- AUD/USD is trading lower, pulling back from multi-week highs stuck on Monday

- Softer Chinese PMIs and a big drop in Australian retail sales contribute to AUD weakness

- AUD/USD near-term bias looks to be shifting lower

The growth engine of the Chinese economy unexpectedly decelerated last month while Australian retail sales are growing at the weakest pace on record outside one-off economic shocks, putting AUD/USD under renewed pressure on Tuesday.

China PMIs soften but not enough to spur stimulus talk

China’s official purchasing managers’ indices (PMI) declined from the levels reported in March, signaling the pickup in activity seen recently may be difficult to sustain. The manufacturing PMI fell to 50.4 from 50.8, although the reading was slightly firmer than the 50.3 level expected. The larger and economically more significant non-manufacturing PMI decelerated sharply, falling to 51.2 from 53.0.

While both surveys indicate activity expanded over the month, the lower readings indicate the breadth of the improvement was smaller. Not a horrible outcome by any stretch but not weak enough to warrant speculation over increased stimulus measures, potentially blunting a factor that has helped to boost risk appetite previously whenever weakness was reported.

Australian retail sales slump again

The non-manufacturing reading took the wind out of the Australian dollar’s sails. Nor was the Aussie helped by another dire Australian retail sales report which revealed nominal turnover skidded 0.4% in March, well below the 0.3% increase expected.

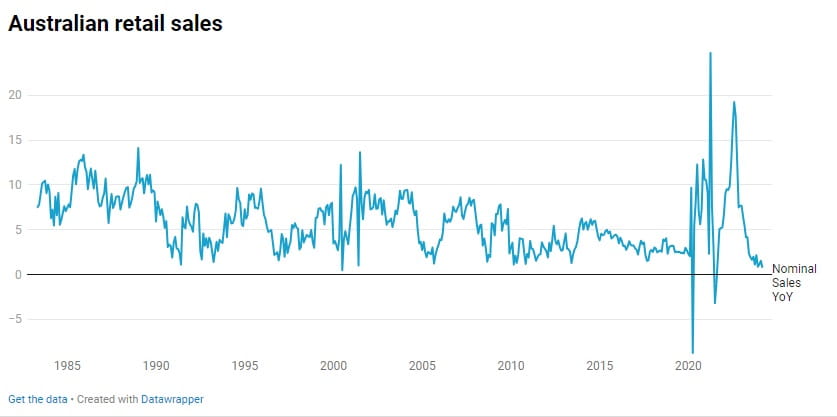

The decline saw growth from a year earlier slow to just 0.85%, the weakest outcome outside the pandemic and introduction of Australia’s GST on record. Considering brisk inflation and population growth sitting around 2.5% per annum, the result suggests turnover in per capita and volume terms is rolling over fast.

Source: X

Normally, that would see the RBA shift towards rate cuts given the threat to economic activity and longer-term price stability. However, with aggregate demand – which includes non-household areas such as government – continuing to exceed what the economy can supply, inflationary pressures are not weak enough to warrant easier monetary policy settings yet.

Following the Chinese and local data, overnight index swaps continue to see Australia’s cash rate finishing 2024 where it sits today at 4.35%, although the risk of a near-term rate hike has been pared somewhat by traders, contributing to weakness in the Australian dollar.

