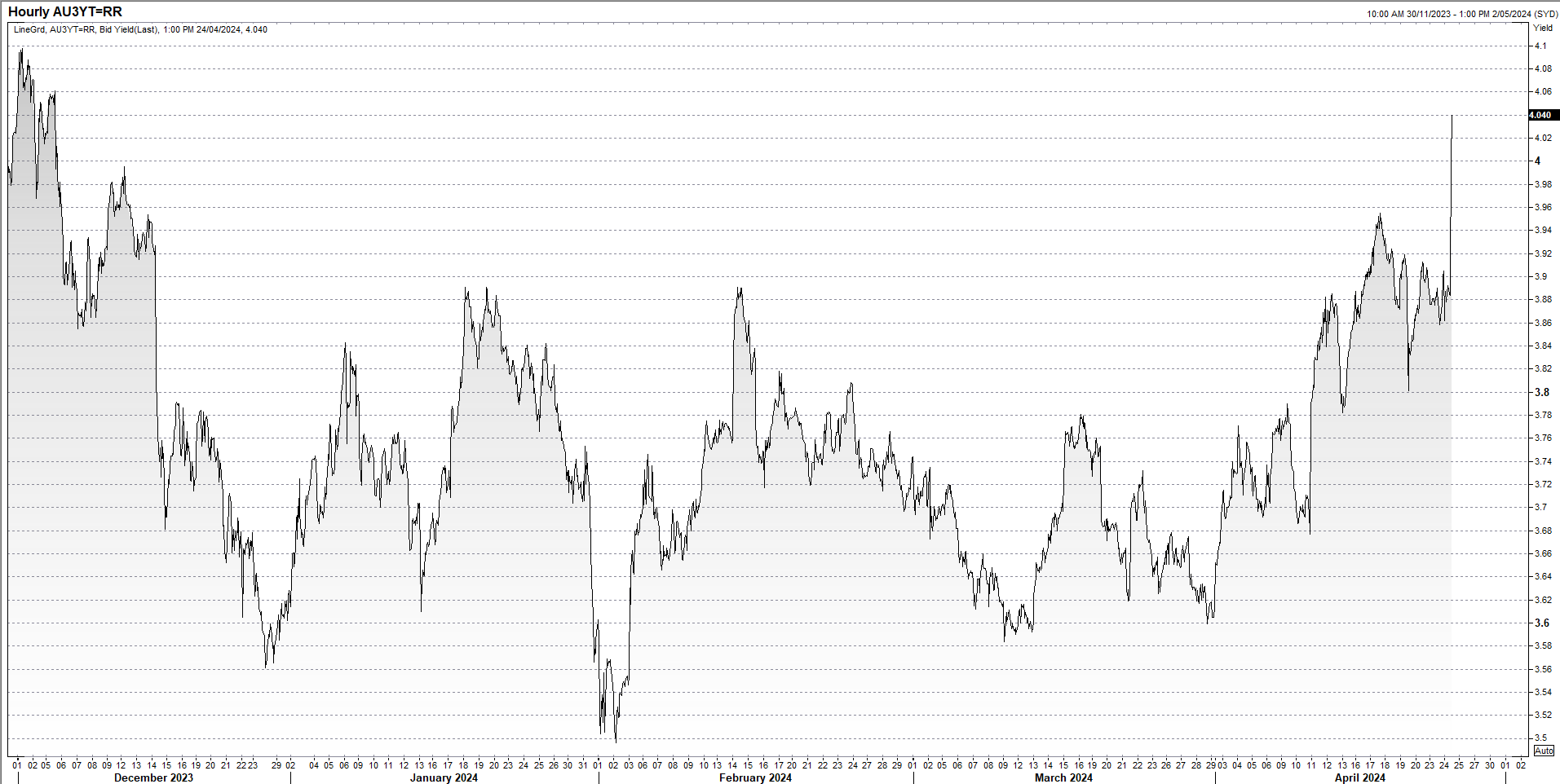

Australian three-year bonds yields, which are sensitive to shifts in RBA cash rate expectations, are quickly pricing in that scenario, jumping back above 4% on the data to the highest level since December.

Source: Refinitiv

Case for AUD/USD upside builds

AUD/USD broke through horizontal resistance at .6490 and former uptrend support located just above .6500 on the inflation report, continuing the impressive rebound seen from the lows of Asian session last Friday.

While the 50 and 200-day moving averages are located just above where AUD/USD trades, having shown little interest in these levels for much of the past six months, there’s not a lot of visible resistance evident until above .6640, providing room for the rebound to run. The price did a bit of work around .6550 earlier this month, but unless the moving averages suddenly become relevant again, that’s it near-term.

With RSI trending higher and MACD crossing from below, momentum is also swinging to the topside, adding to the case for further AUD/USD upside.

-- Written by David Scutt

Follow David on Twitter @scutty