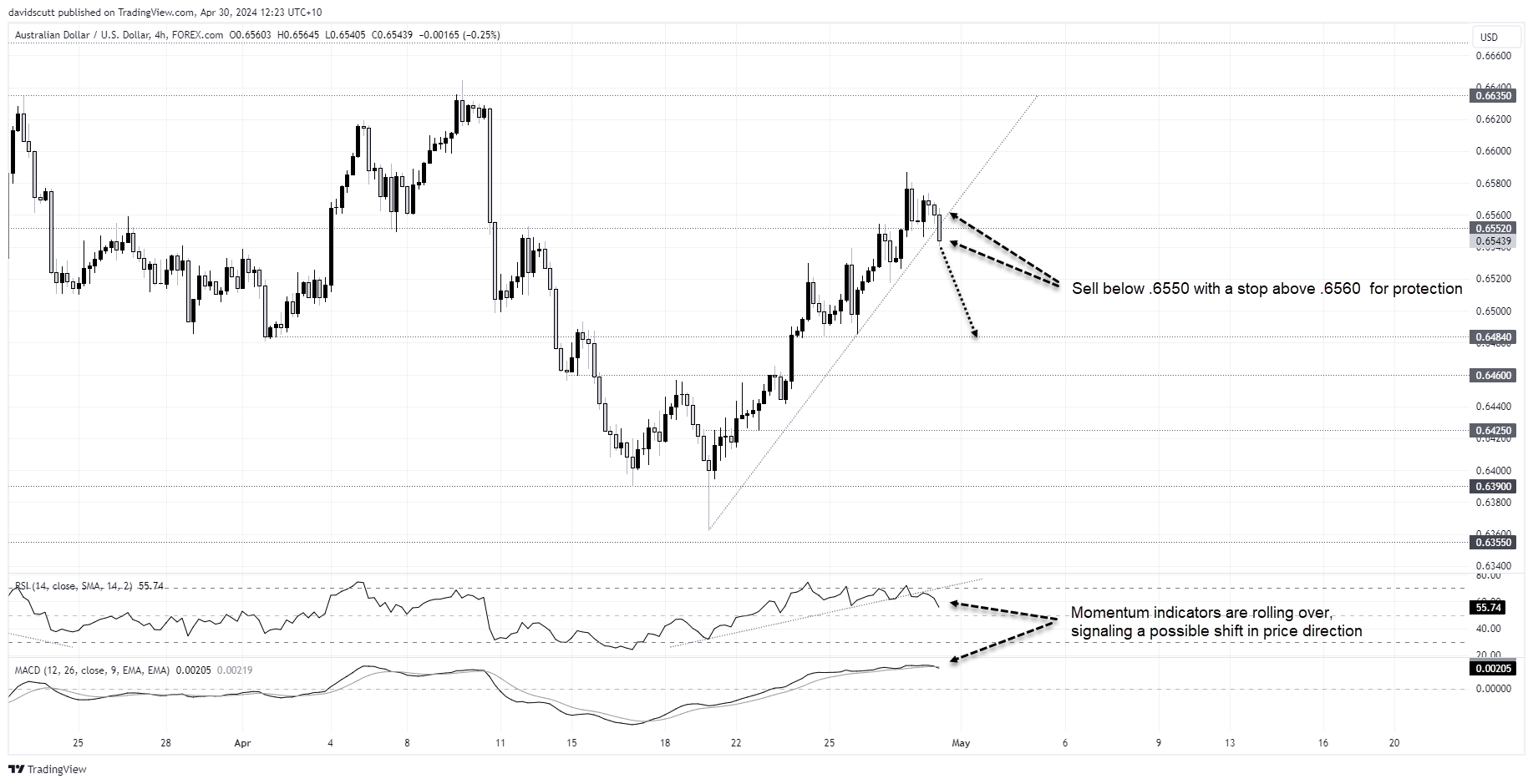

AUD/USD bias shifting lower

Looking at the charts, the uptrend AUD/USD has been sitting in since mid-April was broken following the data , seeing it pull further away from multi-week highs struck on Monday. With the RSI uptrend also broken and MACD crossing over from above, near-term momentum looks to be switching to the downside.

Those willing to take on the short trade on could sell now with stop loss order above .6560, the intersection of the uptrend with former horizontal support. The initial trade target would be .6484, a level AUD/USD did plenty of work either side of earlier this month. Should the trade move in your favour, considering lowering your stop to entry level, providing a free hit on potential downside.

-- Written by David Scutt

Follow David on Twitter @scutty